Financial markets look skittish and unstable, mirroring the uneven state of the global economy. What does it mean for inflation, growth and the path of rates? You can sense the trepidation among investors. Nobody, no matter how many cycles they’ve seen or how successful they’ve been, is certain as to what will happen. This cycle really is different, making even the best forecasters look clueless on occasions.

Turn down the noise and watch bonds

With central bankers’ data dependent, it’s understandable why investors are jumping at shadows to any information, no matter how irrelevant. But in uncertain times it pays to turn down the noise. Rather than react to meaningless data, watch the US bond market instead. It looms as the catalyst that could turn this instability into something far more sinister.

Beware “bond-cano” risk

Right now, US yields are threatening to break to cyclical highs. While there’s lots of focus on what’s happening in shorter-dated securities, it’s the longer-end of the curve you should be watching – 10 years and beyond. To say this is important is an understatement. If we see yields break higher it’s likely to unleash a “bond-cano” on markets, forcing the repricing of asset prices worldwide. Volatility will spike as will risk aversion, exacerbating recent trends.

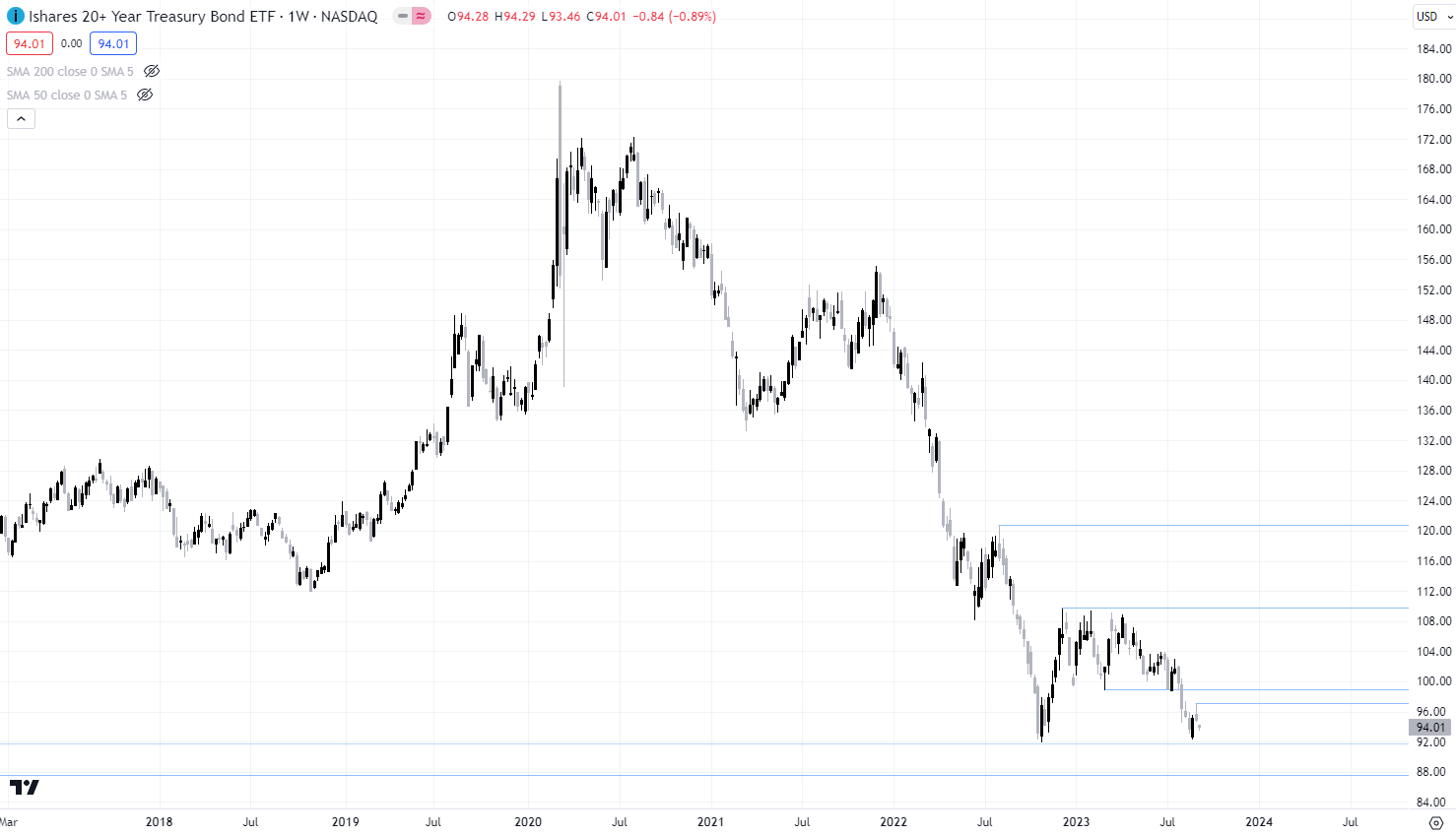

I get bonds are not for everyone; price moving inversely to yields, duration risk, coupons and spreads. But there are simpler ways to monitor the risk of a bond-cano eruption. Plug in ‘TLT’ to any charting platform. It’s the iShares 20+ Year Treasury Bond ETF which tracks the performance of a basket of US bonds with 20 years to maturity or more. It’s currently within a whisker of breaking to fresh lows. If it does, that’s your bond-cano warning being triggered.

