Recession looks almost impossible to avoid

The DAX is in consolidation mode, holding steady at the start of the week after tumbling 3.6% across last week as risk sentiment collapsed.

Central banks across the globe, including the Fed, the Riksbank, SNB, and the BoE, hiked rates to tame soaring inflation, raising fears of recession.

Recession in Germany

The German IFO business climate index confirmed those fears, dropping to its worst level in two years. Business confidence in Germany deteriorated considerably as the deepening energy crisis weighed on companies’ outlook. Data from the IFO institute showed that the business climate index fell to 84.3, down from 88.5 and well below the 87 level forecast. Meanwhile, IFO President Clemens Fuest said, “The German economy is slipping into recession.”

The data comes after PMI data last week which pointed to a grim outlook for the eurozone’s largest economy. The German composite PMI fell to 45.9 in September, down from August’s 46.9, as higher energy costs hit the economy and hurt new business orders.

Perfect storm

The German economy appears to be approaching the perfect storm. The war in Ukraine has put an end to Germany’s until now, the very successful business model of importing cheap gas from Russia and affordable input goods and exporting high-quality products to the rest of the world. Germany flew the flag for globalization. However, with cheap gas no longer an option, as supply chains are being restructured and amid a move towards a less globalized world, Germany needs an overhaul. With inflation at a record high and the cost of living crisis hitting German households, consumers won’t be able to offer much support, at least in the near term.

Learn more about trading the DAX

Where next for the DAX?

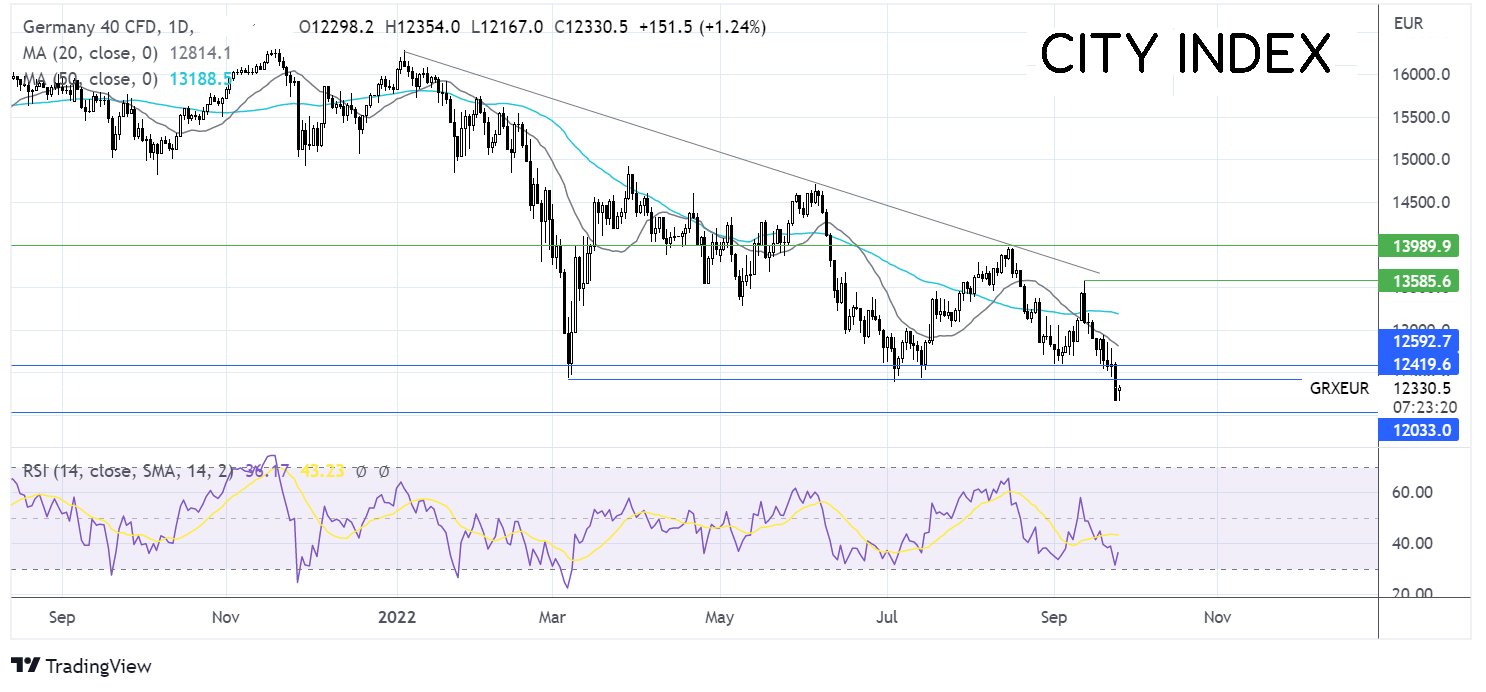

The DAX has been trending lower, forming a series of lower highs and lower lows. On Friday, the price fell below support at 12440 to a fresh 22-month low of 12180.

The RSI is in bearish territory, suggesting more downside to come. Sellers will look for a move below 12180 to test 12000 round number before bringing 11300, the September 2020 low, into the target.

Buyers will look for a move over 12460, the previous week's low, opening the door to 12580 and the 20 sma at 12830.