British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound October advance eases off technical uptrend resistance

- GBP/USD risk for near-term correction – constructive while above 200DMA

- Resistance 1.2720 (key), 1.2823, 1.2906 - Support 1.2569/79, ~1.25, 1.2446/78 (key)

The British Pound rallied more than 5.7% off the early-October lows with GBP/USD halting the advance at technical resistance last week. The December opening-range is taking shape just below and while the broader outlook remains constructive, the October advance may be vulnerable here. These are the updated targets and invalidation levels that matter on the GBP/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

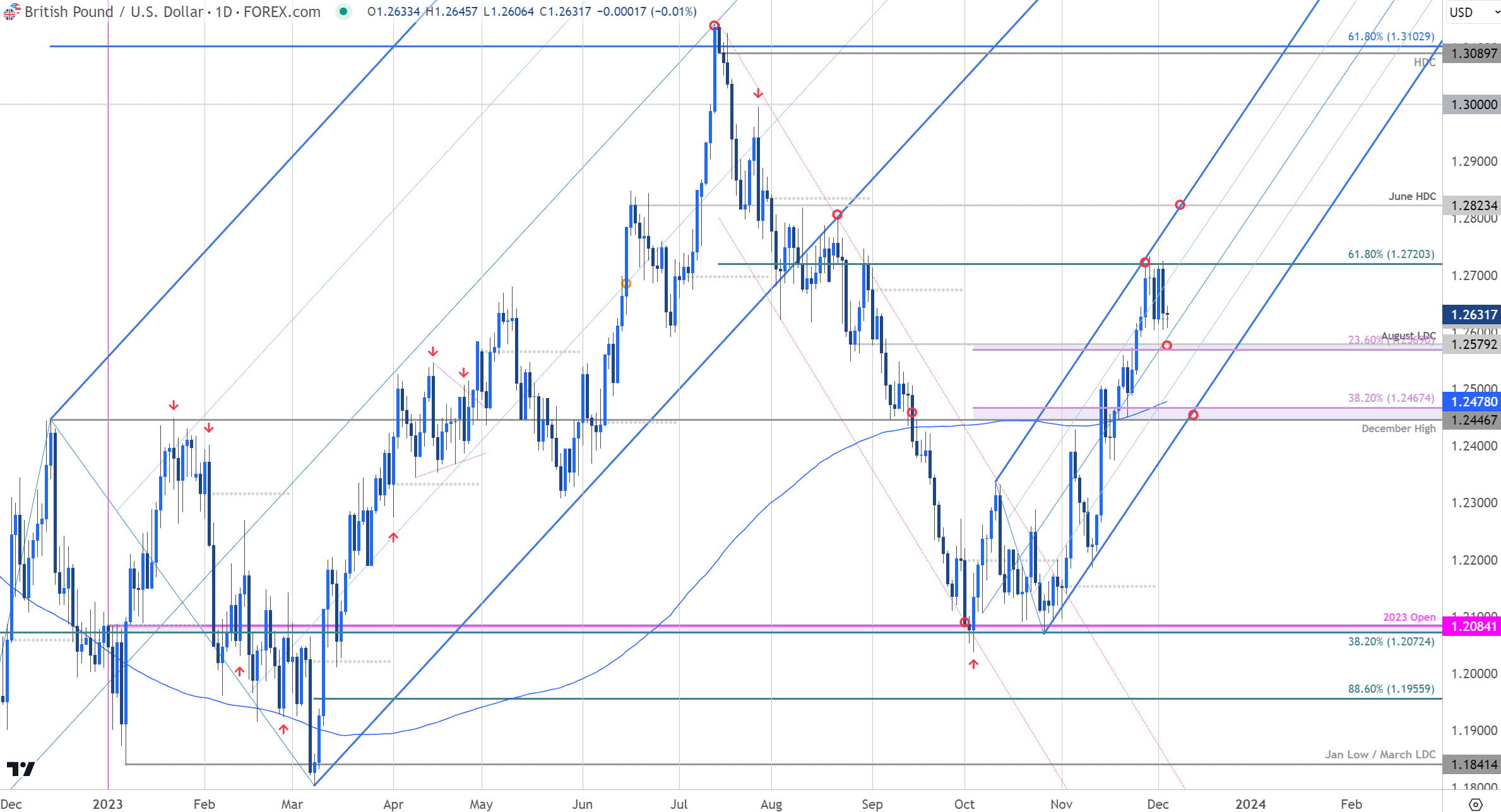

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Short-term Outlook we noted that a, “breakout of a multi-month downtrend in the British Pound has pulled back from near-term, uptrend resistance. From at trading standpoint, losses should be limited to the October open IF price is heading higher with a breach / close above 1.2459 needed to fuel the next major leg in price.” A four-day decline off the highs rebounded off slope support mid-month (well ahead of the monthly open) with GBP/USD rallying nearly 5.3% off the November lows.

The advance exhausted into confluent resistance last week at the 61.8% Fibonacci retracement of the of the July decline at 1.2720. The monthly / weekly opening-range is now taking shape just below and we’ll be looking for the break for further guidance here.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD continuing to trade within the confines off the ascending pitchfork identified last month with the upper parallel catching the highs on this advance. Initial support rests with the 23.6% retracement / August low-day close (LDC) at 1.2569/79- a break below this threshold would threaten a deeper correction within the October uptrend towards the 25% parallel (currently ~1.25) and key support at 1.2446/78- a region defined by the December swing-high, the 38.2% retracement and the 200-day moving average. Losses should be limited by this threshold for the multi-week uptrend to remain viable (bullish invalidation).

A topside breach / close above this resistance zone is needed to mark trend resumption towards subsequent objectives at the June high-day close (HDC) at 1.2823 and the 78.6% retracement at 1.2906.

Bottom line: The Sterling rally is testing Fibonacci resistance with price carving the December opening-range just below- the immediate focus is on a breakout for guidance. From at trading standpoint, losses should be limited by the 1.2446 on pullbacks IF price is heading higher with a close above 1.2720 needed to fuel the next leg higher in price. Keep in mind we have US Non-Farm Payrolls (NFP) on tap Friday with the FOMC & Bank of England (BOE) interest rate decisions slated for next week- stay nimble here. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

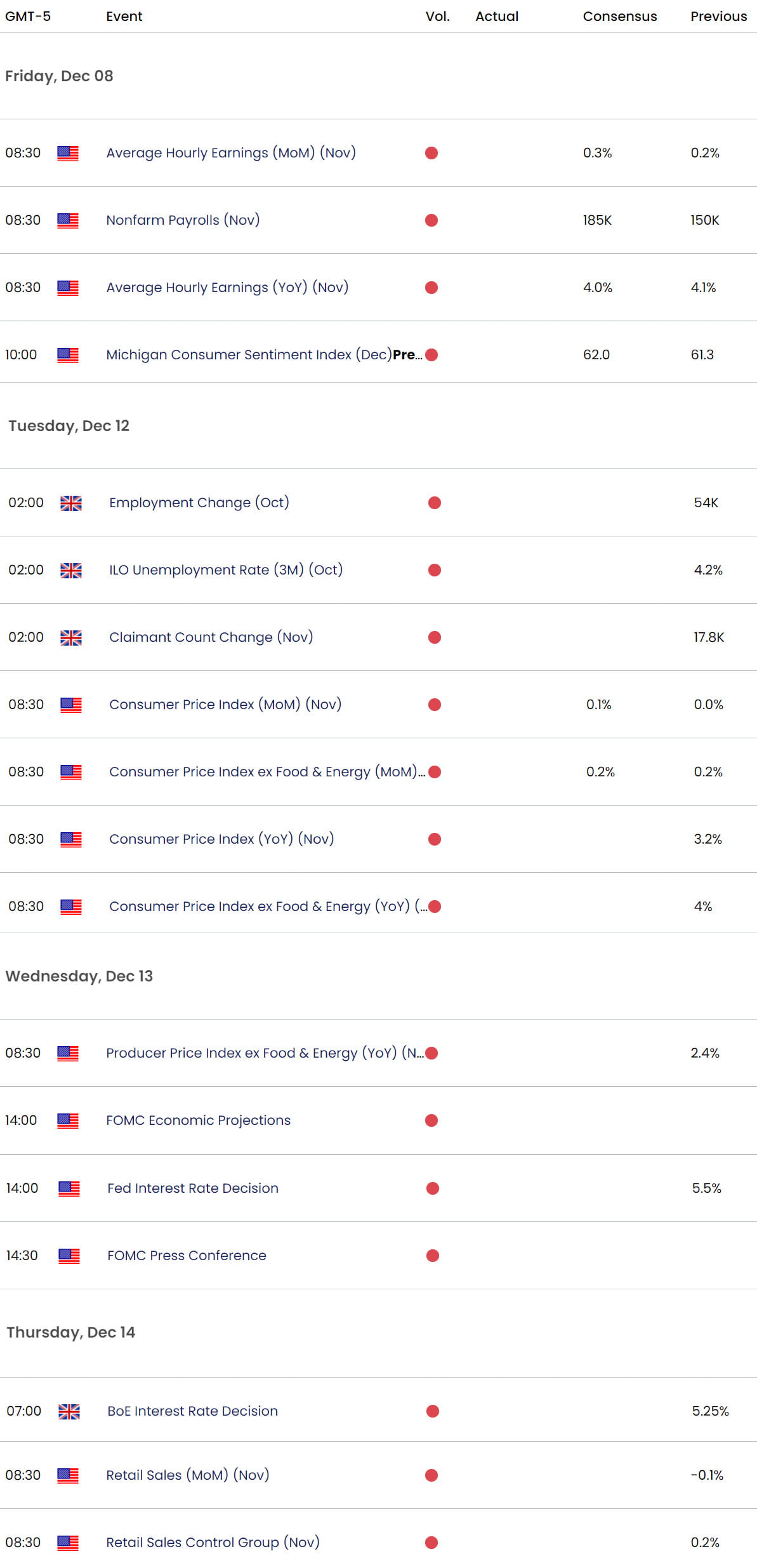

Key GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Oil Short-term Outlook: Crude Fails 80– Bears Charge Support

- Japanese Yen Short-Term Outlook: USD/JPY Correction Continues

- Australian Dollar Short-term Outlook: AUD/USD Bulls Eye Resistance

- Canadian Dollar Short-term Outlook: USD/CAD Threatens July Uptrend

- Gold Short-term Outlook: Gold Bears Claw Back 2K- XAU Hunts Support

- US Dollar Short-term Outlook: USD Recovery Vulnerable

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex