After U.S. President Donald Trump’s Inauguration speech, market participants will be switching their focus on the “crux” which is Trump’s first 100 days in office. Since Franklin Roosevelt, past U.S. Presidents had used their first three months in office to push and pass key legislation. Since Trump’s presidential campaign, his mantra has been “Make America Great Again” and “punished” countries that short-changed and steal jobs from America via unfair trade agreements.

Over at the Asia Pacific region, the fortunes of most Asian nations are tied to trade flows and capital mobility, thus clarity on Trump’s proposed policies for trade and financial deregulation especially the measures imposed by the Dodd-Frank Act enacted after the 2007/08 Great Financial Crisis are the most important issues.

Trade policies

- It is highly likely that President Trump will withdraw from the Trans-Pacific Partnership (TPP) as he has continued to criticise this trade agreement formalised by Obama’s administration as a “disaster” that put America’s interests at a disadvantage.

- Impose trade tariffs (45% as suggested by Trump during his campaigns) and anti-dumping duties on China exports to U.S. It seems that such trade tactics are becoming a reality once Trump takes office. The answer lies in his choice of trade officials; Commerce Secretary nominee Wilbur Ross, U.S. Trade Representative nominee Robert Lighthizer, newly formed White House National Trade Council headed by Peter Navarro. These men are harsh critics of China’s trade practices and favour trade tariffs to protect U.S. industries.

- Trade war – China via its state media outlets has announced that it is willing to cooperate with U.S. as a responsible partner but warned that China will retaliate if “unfair demands” are made. For example, over at the on-going Davos Word Economic Forum, China President Xi Jinping has taken a jab to warn the negative effects of anti-globalisation (indirectly aiming at Trump’s proposed trade policies).

- Power to impose – The U.S. Constitution allows the President the authority to withdraw from trade agreements as well as impose tariffs on countries that have engaged in unfair trade practises without U.S. Congress approval. Therefore, Trump’s administration will be able to impose and dictate such protectionist trade policies within the first 100 days without much opposition.

Financial deregulation

- President Trump has made remarks that current regulations are making difficult for business and individuals to obtain loans from banks due to capital and liquidity constraints. Thus, he is in favour of having a lighter approach on financial regulations and may even dismantle some measures imposed by the Dodd-Frank Act.

- Putting pressure on supervisory agencies that enforce the current regulations to relax on them. Led by Federal Reserve Governor Daniel Tarullo, U.S. has adopted an extra stringent version of the global standards on capital and liquidity set by the Basel Committee on Banking Supervision in the aftermath of the 2007/08 Great Financial Crisis. Trump’s administration may appoint a vice chairman for financial regulation and replace Fed governor Tarullo with an official who is more “bank-friendly”.

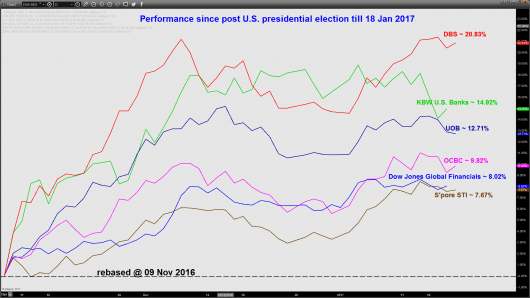

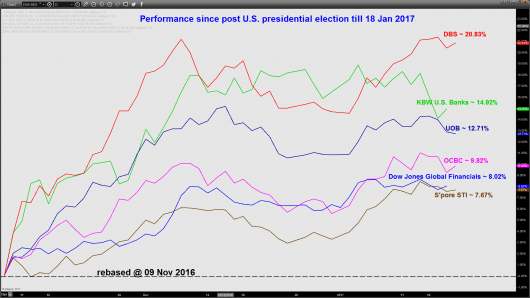

- Global banking stocks have rallied strongly and outperformed their respective benchmarks by around two times after 09 November 2016 in anticipation of such financial deregulations led by U.S.

- Power to impose – Hard within the first 100 days as intense lobbying is required due to Congress approval. Even both the House and Senate are now fully in control by Republicans, several key Republicans congressmen are advocates of stricter financial regulations due to widespread economic turmoil that can be triggered by “too big to fall financial institutions”. Republican Jeb Hensarling, current chairman of the House Financial Services Committee has proposed a capital requirement of 10% for major U.S. banks, almost twice the current amount in exchange for exemption on some of the rulings imposed by Dodd-Frank.

Potential impact on Australia financial markets

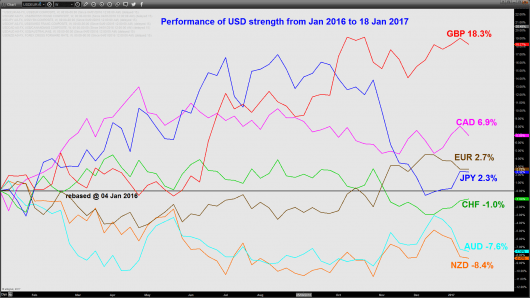

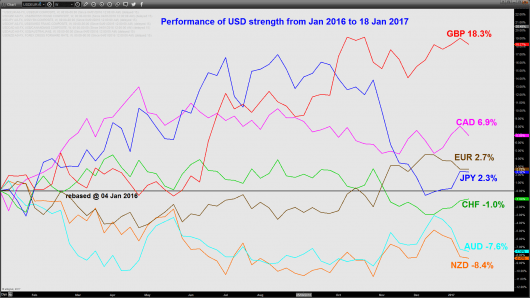

- AUD/USD - as seen from (chart 1), the AUD is the second best performer against the USD since the start of January 2016 even as USD rallied against the rest of the majors after Trump’s victory. The current strength seen in the AUD is being supported by a rally seen in global commodities especially base metals such as zinc and copper due to Trump’s proposed aggressive fiscal policies via infrastructure spending.

- AUD/USD – However, there seems to be a big risk of a mispricing right now as markets participants are not factoring the potential trade conflicts between U.S. and China as per highlighted earlier and can be made worse if Trump’s administration starts to label China as a “currency manipulator”. Under such scenarios, trade flows will be disrupted in the Asia Pacific region and put a drag on Australia’s economic growth as fortunes of Australia’s growth are heavily dependent on China now. Thus in order to counter such headwinds, Australia central band, RBA may start another round of monetary easing measures which can dampen the strength of the AUD and easily reverse the current gains seen in the AUD/USD.

- AUD/USD – as seen from (chart 2), technical analysis has suggested that the pair is now trading at potential inflection zone of 0.7560/0.7710 where a potential bearish reversal may take it down towards the 0.6690 in the long-term (3 to 6 months).

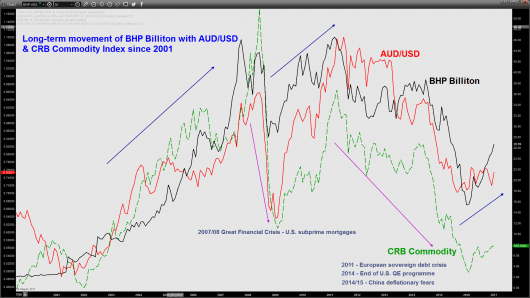

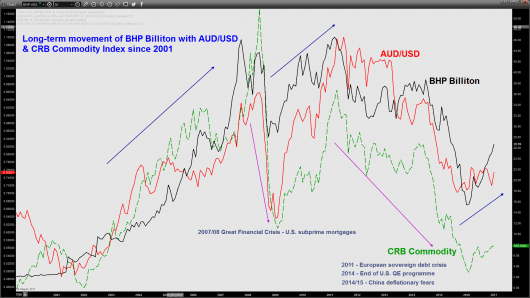

- Commodities stocks – the majors such as BHP Billiton has enjoyed a strong rally of 80% from its January 2016 low, also reinforced by Trump’s aggressive Interestingly, as seen from (chart 3), the long-term movement of BHP Billiton has moved in lock-step with the AUD/USD. Given the above risks as per highlighted above on the AUD, the current bullish trend seen in the share price of BHP Billiton can be easily reversed as well via a negative feedback loop. Also, from a technical analysis perspective (see chart 4), the on-going up move has limited potential upside as it is now coming close to significant resistances of 28.92 follow by 31.67.

