Q2 Macroeconomic Outlook

The first two months of 2023 painted an optimistic picture for global economic prospects.

Between a warmer-than-feared winter in Europe and an as-smooth-as-could-be-reasonably-expected reopening of the Chinese economy, economists had moved from debating whether we would see a “soft landing” or a “hard landing” in 2023 to pondering whether a “no landing” scenario, where global growth continued unabated despite higher interest rates, could be on the table.

As we flipped our calendars to March though, risks started to rear their heads. Looking ahead to the second quarter, the fallout from surging interest rates on the financial system will be a key theme to watch, highlighted by concerns about regional banks in the US and major European money cente banks like Credit Suisse and Deutsche Bank.

Q2 global growth outlook

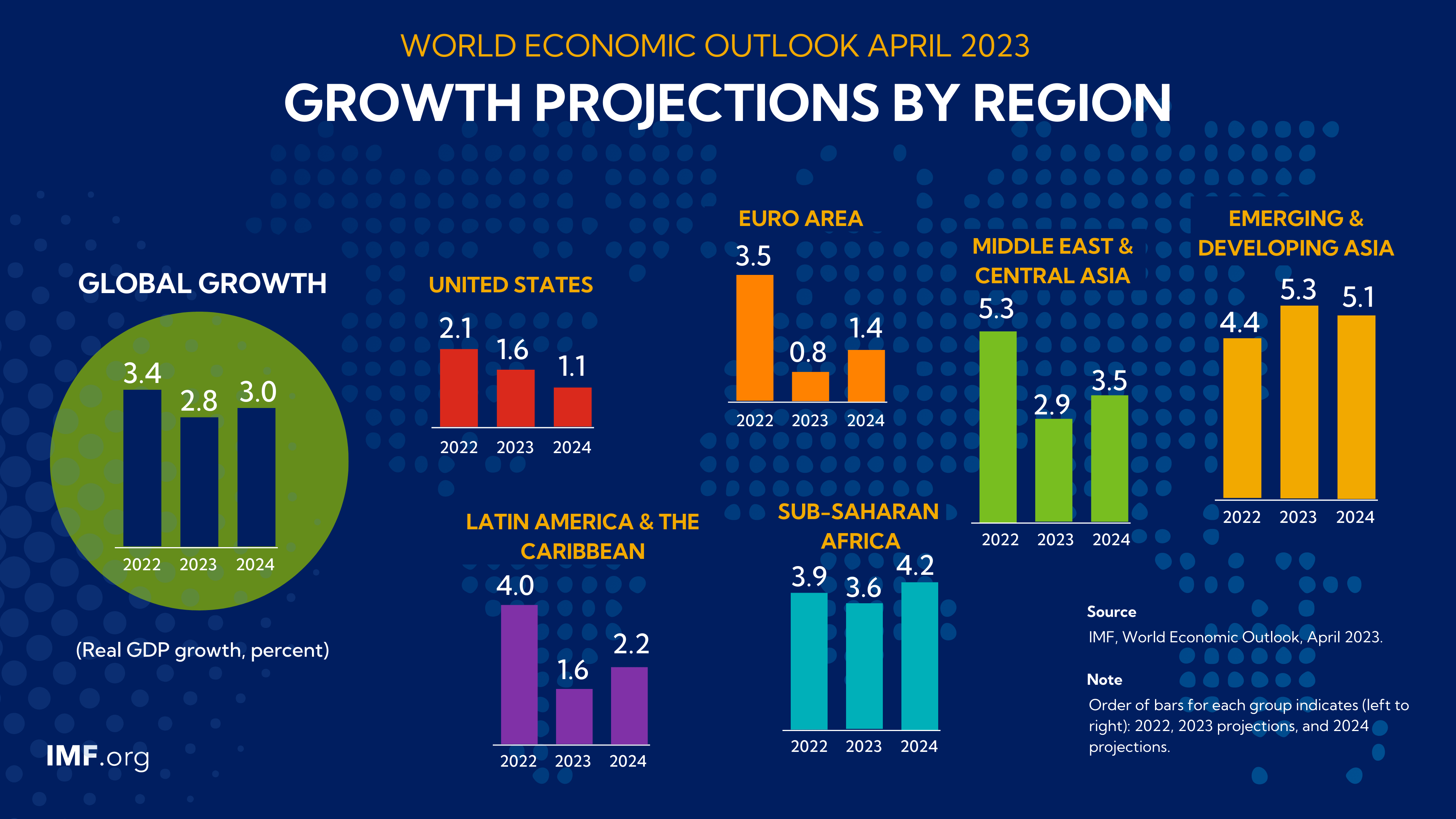

Per the IMF’s most recent World Economic Outlook, global growth is still expected to be moderate across the year, but the feared worst-case scenarios have been averted.

