US futures

Dow futures 0.58% at 39350

S&P futures 0.71% at 5250

Nasdaq futures 0.95% at 18333

In Europe

FTSE 0.57% at 7975

Dax 0.18% at 18405

- US jobless claims rise to 221k from 212k

- Fed Chair Powell’s tone is considered dovish

- Tesla looks to India

- Oil rises for a fifth straight day on supply concerns

Jobless claims rise ahead of tomorrow's NFP

US stocks point to a higher start, extending gains from yesterday as the market digests Federal Reserve chair Jerome Powell's comments and the latest jobless claims data ahead of tomorrow’s non-farm payroll report.

In his speech yesterday, Fed Chair Powell reassured that the central bank was still looking to cut interest rates this year; however, he reiterated that policymakers need to see more evidence that inflation is cooling towards the 2% target before starting to cut.

He added that recent strong data hadn't changed the Fed's outlook, calming concerns that recent upward surprises in data could knock the Fed off its rate cutting course.

Meanwhile, jobless claims rose by more than expected, adding 9k to 221k, ahead of the 214k expected. The data comes after ADP payroll data yesterday rose by more than forecast, and ahead of tomorrow's nonfarm payroll report.

Tomorrow’s non-farm payroll is expected to show 215k jobs added in March, which would mark the slowest pace of job growth since November last year.

Looking ahead, attention will be on Federal Reserve speakers, with Richmond Fed President Thomas Barkin and Cleveland Fed President Loretta Mester hitting the airwaves. The Fed officials could shed more light on the timing of the Federal Reserve's next move. Fed speakers this week have broadly pointed to three rate cuts this year but agreed that more evidence was needed before making the first move.

Corporate news

Tesla remains in focus on reports that the EV maker will study sites in India for a proposed $2-$3 billion EV plant. A move into India, the world’s most populous country and the world's fastest-growing economy comes at its traditional markets in the US, and China is experiencing slower demand.

Disney is rising after its board survived a shareholder vote amid the ongoing battle with activist investors. CEO Bob Igor and the current board will retain their seats and continue with the turnaround program.

Levi Strauss is set to open 12% higher after the jeans retailer lifted its annual profit forecast after recent cost savings and after less aggressive discounting.

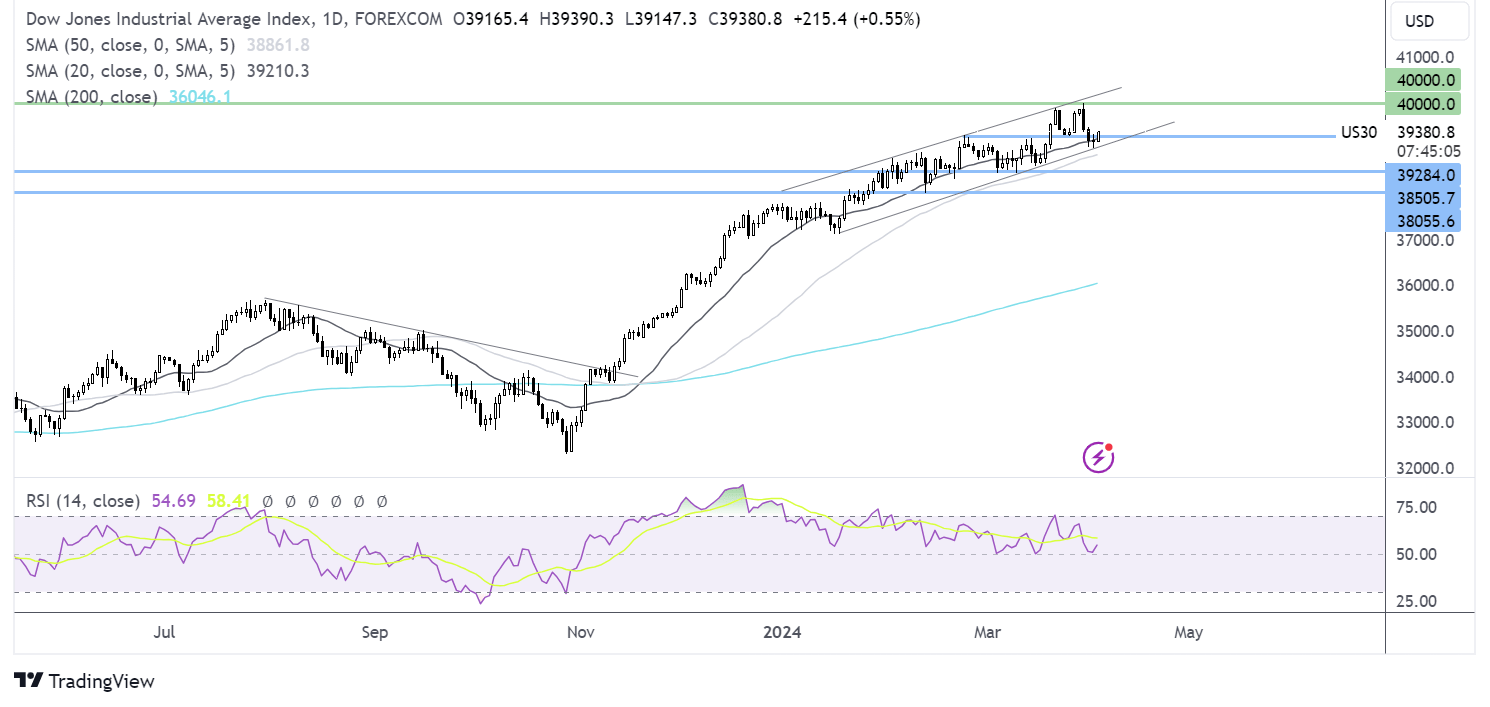

Dow Jones forecast – technical analysis.

The Dow Jones continues to trade in a rising channel. The recent sell off this week saw the index test the lower band of the channel at 39,000, before rebounding back above the 20 SMA and 39284 the February high. Buyers will look to extend gains towards 40000. On the downside, support can be seen at 39,000 the weekly low. Below here 38740, the March low comes into play.

FX markets – USD falls, EUR/USD rises

The U.S. Dollar is extending losses away from its five-month high reached earlier in the week as yields fall following Federal Reserve Chair Powell’s speech. Attention will now turn to US Federal Reserve speakers, who could provide further clues on the timing or scale of the Fed rate cuts this year.

EUR/USD is rising after the eurozone services PMI was upwardly revised to 51.5, up from 50.2 in February and ahead of the preliminary reading of 51.1. The data suggests that the service sector is gaining momentum, ofFsetting a deeper downturn in the manufacturing sector.

GBP/USD is struggling to rise above 1.2650 after UK services PMI was downwardly revised to 53.1 in March from 53.8 in February. This marks a four-month low. Service sector businesses also raised their costs at the slowest pace in six months, giving some hype that sticky service sector inflation may start to cool.

Oil steadies at a 5-month

Oil prices are inching higher for a fifth straight day, reaching a fresh five-month high on tight supply concerns and as the demand outlook brightens.

OPEC+ voted to maintain oil production cuts at the meeting on Wednesday while pressing some members to adhere more closely to the ongoing output cuts, raising concerns over tight supply.

Escalating geopolitical tensions in the Middle East and concerns that Iran might be drawn into the Israel-Hamas war are putting upward pressure on oil prices. Iran is the third largest OPEC+ member so rising fears of their involvement increases the risk premium on oil.

Finally, upbeat data from China this week and the resilience in the US economy is adding to the brighter demand outlook for oil prices.