Potential impact on Singapore stock market

- Banking stocks – The three major banks; DBS, OCBC & UOB are the major constituents stocks of the benchmark FTSE Straits Times Index (STI) as they have a combined total weightage of close to 30% in terms of market capitalisation. As seen from (chart 5), all these three banks have outperformed the benchmark STI and the broad based Dow Jones Global Financials Index since 09 November 2016 (post U.S. Presidential election).

- Risk of mispricing – The rally seen in Singapore banking stocks have largely been fuelled by the highly anticipated Trump’s financial deregulation policies which can face headwinds as per highlighted earlier. In addition, Singapore economic growth has deteriorated since 2014 from an annual rate of 5.2% to 1.8% estimated for 2016. Bad loans provision has continued to increase that has put downside pressure on banks’ profit margins. Singapore is heavily dependent on its external sector, a trade war between China and U.S. is likely to weaken economic growth further as trade flows are being disrupted. The current up move seen in the three Singapore banks have not priced in such potential negatives which can easily derail their current respective bullish trend.

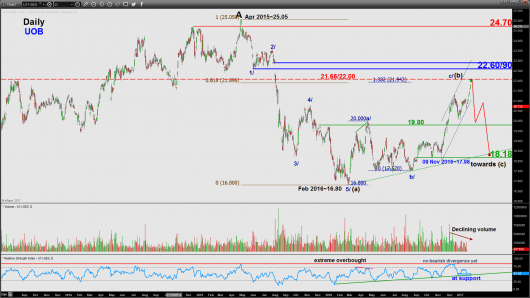

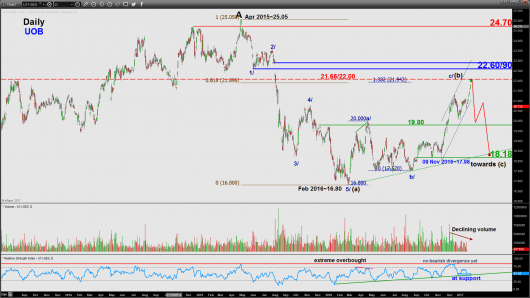

- Limited upside potential – As seen from (chart 6), the technical chart of UOB is advocating for a potential “last push up” towards the 21.66/22.00 resistance before it faces the risk of a bearish reversal in the long-term (3 to 6 monthsChart 1 –

Chart 1 – USD performance against major currencies

Source: eSignal (click to enlarge chart)

Chart 2 – AUD/USD now back at significant resistance zone of 0.7560/0.7710

Source: eSignal (click to enlarge chart)

Chart 3 – Long-term movement of BHP Billiton with AUD/USD

Source: eSignal (click to enlarge chart)

Chart 4 – BHP Billiton (ASX: BHP)

Source: eSignal (click to enlarge chart)

Chart 5 – Performance of Singapore banks

Source: eSignal (click to enlarge chart)

Chart 6 – UOB (SGX: U11)

Source: eSignal (click to enlarge chart)

Source: eSignal (click to enlarge chart)

Disclaimer

The material provided herein is general in nature and does not take into account your objectives, financial situation or needs. While every care has been taken in preparing this material, we do not provide any representation or warranty (express or implied) with respect to its completeness or accuracy. This is not an invitation or an offer to invest nor is it a recommendation to buy or sell investments. City Index recommends you to seek independent financial and legal advice before making any financial investment decision. Trading CFDs and FX on margin carries a higher level of risk, and may not be suitable for all investors. The possibility exists that you could lose more than your initial investment further CFD investors do not own or have any rights to the underlying assets. It is important you consider our Financial Services Guide and Product Disclosure Statement (PDS) available at www.cityindex.com.au, before deciding to acquire or hold our products. As a part of our market risk management, we may take the opposite side of your trade. GAIN Capital Australia Pty Ltd (ACN 141 774 727, AFSL 345646) is the CFD issuer and our products are traded off exchange.

Source: eSignal (click to enlarge chart)

Source: eSignal (click to enlarge chart)