TLT EFT one way to express a view on yields

The price action on the TLT weekly chat – which shows the move in long bond valuations over the pandemic era better than any other timeframe – is anything but bullish, managing to stage a feeble bounce earlier this year before resuming its downward trajectory again.

Downside appears likely given the momentum, but after such a dramatic selloff, and with so much uncertainty over the inflation and growth outlook which will influence the US fiscal trajectory, the risk-reward for going short now is unappealing. You’d want to see a break $91.85 – which is the level you should be watching – before considering such a trade.

If that were to break it could open the door to a move down to $87.50. For those positioning for a bounce, again, you’d want to see a retest of support level before initiating longs. $97 would be the first upside target with $110 after that. From a fundamentals perspective, the Fed signaling an end to rate hikes, accompanied by market-based inflation measures remaining anchored near the Fed’s 2% target, would be a bullish backdrop for long trades.

Source: Trading View

USD likely to benefit from yields breakout

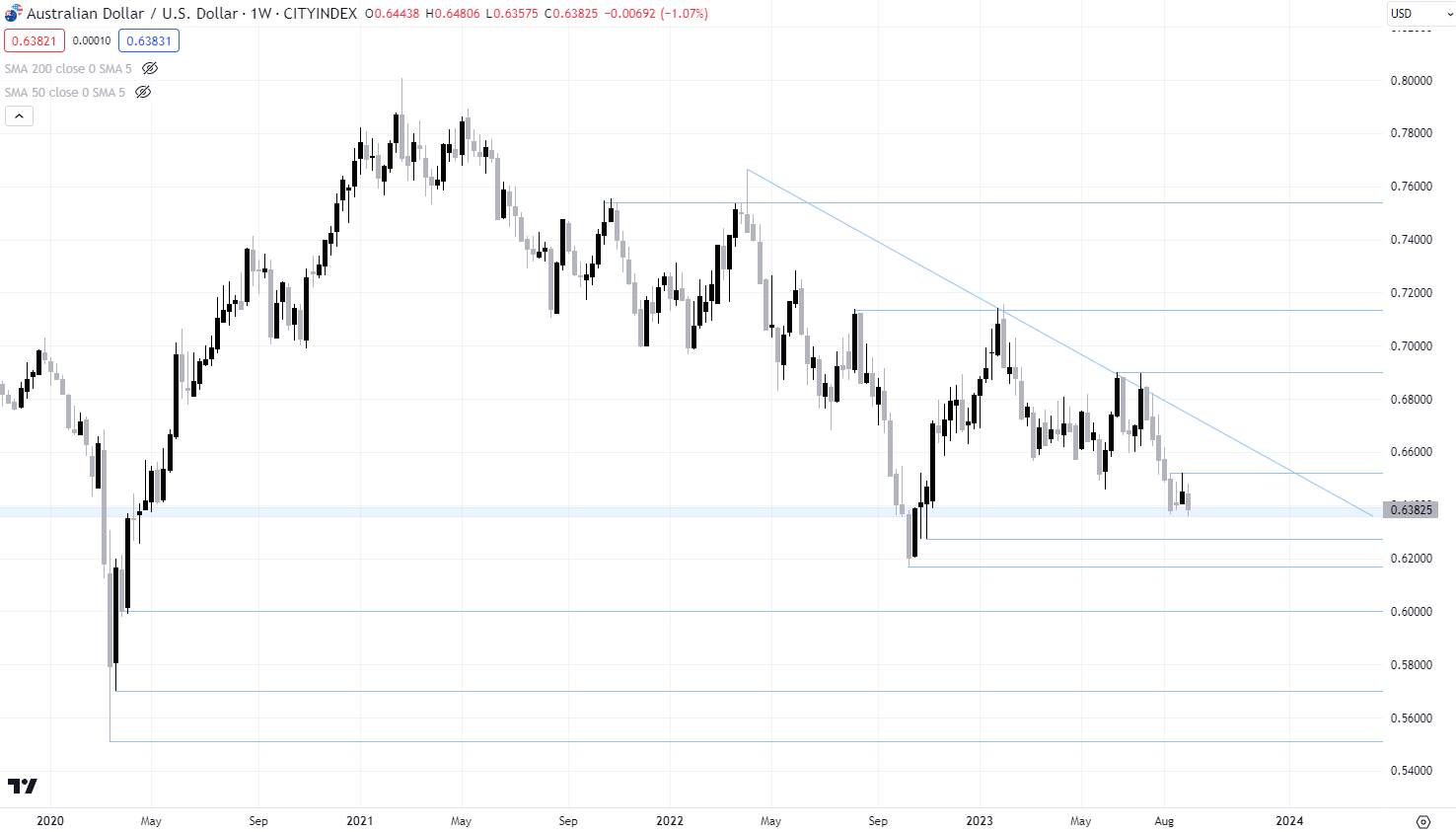

Outside of bonds or ETFs, the FX market is another way to trade a breakout in US yields as the likely increase in risk aversion would normally fuel gains in the US dollar. As a cyclical currency closely aligned to the performance of the Chinese economy, the Aussie dollar stands out as one that could really move if market volatility increases.

Like TLT, it's sitting just above key support , reversing hard in recent months as optimism surrounding China’s reopening floundered. Another lift in US yields could push the AUD/USD through the bottom of this support range at .6355, opening a potential move down to .6270 and then to .6170, the low seen last year.

Should yields not break higher, downside pressure on the AUD/USD will likely dissipate. .6520 would be the first upside target with long-term downtrend resistance – currently located above .6700 – the next level beyond that.

Source: Trading View

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade