Q2 Commodities Market Outlook

Well, 2023 has certainly been lively. Equity and commodity traders were quick to rejoice news of China’s reopening in early January, whilst yen traders were treated to an out-of-meeting policy adjustment which gave currency markets a jolt. And whilst geopolitical tensions have receded somewhat, they have now been replaced with fears of contagion and central bank pivots. With that in mind, we take a fresh look at oil and gold to update our analysis from our 2023 outlook guide.

Oil may be rangebound for now, but no range lasts forever

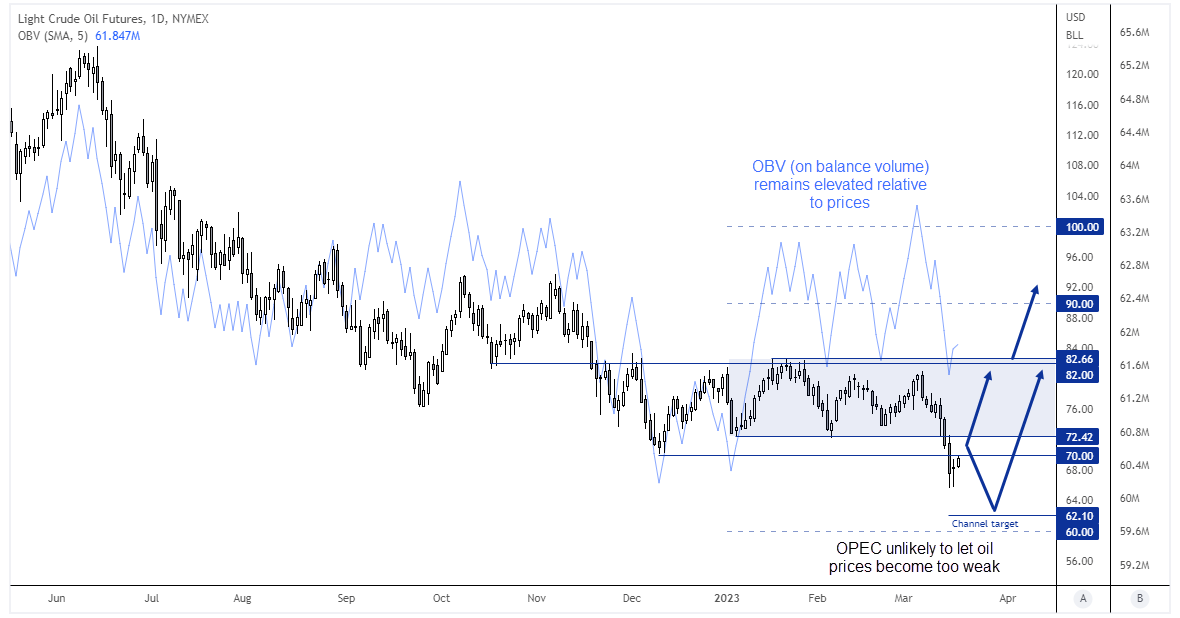

At the time of writing, WTI is down around -13% YTD with a range of 25%, which is less than the 86% high-low range rollercoaster 2022 delivered.

Until last week, WTI had had been ranging between $70 to $83 since December. Yet recent market turbulence surrounding the implosion of Silicon Valley Bank pushed oil prices to a 15-month low as volatility began to wake up. Its downside break is in line with its established bearish trend, but we suspect any downside break could be limited.

Not only will OPEC likely support prices with a break into the $60’s, but China’s great reopening continues to support demand hopes and the government is targeting GDP to be around 5% in 2023. The IMF also upgraded their own GDP forecast to 2.9% for 2023. And if central banks are forced to cut rates sooner than later, it could weaken the dollar and support oil prices.

To counter that, if inflation remains sticky then it calls for higher interest rates which would be a drag on oil prices. And the WTI futures curve is also in backwardation, which shows expectations for lower prices as the year progresses.

In a nutshell, upside potential is capped by slower growth and high inflation whilst downside potential capped by OPEC and demand.

Oil market conclusions

- The break of the $73 - $83 channel projects a continuation to around $62

- We expect OPEC to support prices above $60

- OBV (on balance volume) remains elevated relative to prices, casting doubt to the downside breakout

- Soft growth and high levels of inflation is currently capping upside potential

- But if the Fed cut rates and guide economy to a soft landing, WTI could be headed for the $90 - $100 range

