The rally in ASX200 has been supported by elevated commodity prices that have boosted the mining and energy sectors. As well as $24bn in dividend payments, due to hit bank accounts this week, most of which has or will return to markets.

Also supporting the local bourse, the release of the Federal Budget at 7.30 pm tomorrow night will allow the government to pull “a rabbit out of its hat” ahead of the upcoming Federal Election.

A faster than expected economic recovery from the pandemic and higher commodity prices will see the government increase spending across infrastructure, defence, and households to assist with “cost-of-living” pressures. Examples of which will include support for first home buyers and a cut to the government’s fuel exercise tax of between 10c and 20c.

At the same time, Westpac economists expect the government to announce a reduced budget deficit for 2021/22 of ~$77.7bn vs the $99.2bn that was forecast in the Mid-Year Economic and Fiscal Outlook (MYEFO) in December.

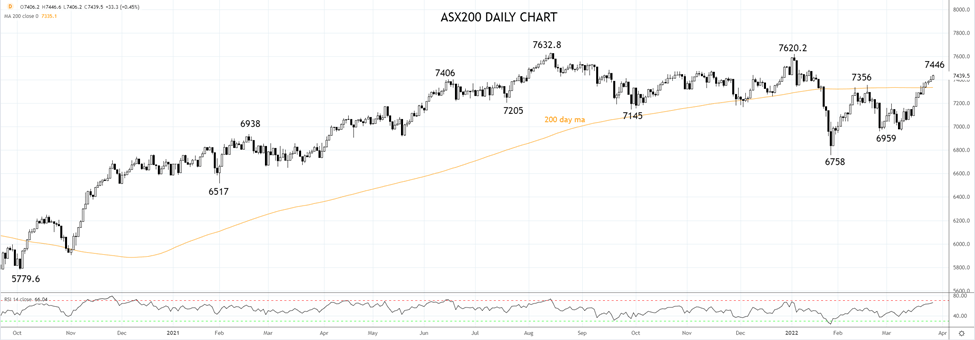

As viewed on the chart below, the ASX200 has extended gains today to be trading 33 points higher at 7440 just 2.5% below its all-time highs of August last year. Once the usual end of the month and quarterly rebalancing flows are complete, comes the month of April usually a good one for the local market.

As such, providing the ASX200 holds above support at 7330/00 on a closing basis, it is difficult to imagine the ASX200 coming all this way and not testing and breaking the all-time August 7632 high, before a pullback of sorts in May.

Source Tradingview. The figures stated areas of March 28th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade