Crude Oil Key Points

- West Texas Intermediate and Brent Crude Oil are gaining $2/barrel today ahead of this weekend’s OPEC+ meeting, where the group is expected to cut production.

- At the same time, the US is ramping up its production, leaving a muddled medium-term supply outlook against expectations of falling demand into 2024.

- Both WTI and Brent could rally further from here after breaking out of their bearish channels.

Crude Oil Fundamental Analysis

Both West Texas Intermediate and Brent Crude Oil are gaining $2/barrel today ahead of this weekend’s OPEC+ meeting.

The group is expected to consider additional production cuts in the wake of a $20 drop in oil prices over the last two months. If OPEC+ does decide to scale back drilling yet again, it could prove to be a near-term bullish catalyst for crude prices, but longer-term questions remain about whether all members will adhere to new limits…and how the limits can be enforced for any noncompliant nations.

Outside of OPEC, traders are also tracking oil rigs in the US, which ticked higher for the first time in three weeks, and refiner production data, which is on track to rise by more than 550K bpd this week. While the supply picture remains mixed between rising US production and the potential for cuts from OPEC, negative economic data continues to point to falling demand heading into 2024, keeping both contracts under pressure.

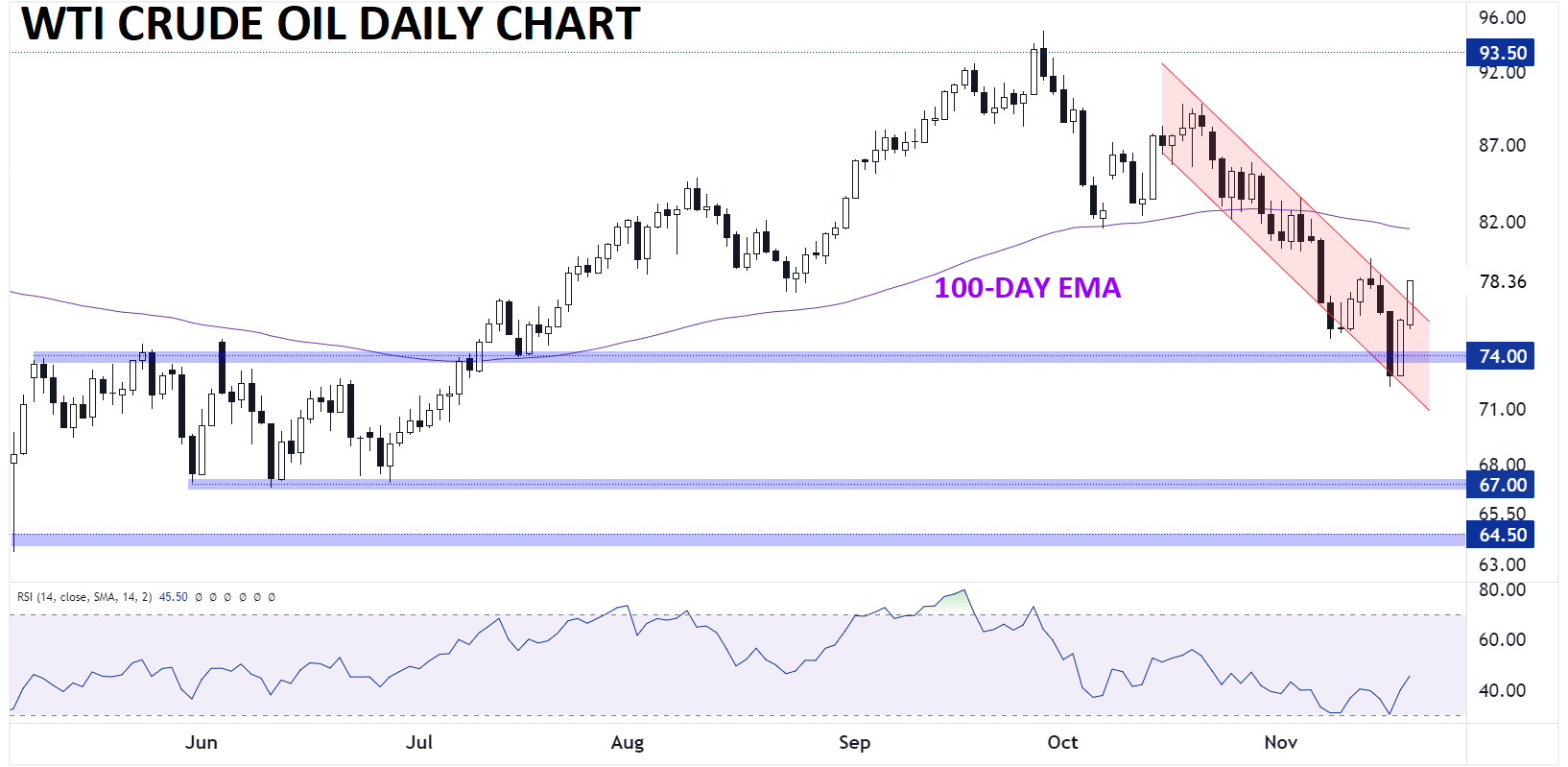

Crude Oil Technical Analysis – WTI Crude Daily Chart

Source: TradingView, StoneX

As the chart above shows, WTI had been trending lower for more than a month before a sharp bullish reversal over the last two days. Astute traders may have noticed the bullish divergence with the 14-day RSI, which signaled declining selling pressure, despite the new low in prices, late last week.