In its Q1 update, the IMF predicts 2.8% growth for the global economy in 2023 , well below the 2022 estimate of 3.4% and 21st century average of 3.8% as higher interest rates and the ongoing Russia-Ukraine war take a toll on growth.

As the graphic below shows, growth is expected to be relatively tepid in the US (1.6%) and Euro area (0.8%), with stronger growth projected in Asia and Africa.

Source: IMF

Inflation outlook

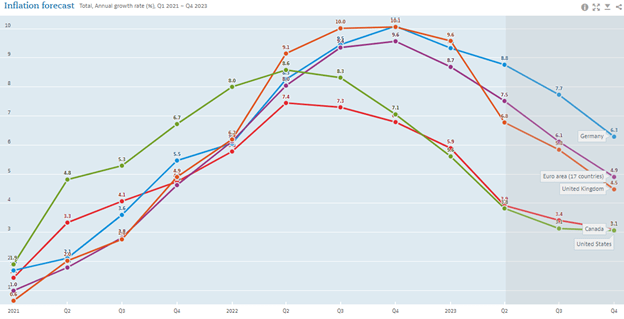

As we projected in our full 2023 Market Outlook reports, it’s looking increasingly likely that inflation has peaked across the developed world. The combination of normalising supply chains, market adaption to the ongoing Russia-Ukraine war, and rapidly rising interest rates appears to have kicked off a disinflationary process that may last through the rest of the year, if OECD forecasts can be trusted:

Source:OECD

With peak price pressures (likely) behind us, the market will shift its focus to the pace of the decline. If the rate of declines in inflation shows any signs of slowing, policymakers are likely to take notice and consider additional measures to ensure price increases do not become entrenched. As we discussed in our full 2023 outlook, the risks of sticky/secular inflation remain, with potential benefits for gold and other commodities if central banks are forced to tolerate an extended period of above-2% inflation.

Central banks

Speaking of central banks, one important factor to watch as we move through Q2 will be the impact (if any) from the aggressive interest rate hiking cycle that central banks started roughly a year ago. While the exact delay is hotly debated and ever-changing, economists broadly agree that monetary policy impacts underlying economic activity with a lag.

As of writing in mid-March, there are early signs of stress in developed market banking systems, highlighted by the first US bank failures (including the implosion of Silicon Valley Bank, the 2nd largest failure in the country’s history) and a bailout of the long-troubled European bank Credit Suisse. These issues may serve as the proverbial “canary in the coal mine” for major central banks.

After earlier implying sustained interest rate increases throughout the first half of the year, central banks from the Fed to the Bank of Canada to the European Central Bank and others have toned down their hawkish language or outright paused their rate hiking cycles on the expectations that tighter lending standards from banks will act as pseudo rate hikes in slowing the economy.

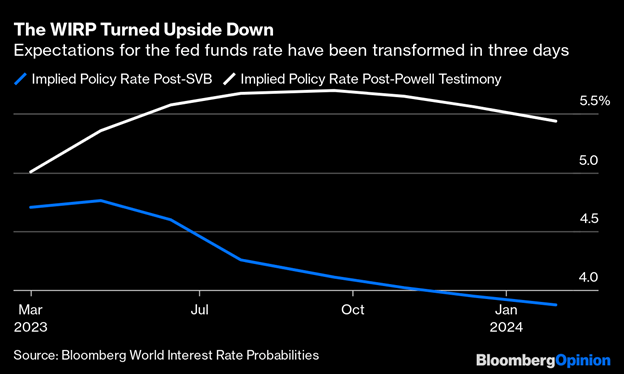

As an illustrative example, traders had projected that the Federal Reserve would raise interest rates well above 5.5% and keep them there throughout the year in the wake of the FOMC meeting on March 1st, but the ensuing implosion of Silicon Valley Bank has traders projecting a peak rate of just 4.75% and a full 75bps of interest rate cuts by year-end as we go to press.

Source: Bloomberg

Conclusion

On balance, the first few months of 2023 have improved the near-term global economic outlook, but the risks from continued turmoil in the banking system and/or sticky inflation could still lead to downside scenarios as we move through the rest of the year. Whether policymakers will be able to thread the needle for a so-called “soft landing” will depend on how economic variables like GDP and inflation interact with slowing bank lending amidst elevated interest rates.

As always, a flexible approach to trading will be essential as we move through the second quarter of the year.

Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX