EUR/USD falls after manufacturing PMI data & ahead of German inflation figures

- Eurozone manufacturing PMI fell to 46.1 from 46.5, adding to ECB rate cut expectations

- German CPI is expected to cool to 2.2%

- EUR/USD falls to a 6-week low

EUR/USD trades under pressure after the manufacturing PMI worsened in March. The PMI slid to 46. 1, down from 46.5, hitting a three-month low.

Meanwhile, the German manufacturing PMI also fell deeper into contraction territory, dropping to 41.9 in March, a 5-month low, and down from 42.5 in February.

Factory gate prices fell the most in five months, and firms reported increasing competition for new business. Also, the rate of job cuts was the most marked in 3 1/2 years, highlighting the excess capacity in this manufacturing sector. The weak demand environment has pressurized input prices, although manufacturers were more optimistic about the 12-month outlook amid hopes of improved demand in the second half of the year.

The weak manufacturing PMI numbers came after a slide in German retail sales as more adding to evidence that the eurozone's largest economy is struggling and aligning with recent downward revisions to growth forecasts in the region.

These figures add to speculation that the ECB will be cutting interest rates in June.

Attention will now turn to German inflation data, which is expected to cool to 2.2%, down from 2.5%. Softer-than-expected inflation figures for March could further support bets of an earlier ECB rate cut pulling EUR lower.

Meanwhile, weakness in the euro zone's economy is divergent from the strength of the US economy after stronger-than-expected ISM manufacturing data. The US economy's resistance supports expectations that the Federal Reserve may not cut interest rates as soon as expected, lifting the USD.

US Federal Reserve speakers later today could shed more light on when the central bank is looking to cut rates, by how many, and the possible scale of rate cuts this year.

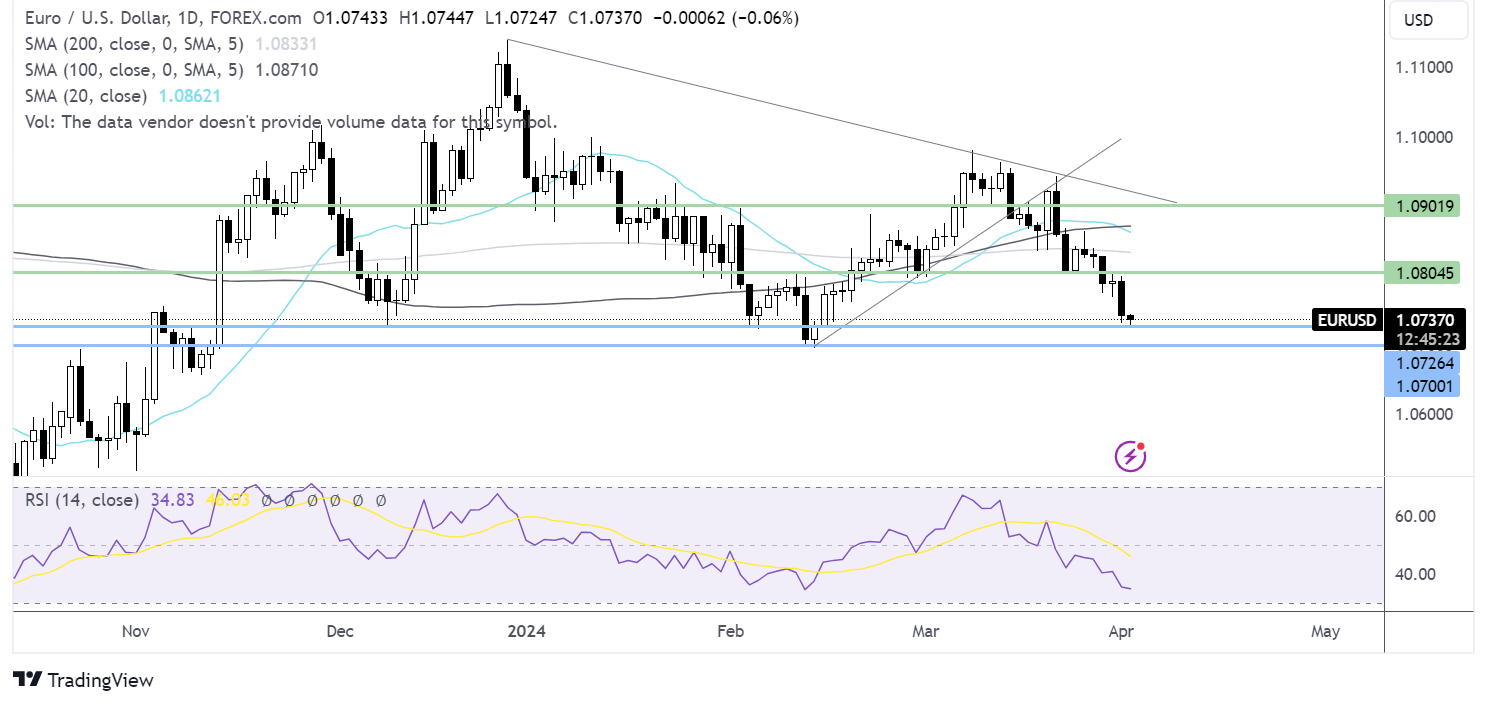

EUR/USD forecast – technical analysis

EUR/USD has been trending lower since mid-March, forming a series of lower highs and lower lows. The price is testing support at 1.0725, which is the early February low. A break below here brings 1.0695, the 2024 low, into focus before heading toward 1.06.

Any recovery must retake 1.08, the April high, and the 200 SMA at 1.0835. Above here, buyers will look towards the 1.09 round number.

GBP/USD struggles at a 6-week low on USD strength

- UK manufacturing PMI rises above 50

- USD holds firm after spiking to a 4.5-month high

- GBP/USD falls to 1.2550

GBP/USD fell for the third straight day, crossing below the 200-day moving average on USD strength and despite more robust UK manufacturing data.

The US dollar spiked to a 4.5-month high overnight above 105 after stronger-than-expected economic data, which saw investors rein in expectations of a Fed June rate cut.

Yesterday, USISM manufacturing data showed a sharp rise, moving back into expansion after 16 months of contraction. Prices paid also jumped sharply, adding to concerns that inflation could be slow to fall below the Fed's 2% target, delaying rate cuts.

The data comes after Federal Reserve Chair Jerome Powell said on Friday that the central bank was In no rush to lower interest rates after inflation rose slightly in February.

Looking ahead, attention will be on US factory orders and Jolts job opening data. The latter is expected to show that job openings only fell very slightly, highlighting the resistance in the US labor market.

Several fed speakers, including Mester, Williams, and Daly, are all due to speak and could shed more light on when the Federal Reserve will start cutting interest rates.

Meanwhile, the pound trades under pressure despite manufacturing returning to growth in March. The manufacturing PMI was upwardly revised to 50.3, rising from 47.5 in February and ahead of the 49.9 preliminary reading. The manufacturing sector had been the weak link in the UK economy, as services had already returned to expansion earlier in the year.

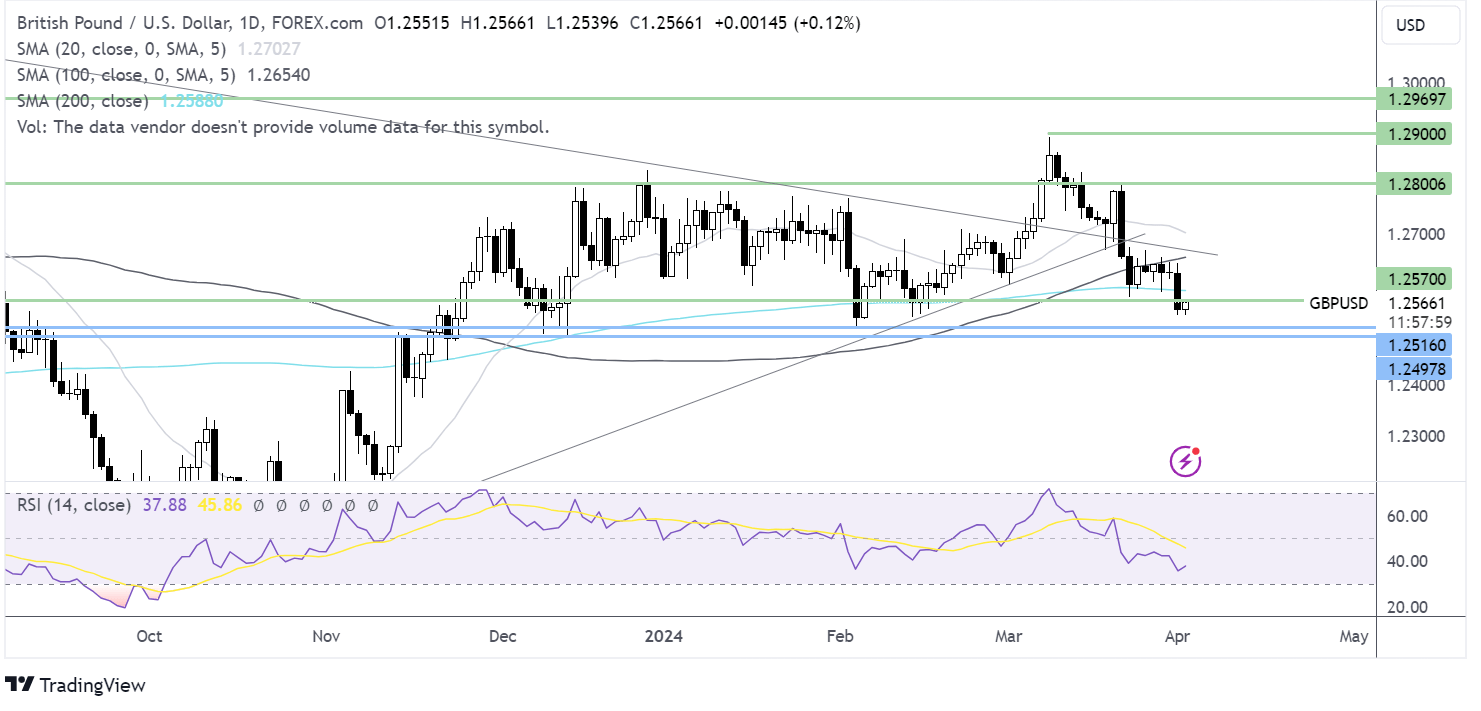

GBP/USD forecast – technical analysis

GBP/USD has fallen below the 200 SMA and 1.2575, last week’s low and is finding support around 1.2550.

Sellers, supported by the RSI below 50, could look to break below 1.2550 to extend losses to 1.2520, the 2024 low, and 1.25, the round number.

A recovery would need to rise above 1.2575 and the 200 SMA to 1.2590. Above here, buyers could gain momentum towards 1.2670, the falling trendline resistance dating back to July last year.