Artificial intelligence is revolutionising the way we trade. While using AI for trading can enhance efficiency, it also entails certain risks. Let’s discuss this below.

- What is AI trading?

- How AI is used in trading

- Benefits of AI

- Risks of AI

- Alternatives to AI with City Index

- FAQs

Before we dive into the benefits and risks of trading with AI, let’s take a quick look at what AI trading is.

What is AI trading?

Artificial Intelligence (AI) trading refers to computer software which analyses market data and informs trading strategies. AI tools have unlocked potential new opportunities thanks to the unmatched speed at which they process vast quantities of information, supporting real-time buy and sell decisions.

The algorithms are generally programmed using machine-learning techniques that identify patterns and trends in market data. These are typically used to make predictions about future price movements to find opportunities for buying and selling, but machine learning models can also help traders and investors uncover potential risks.

As a result, many traders and investors are starting to use AI-driven trading platforms to help them make better-informed decisions.

How is AI used in trading?

AI systems collect large amounts of financial and market data from various sources, and transform this into an accessible format, which can be used as the basis for:

- Order execution – AI can inform the buy and sell points in a market

- Technical indicators – AI can analyse existing price data to find insights into volume, liquidity and more

- Strategies – AI can automate entry and exit points when certain conditions are met. This is known as algorithmic trading

Benefits of using AI in trading

AI trading provides several benefits to those looking to adapt their trading strategy or gain a deeper understanding of the markets. However, it is important to note that AI is a tool in continuous development and can be reliant on human input and supervision.

The main benefits are:

- Improved efficiency and accuracy

- Enhanced risk management

- Scalability

Improved efficiency and accuracy

The ability to make quick, accurate decisions is one of traders’ most important attributes. AI can enable quick decision-making, potentially taking advantage of market opportunities before human traders can react.

Increased efficiency can also help traders react more quickly to changing market conditions, potentially ahead of market trends and other buyers and sellers that rely on manual analysis and research. What previously took weeks and months can now be processed in minutes and seconds.

AI can also automate the execution of trades, reducing the tendency for manual intervention and freeing up time for strategy review and research. What’s more, AI has the potential to become a completely independent system. Currently, algorithmic traders have to set their own parameters for trade execution. But AI could use machine learning to adjust entry and exit points.

Enhanced risk management

AI can be used to look for anomalies in new trades by weighing them against historic trade behaviour. This is an efficient way to minimise potential risks and errors. Continuous monitoring provides precise performance tracking, detecting where potential mistakes are encountered through the algorithm and correcting them along the way.

Furthermore, emotional decision-making, fatigue, and cognitive biases can all lead to poor trading decisions. AI-driven systems reduce the risk of these factors by making decisions based on objective data analysis and, because they are not influenced by emotions or subjective biases, AI tends to lead to more rational trading decisions.

AI can also improve security and market integrity by observing trading trends and spotting suspect behaviour in real time, assisting in the detection and mitigation of fraudulent activity. This can be performed much quicker by machine learning algorithms.

Scalability

AI trading can efficiently handle large-scale data analysis and trading operations, making them suitable for managing large and diverse portfolios. High-frequency trading (HFT) is a method of trading that uses powerful computer programs to conduct a large number of trades in milliseconds. These trades need to be large because HFT strategies are based on minute discrepancies in market prices

Risks of AI trading

However, these models are only reliable to a certain extent, as unpredictable market fluctuations or discrepancies in data accuracy could lead to inaccurate predictions. There are also risks associated with ethics, data use, volatility and regulation, among others.

- Dependence on data quality

- Limited regulation

- Risk of over-optimisation

- Ethical concerns

Dependence on data quality

The first risk associated with the use of AI trading is that these systems are only as good as the data they are trained on. Therefore, if the data is biased or incorrect, the system will also be affected.

Additionally, if the data set does not adapt to market conditions, this can lead to the AI engine developing trading strategies which are not aligned with the current market, resulting in poor trading performance.

Human biases can also seep into AI systems through the developers that create them. These biases can stem from personal beliefs, preferences, or even unconscious biases leading to unwanted trading results.

Limitations of regulation

The current limits on the regulation of AI trading, and data used to run the systems, is an important risk to consider. Nowadays, regulators are still figuring out how to deal with accountability in the context of AI-powered trades. Regulating new systems takes time - as we have seen with algorithmic and high-frequency trading - and as AI develops at a very high speed it is difficult for the regulators to keep up

Developers and programmers alike state that as machine learning engines correct mistakes and develop independently, there are elements and outcomes which stretch out of their control. This may require new regulation that could capture the development of the engines affected. This poses a new question: could we use AI to regulate AI?

Risk of over-optimisation

AI-driven trading systems can sometimes be overly optimised, meaning they perform well on historical data but may not perform as well in real-time trading. This is because these systems may be tailored specifically to analyse past market conditions, they function as a ‘lagging system’, which makes them less adaptable to new and unforeseen situations.

In the context of volatile and often unpredictable market conditions, AI systems may not be able to perform due to sudden market changes that do not align with analysis of past results.

On the other hand, AI and machine learning systems could themselves create risk and market volatility, instead of mitigating it. Although they provide clear benefits such as market liquidity, these algorithms may be less discernible, creating even more unpredictable changes within markets.

Ethical concerns

Lastly, the use of AI in trading comes with ethical concerns that should not be ignored. These include:

- Inequality: Firstly, the high initial costs associated with AI-driven trading platforms may lead to a concentration of information among those who can afford to access these tools, exacerbating income inequality.

- Transparency: Due to limited regulation, there is a perceived lack of transparency - companies and developers are not required to disclose much of their work or data behind these systems. The “black box problem” adds onto this: for some AI models, not even their developers may fully comprehend how they arrive at specific decisions.

- Privacy: Controlling vast amounts of data is a major competitive advantage and creates a significant incentive for firms to collect as much data as possible, which can lead to data protection violations. This could impact millions of individuals and businesses globally.

- Accountability: The complexity and constant change of these systems can make it hard for regulators and lawmakers to assign responsibility and accountability. At what point do we stop holding the creators and developers accountable for the actions of their systems, if no one has complete access to how they process data? How will we judge the actions of AI systems if they ever become fully independent in their trading? These are just some of the questions that financial institutions and individuals are starting to ask themselves, as AI speedily develops into new forms that outperform human traders.

Alternatives to AI with City Index

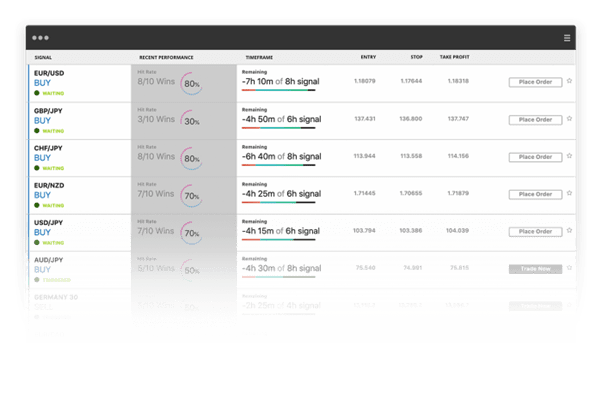

City Index offers an alternative to AI in the form of an algorithmic system which generates short-term trading signals. It automatically monitors 36 major global markets across thousands of price data points to highlight potential trading opportunities.

This tool can help you to better understand the markets, improve the accuracy of your decision-making and diversify your portfolio when you trade with City Index.

How do I trade with SMART signals?

Follow these four steps to open your first position using SMART Signals:

- Open your City Index account, or log in if you already have one.

- Navigate to the Signals tab on Web Trader, or tap ‘More’ and then ‘SMART Signals’ on mobile.

- View the list of the current trade ideas from the SMART Signals engine. You’ll see their previous win rate, details of the trade and how far the market is from the suggested entry.

- Choose a signal to trade. You can set up your own trade parameters, or go with those suggested by the engine.

AI trading FAQS

What are AI stocks and can I trade them?

AI stocks are the shares of companies that are involved in the artificial intelligence industry or that invest in the technology.

The current artificial intelligence landscape can be full of opportunities. The main issue for investors and traders alike, though, is that many of the leading lights in AI are privately owned. However, there is a selection of AI stocks you can trade directly with City Index.

There is also a new AI Index, the BITA Artificial Intelligence Giants UST Index, which aims to provide exposure to the AI sector through a selection of publicly listed companies in the US.

Learn more about shares trading

Will AI be the future of trading?

The use of AI in trading seems to have a bright future. AI algorithms will become even more complex as technology develops, enabling them to analyse all forms of unstructured data. The trading experience will most likely also be improved by AI-powered chatbots and virtual assistants, which could offer individual traders real-time assistance and customised advice.

Furthermore, individual traders, financial organisations and hedge funds are progressively adopting AI into their trading operations. As AI-driven trading systems show the potential to outperform conventional methods, this trend is expected to continue.

Learn more about current news & analysis