Q2 Market Outlook: Indices in play

US Outlook

The Fed started to slow the pace of rate hikes in Q1 and the fallout from the SVB and Signature bank collapse saw investors reprice future Fed rate hike bets.

The Nasdaq, a laggard in 2022, has outperformed the Dow Jones and the S&P 500 so far this year as rate hike bets have eased and investors rotate back into high growth tech stocks. While the market is pricing in a 25 bps hike in May, it is also expecting several rate cuts by the end of the year. This, combined with the drive for efficiency and profitability in the tech sector, means that the Nasdaq could outperform its cyclical peer the Dow Jones again this quarter.

That said recession fears are also on the rise. Signs of the US economy slowing could raise downturn fears further, which, with interest rates still high could act as a drag on stocks.

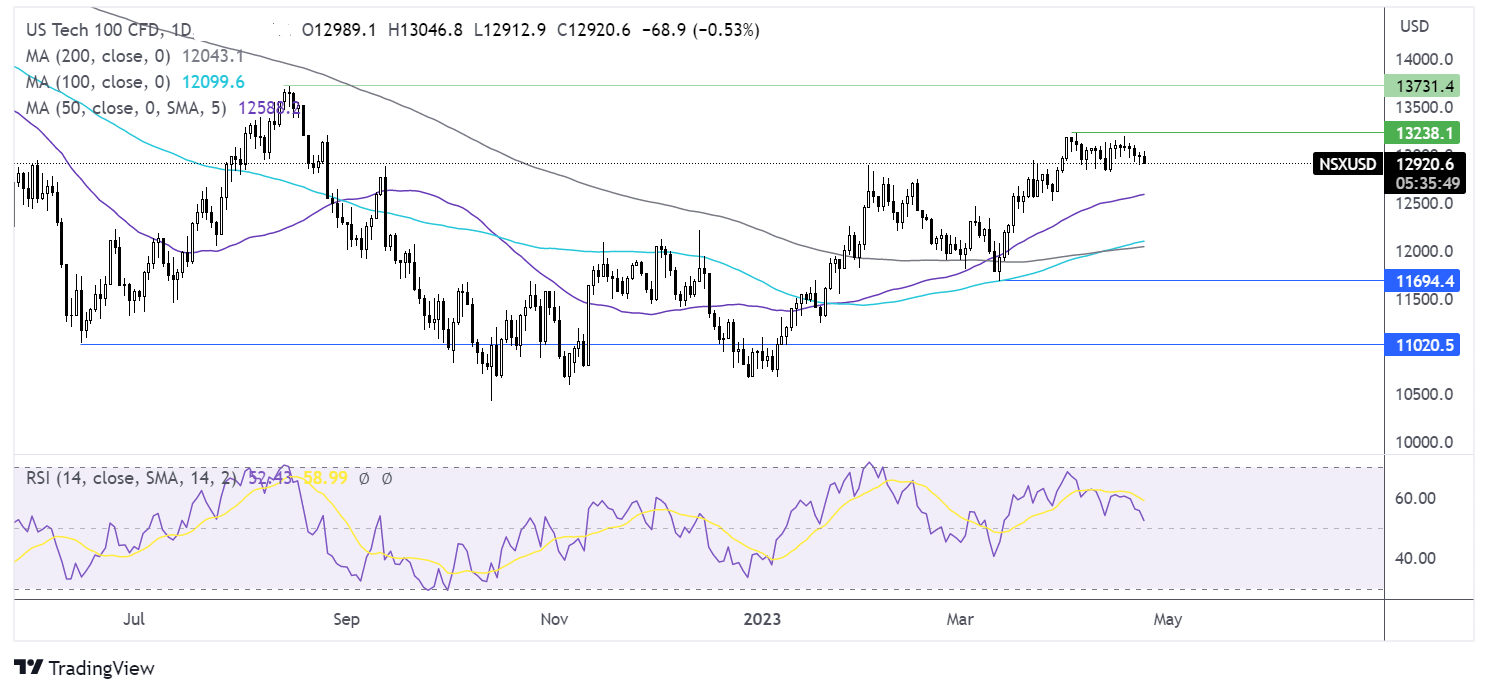

Nasdaq

Buyers will look for a rise over 13225 near term to extend gains to 13,725, the August high. A rise above here could see buyers gain momentum.

For sellers, a move below the 200 sma at 12040 could be significant and opens the door to top 11700 the March low.

Source: TradingView, StoneX

Europe Outlook

After a milder-than-expected winter, gas prices have fallen, and risks of an energy crunch have eased considerably. Recent data points to a eurozone economy that is more resilient than expected, and one that may avoid a recession across the coming quarters or experience only a mild downturn.

Inflation is expected to continue falling, albeit slowly. The ECB is likely to hike rates again in May and potentially June, which could keep gains in the DAX limited across the quarter.

The ongoing economic rebound in China, a key trading partner for Germany in particular, is a tailwind, although the recovery there is proving to be bumpy. There are still plenty of risks, which could keep volatility high near term; recent developments in the financial sector have reminded us of that.

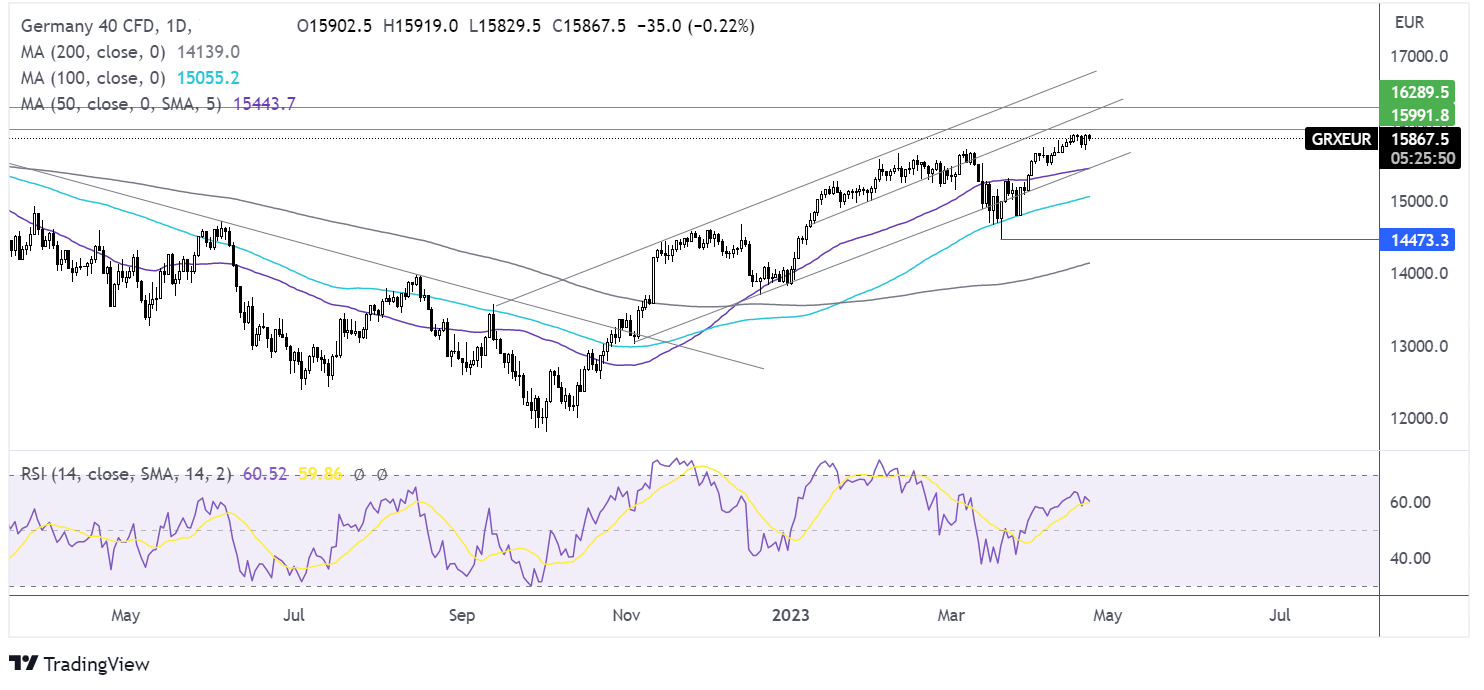

DAX

The DAX has recovered from the late March lows, re-entering the rising channel but appears to be struggling for further momentum. Buyers could look for a rise above 16000 to extend gains to 16300.

Sellers will look for a fall below 15420 the 50 sma and the lower band of the channel. 15000 the 100 sma and round number is also a significant support.

Source: TradingView, StoneX

UK Outlook

On a similar footing to Europe, the economic downturn is not expected to be as deep as initially feared, with PMI data showing activity returning to growth as of writing in March. While inflation remains stubbornly high, the BoE expects consumer prices to start falling from April thanks to the base effect, falling energy prices and the impact of high interest rates. That said another rate hike in May is likely and possibly June. A strong rebound in confidence is unlikely anytime soon and households are likely to remain squeezed.

While the FTSE could find support from miners as China’s economy continues to rebound, heavily-weight banking stocks could remain under pressure should recession fears grow.

Given our slightly bullish stance towards GBP/USD across the year, the multinationals which make up over 80% of the FTSE 100 could also come under pressure from a less beneficial exchange rate.

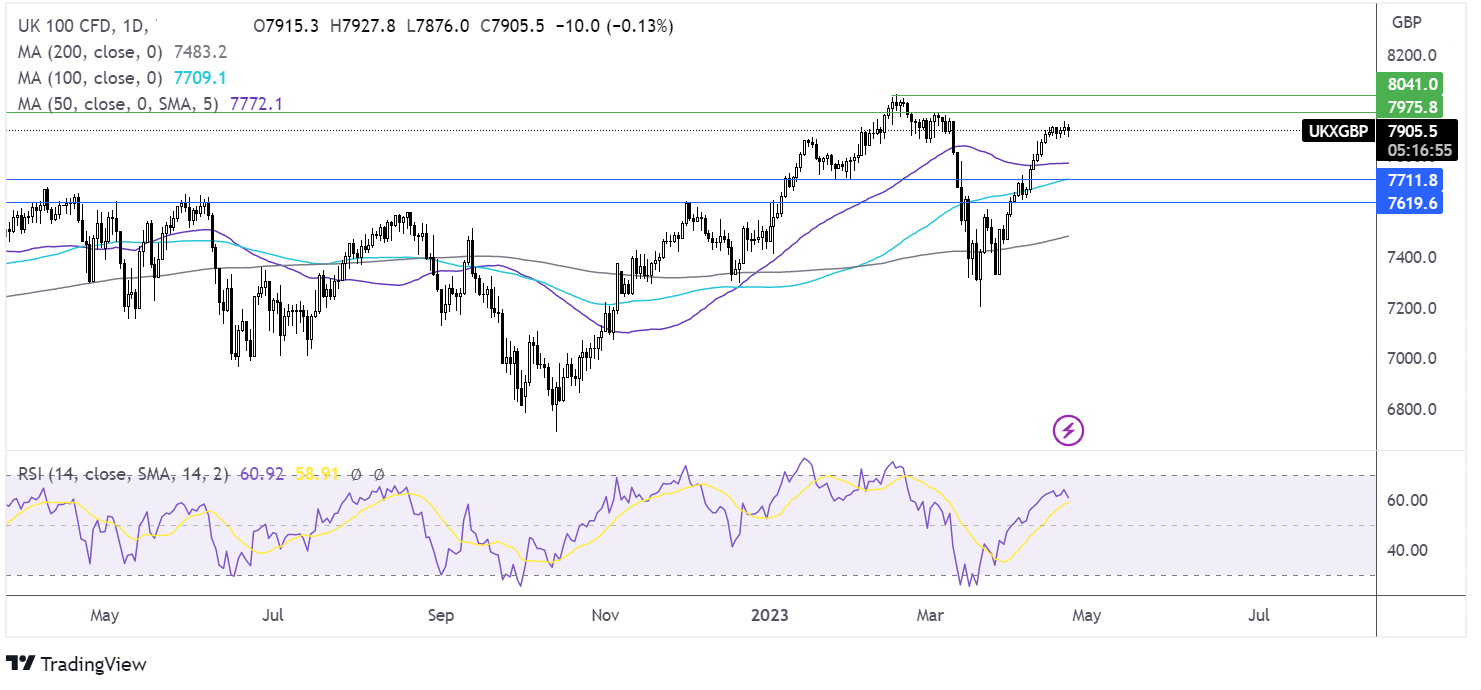

FTSE

The rebound in the FTSE brings 7975 the March high into focus with a rise above here bringing 8045 and fresh all-time highs into focus.

A break below 7700 the 100 sma and 7616 the December high, exposes the 200 sma 7485. The price has broad traded above the 200 sma since mid-November.

Source: TradingView, StoneX