au stock focus the worst may not be over for harvey norman 2692632017

Last month, e-commerce juggernaut Amazon has announced officially that it will set up a major operation that includes warehouses in Australia by 2018. This will […]

Last month, e-commerce juggernaut Amazon has announced officially that it will set up a major operation that includes warehouses in Australia by 2018. This will […]

Last month, e-commerce juggernaut Amazon has announced officially that it will set up a major operation that includes warehouses in Australia by 2018. This will be a big shakeout to the local Australian retailing business landscape as Amazon’s strategy is likely to compete on a platform of low prices, wide variety of products selection and fast delivery services. In addition, Amazon will also offer their premium Prime Now service that provides faster deliveries within one hour.

The three pure plays Aussie retailers that will have a significant impact will be Harvey Norman, Myer and JB Hi-Fi. Even though all these three retailers have e-commerce platforms for their respective products offerings, it is likely that they are not able to compete with Amazon in terms of scale and efficiency.

At the moment in Australia, Amazon is already selling entertainment services that include ebooks and Amazon Prime streaming of television series and moves. The next focus for Amazon in Australia will be consumer and home electronics products that are being dominated currently by Harvey Norman and JB Hi-Fi.

An analysis report released by Slice Intelligence in February 2017 that analysed more than 4 million online purchases had found out that 43% of total online retail sales in the U.S. were transacted through Amazon platforms in 2016. In addition, Amazon had accounted a lion share of 53% in terms of growth in U.S. e-commerce sales for 2016.

Also, Amazon had seen its presence increased significantly in other overseas markets that it had setup business operations in the recent years. It now sells more non-food products in Germany and the U.K. than any retailers. In a recent survey conducted by Nielson in February, around 56% of Australian adults had indicated that they will buy from Amazon when it opens in Australia.

Therefore, Amazon is likely to be a serious threat to Aussie retailers and force them to cut the current selling price of consumer and electronic products in order to remain competitive. In the coming years, the profit margins of Harvey Norman, Myer and JB Hi-Fi will face potential downside pressure.

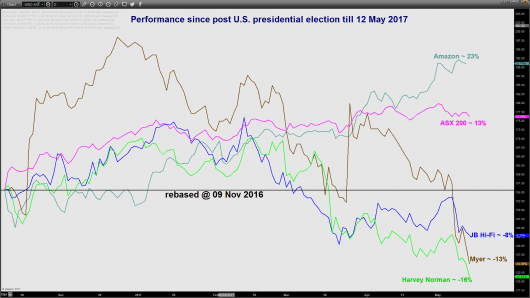

Interestingly, even before Amazon set up its core businesses in the Australia, the share prices of Harvey Norman, Myer and JB Hi-Fi have started to face headwinds as they have underperformed significantly against the benchmark ASX 200 since the post U.S. president election rally in November 2016 (see chart 1). The worst among the pack is Harvey Norman where it had declined by 16% versus a gain of 13% seen in ASX 200 despite a record half-year trading result that ended in 31 December 2016 where it had recorded a 20% increase in after-tax earnings to $204.3 million excluding the impact of property revaluations.

(Click to enlarge chart)

Given the current weak performance seen in Harvey Norman’s share price, we will be curious to know whether it has priced in fully future potential negative impact on its profit margins that will be caused by the upcoming emergence of Amazon in Australia.

Now, let’s us take decipher this question from a technical analysis perspective.

Intermediate resistance: 4.44

Pivot (key resistance): 4.77

Supports: 3.77, 3.33 & 2.90

Next resistance: 5.58

Harvey Norman has now started to evolve within a medium-term (1 to 3 months) bearish downtrend and as long as the 4.77 pivotal resistance is not surpassed, it is likely to shape a further potential down leg to target 3.77 follow by 3.33 next.

On the other hand, a clearance above 4.77 may invalidate the on-going bearish trend to see a recovery to retest the major August 2016 swing high of 5.58.

Charts are from eSignal

Disclaimer

The material provided herein is general in nature and does not take into account your objectives, financial situation or needs. While every care has been taken in preparing this material, we do not provide any representation or warranty (express or implied) with respect to its completeness or accuracy. This is not an invitation or an offer to invest nor is it a recommendation to buy or sell investments. City Index recommends you to seek independent financial and legal advice before making any financial investment decision. Trading CFDs and FX on margin carries a higher level of risk, and may not be suitable for all investors. The possibility exists that you could lose more than your initial investment further CFD investors do not own or have any rights to the underlying assets. It is important you consider our Financial Services Guide and Product Disclosure Statement (PDS) available at www.cityindex.com.au, before deciding to acquire or hold our products. As a part of our market risk management, we may take the opposite side of your trade. GAIN Capital Australia Pty Ltd (ACN 141 774 727, AFSL 345646) is the CFD issuer and our products are traded off exchange.