Q2 Market Outlook: Big Tech

Big Tech delivered a welcome surprise in the latest quarter as the group of behemoths beat expectations. Better than anticipated demand helped topline results impress. Amazon and Microsoft continued to deliver double-digit cloud computing growth even as the market slows down, Alphabet and Meta both benefited from signs of a recovery in demand for advertising, while Apple delivered a surprise lift in iPhone sales and record service revenue. Meanwhile, earnings also came in rosier than forecast because expense growth slowed as inflationary pressures ease and cost control measures, including a widespread cut in headcount, start to make an impact and bolster margins.

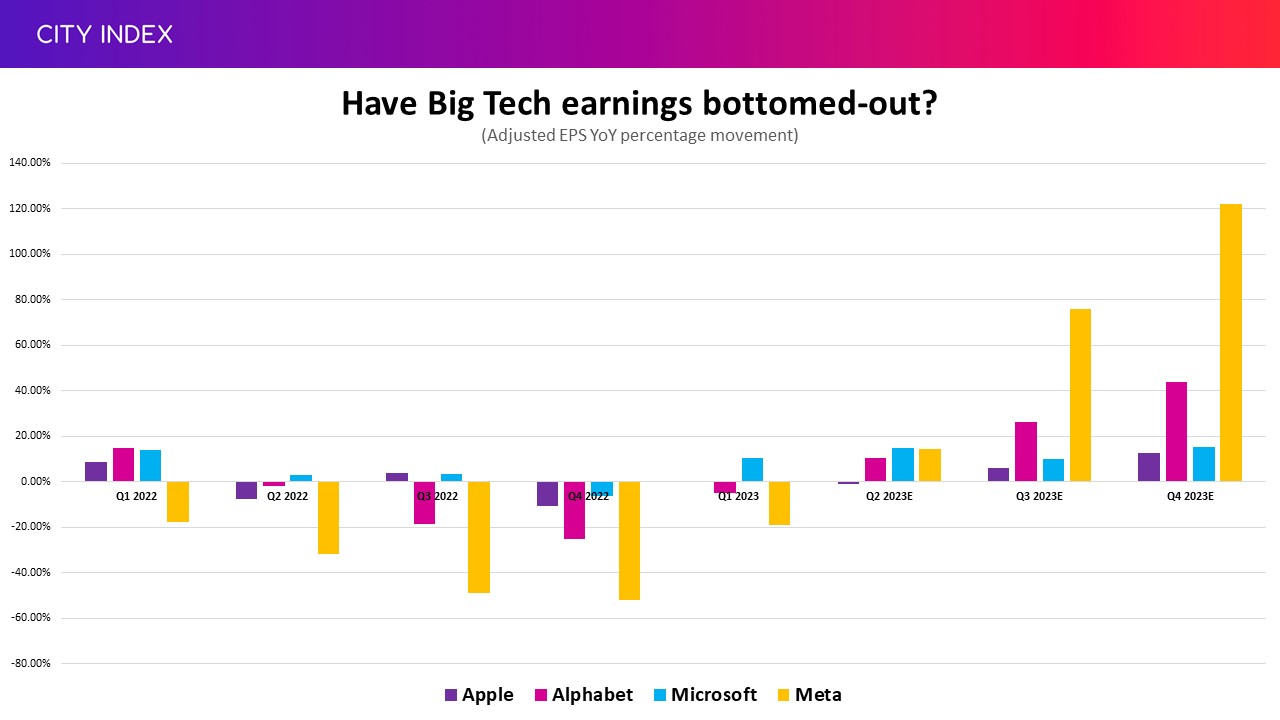

Have Big Tech earnings bottomed-out? Markets are confident that the worst is now behind the industry and that the majority of players will grow their bottom lines in the second quarter of calendar 2023 before experiencing a significant acceleration in the second half. That will be partly thanks to easier comparatives, although the outlook remains clouded by the threat posed to demand from a potential recession and tighter financing conditions. Markets have incorrectly believed earnings would have hit the trough in recent quarters, so assumptions that growth will reaccelerate should be taken with a pinch of salt given the tough and uncertain macroeconomic conditions.

With that in mind, analysts believe the slowdown in the cloud computing market could continue for several more quarters, although both Amazon and Microsoft should see their operations continue to grow their toplines even if profitability continues to be tested as they both try to assist (and more importantly retain) customers that are more conscious and disciplined with spending than ever before. Demand for hardware remains shaky and we may have to wait until much later in 2023, or possibly until 2024, for demand to pick back up, even if some like Apple are managing to defy the wider downturn. The anticipated recovery in advertising remains threatened by a potential recession, although Meta and Alphabet offer the best bang for each buck. The point to take away here is that visibility in terms of the outlook remains limited and vulnerable to what the rest of 2023 has to bring. For now, hopes are much higher for the second half of the year but we think the actual outcome is, if anything, currently geared toward the downside given the many unanswered questions surrounding the macroeconomic picture. Regardless, Big Tech remains in prime position to bounce back when economic conditions improve, confidence recovers and risk appetite returns to the market.

Apple, Alphabet, Microsoft, Meta and Amazon dominate the Nasdaq 100 and make up over 44% of the index. The group of five have been among the top 20% of performers in the tech-heavy index since the start of 2023 and all of them, apart from Alphabet, have outperformed the wider market and this is why the Nasdaq 100 has recently managed to climb to nine month highs. That shows that they have acted as a much-needed haven this year, offering some safety and reliability at a time when risks have heightened for smaller and riskier bets in the tech space. Cash is proving king and Big Tech is flush with it, and while cashflows are not immune to the current environment they are relatively safe and reliable. We believe Big Tech will continue to outperform this year as a result.

Protecting profitability is key so long as growth is subdued, which could remain the case until interest rates peak and the Fed pivots. Markets remain optimistically convinced that we will see multiple rate cuts before the end of 2023 despite a pushback from Fed officials. ‘For most of our history, we saw rapid revenue growth year after year and had the resources to invest in many new products. But last year was a humbling wake-up call. The world economy changed, competitive pressures grew, and our growth slowed considerably,’ Meta CEO Mark Zuckerberg said earlier this year, adding that he thinks this ‘new economic reality will continue for many years’. That is a message that heeds warning to all of Big Tech right now.

On the flip side, we have also seen Big Tech rewarded for finding new, potentially huge catalysts that could revive growth going forward. The eruption of artificial intelligence this year will keep grabbing headlines as companies find more ways to put it to good use, but we are yet to see any evidence that Big Tech is successfully monetising their early efforts in a significant way. We could see it help Big Tech do more with less before it starts earnings them cash in the form of revenue, but we do think progress could be swift over the coming years based on how far some AI tools like ChatGPT have advanced in recent months.

Notably, Big Tech valuations have diverged in recent years. The result has seen Microsoft and Apple, arguably the two strongest performers of the group over the past 18 months, continue to demand a sizeable premium valuation over their Nasdaq 100 peers (in terms of blended-forward price-to-earnings ratio) while Alphabet and Meta are still trading at substantial discounts as the advertising market they both rely on is yet to recover. The question remains whether these gaps in valuation will persist, widen or narrow. Either way, it provides an opportunity for traders to capitalise and offers a chance for long-term investors to pounce.

Source: Bloomberg, as of May 11, 2023

Written by Joshua Warner, Market Analyst