Gold – more of a trader’s market at present

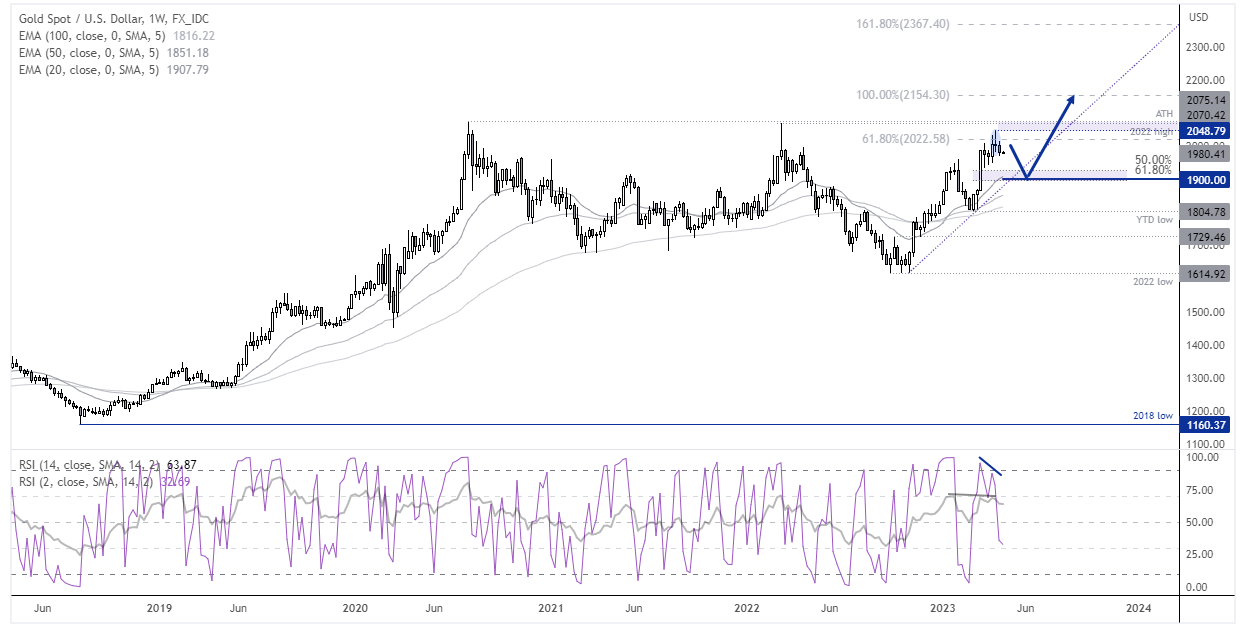

It was a lively quarter for gold in Q1, which saw its January gains wiped out in February before re-establishing itself as a safe-haven asset in March.

The heightened level of volatility and sensitivity to headline risks made it more of a trader’s market than an investor’s one. Its inverted relationship with bond yields and the US dollar remained as strong as ever as the debacle surrounding Silicon Valley Bank and concerns over contagion played out. And whilst that may remain the case over the foreseeable future, gold is also vulnerable to handing back its recent gains as quickly as they were made should appetite for risk return. Especially if Central banks make it clear that we’re not as close to the terminal rate as investors hoped.

But if we take a step back, we know that central banks continue to pile into gold and that the futures curve remains in contango to show confidence in higher prices in future. Price action also appears to be impulsive from the 1614.92 low which suggests it will break to a new record high this year. However, a bearish divergence has formed on RSI (2) and RSI (14) to suggest a pullback is required whilst prices remain below the ATH and 2022 high. 1900 and / or the bullish trendline may provide some support should prices retrace from current levels.

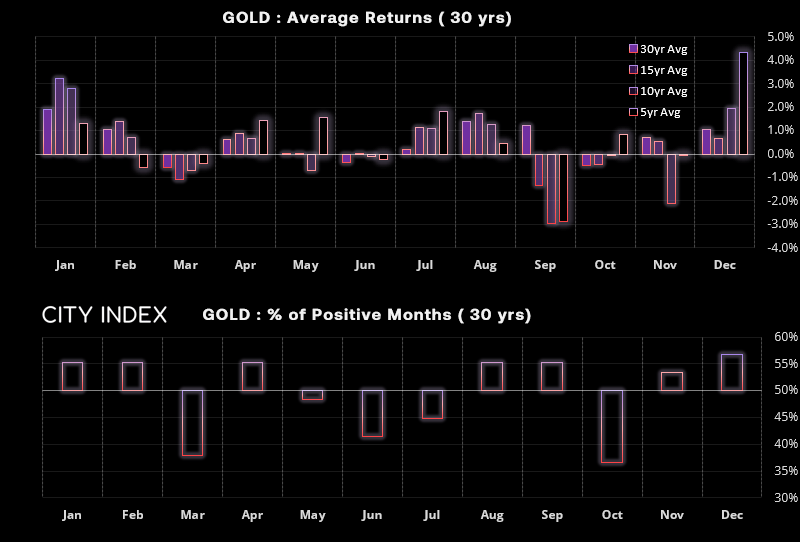

If we look at seasonality, March has posted negative average returns over the past 30 years whilst April average returns have been positive. Yet the current investment climate likely makes seasonal patterns less reliable. Furthermore, average returns for May and June don’t show much of a pattern at all, which makes it a murky environment for investors.

Gold market conclusions

- We remain bullish on gold for 2023, but it is unlikely to be a walk in the park

- Central banks, China and India are expected to continue provide support for gold in 2023

- Headline risks remain a key driver for gold, which likely makes it more of a trader’s market than an investor’s one for Q2

- Gold is vulnerable to handing back its recent gains if appetite for risk improves and central banks remain hawkish

- Upside risks for gold include safe-haven flows, softer inflation and lower interest rate

- Downside risks include risk-on environment, higher inflation and higher interest rates