Now, prices are on track to close above their bearish channel, potentially setting the stage for a more extended bounce toward the 100-day EMA near $81 as we head toward December. Well the near-term fundamental catalysts and technical breakout point to short-term upside, the medium-term upside may be limited to the low- to mid-$80s as long as leading economic indicators continue to point to declining demand heading into next year.

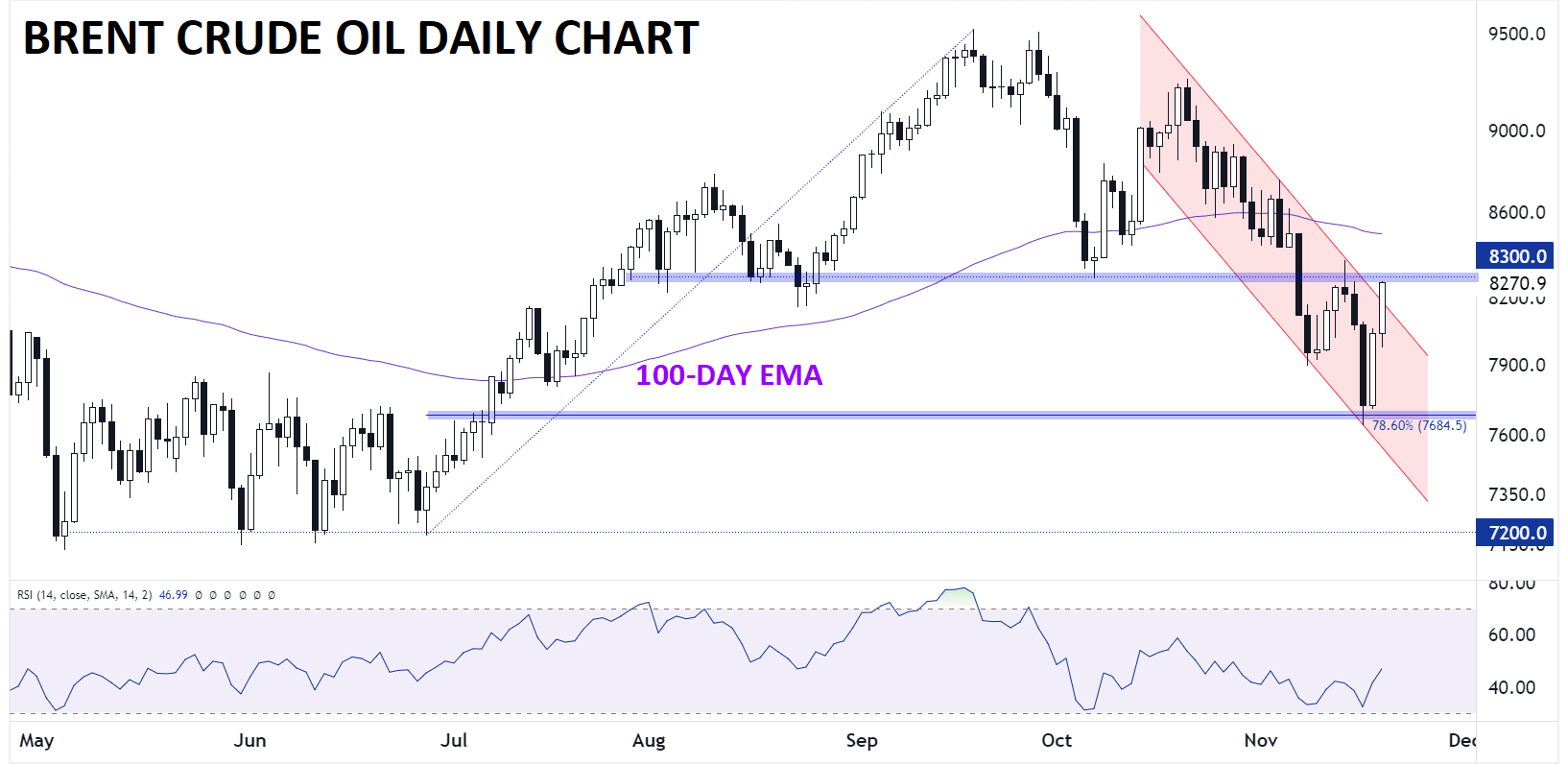

Crude Oil Technical Analysis – Brent Crude Daily Chart

Source: TradingView, StoneX

The technical outlook for Brent is similar, though perhaps not quite as optimistic in the near term, at least so far. While Brent crude oil is breaking out of a bearish channel of its own, the global benchmark has yet to clear previous-support-turned-resistance in the $83.00 area. If bulls are able to overcome that resistance area, a continuation toward the 100-day EMA around $85.00 could be next, though once again, the more ominous long-term demand concerns could cap gains below $90.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX