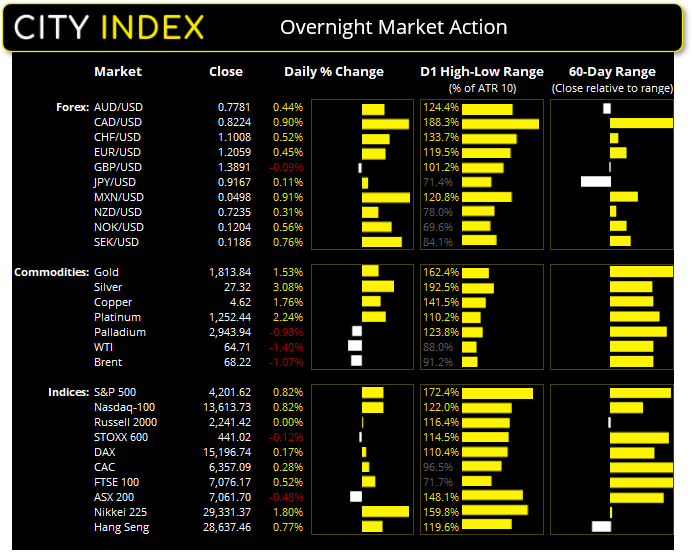

Asian Futures:

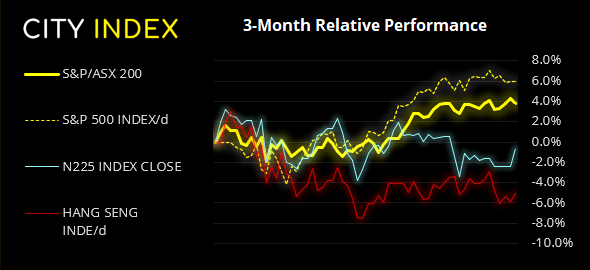

- Australia's ASX 200 futures are up 24 points (0.34%), the cash market is currently estimated to open at 7,085.70

- Japan's Nikkei 225 futures are up 70 points (0.24%), the cash market is currently estimated to open at 29,401.37

- Hong Kong's Hang Seng futures are down -112 points (-0.39%), the cash market is currently estimated to open at 28,525.46

UK and Europe:

- UK's FTSE 100 index rose 36.87 points (0.52%) to close at 7,076.17

- Europe's Euro STOXX 50 index fell -3.35 points (-0.08%) to close at 3,999.44

- Germany's DAX index rose 25.96 points (0.17%) to close at 15,196.74

- France's CAC 40 index rose 17.62 points (0.28%) to close at 6,357.09

Thursday US Close:

- The Dow Jones Industrial rose 97.31 points (0.93%) to close at 34,584.53

- The S&P 500 index rose 34.03 points (0.82%) to close at 4,201.62

- The Nasdaq 100 index rose 110.361 points (0.82%) to close at 13,613.73

Jobless claims fall to lowest level since the pandemic

Another strong employment report overnight saw US jobless claims fall below 500k and layoffs fall to their lowest level since the year 2000. The Dow Jones rose 0.5% to set a new-record, the S&P 500 printed a bullish outside day and closed at a five-day high after finding support at the 20-day eMA. Whilst the Nadaq-100 posted a 0.82% gain above its 50-day eMA, it remains very much the laggard of Wall Street after falling -4.82% from its record high.

ASX 200 Market Internals:

The answer yesterday’s question, “is today the day” (that the ASX breaks above 7100), is a resounding no - thanks to increased tensions between Beijing and Canberra. This makes it the second day at its highs it failed to close above 7100 and the day closed with a two-bar bearish reversal. Still, it remains above its 20-day eMA and it could take a positive lead from Wall Street, so we need to see prices hold above yesterday’s low to stand any chance of a bullish closing above 7100 today.

ASX 200: 7082.3 (0.25%), 28 April 2021

- Information Technology (2.25%) was the strongest sector and Consumer Staples (-1.27%) was the weakest

- 6 out of the 11 sectors outperformed the index

- 5 hit a new 52-week high, 1 hit a new 52-week low

- 74.5% of stocks closed above their 200-day average

- 60% of stocks closed above their 20-day average

Outperformers

- + 7.91% - Nickel Mines Ltd (NIC.AX)

- + 6.77% - Ramelius Resources Ltd (RMS.AX)

- + 5.38% - Resolute Mining Ltd (RSG.AX)

Underperformers:

- -5.62% - Nuix Ltd (NXL.AX)

- -4.52% - Unibail-Rodamco-Westfield SE (URW.AX)

- -3.86% - Woolworths Group Ltd (WOW.AX)

Learn how to trade indices

Forex: Dollar rolls over at key resistance

The USD was the weakest major overnight and traded lower against all but the British pound. The dollar index (DXY) rolled reaffirmed resistance at 91.40 and fell to a three-day low following strong employment data and FOMC reluctance to ‘talk taper’ at this week’s meeting. All eyes are now on today’s Nonfarm payroll report to see if another million jobs can be created.

- The Bank of England (BOE) held rates, yet tapered their bond purchases and raised their GDP forecast for 2021 to 7.5% from 5% previously. However, growth for 2022 was revised lower, sending the British pound lower against all but the dollar.

- Strong retail sales in Europe lifted EUR/USD to a two-day high, confirming a bullish wedge outlined in yesterday’s video. The target remains at the base of the wedge around 1.2150.

- The Japanese yen was the weakest major amidst a risk-on environment.

- CAD/JPY broke above key resistance outlined in yesterday’s European Open report and is not too far from the initial target at 90.0. Given the strength of the trend we expect the trend to march higher, and our bias remains bullish above 89.22.

- AUD/CAD continues to tease with a break beneath the December low. Our bias remains bearish beneath 0.9535 and for a break below 0.9457.

Learn how to trade forex

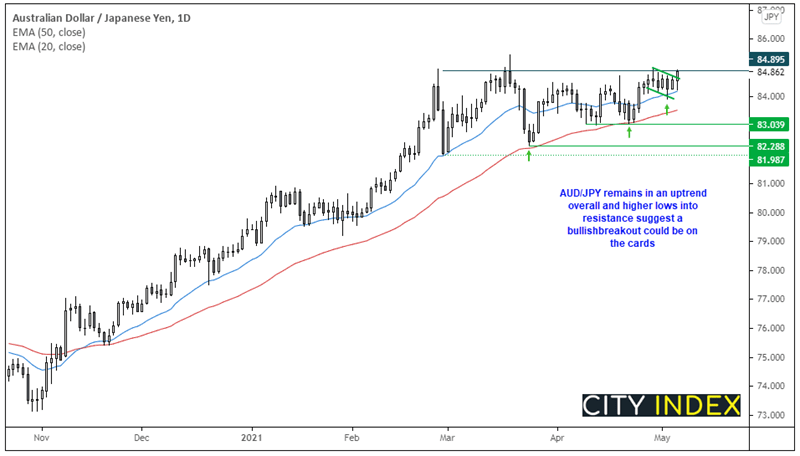

AUD/JPY ready to break higher?

Despite choppy trade of late, AUD/JPY remains in an uptrend on the daily chart and higher lows into resistance show increased demand, whilst prices bounce from the 50 and 20-day eMA’s. The cross closed just beneath the February high, but with a higher low around 84.00 this week and momentum pointing higher, we suspect a bullish breakout could be imminent as long as the risk-on vibe continues.

- A break above 85.05 assumes bullish continuation

- The bias remains bullish above yesterday’s (bullish outside day) low

- 86 is the initial target (round number), next major resistance is 87.20

Commodities: Gold finally cracks 1800, copper flies, oil sags

After much anticipation, gold finally broke above 1800 to clear its 200 day-eMA on its third attempt. The daily trend continues to carve out a bullish structure, and the 1835 target (projected from the double bottom from the 1767 low) remains intact. From here, the bias remains bullish above 1800.

As discussed in yesterday’s video, were the dollar index to fall from resistance (as it did) it should send copper to new highs and break EUR/USD out of its bullish wedge. We’re glad to say it all came to fruition. Copper futures now trade at $4.60 and trade just 49c from its February 2011 high.

Oil prices were lower for a second consecutive session after hitting key resistance levels as coronavirus cases continue to surge in India. Brent futures trade at 68.57 yet the daily trend remains bullish above the 66.40 low, so a retest and break above $70.00 remains feasible.

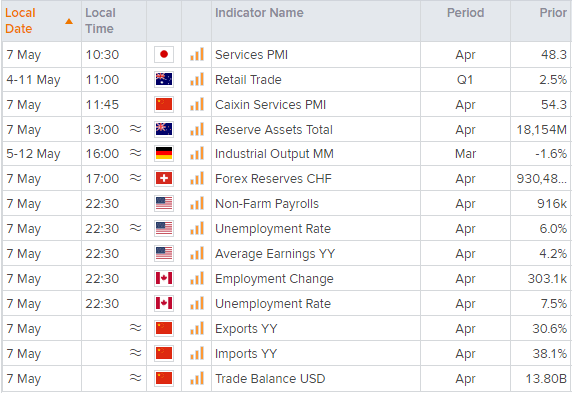

Up Next (Times in AEST

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.