- What are bonds?

- Examples of bonds

- Corporate bonds vs government bonds

- Bonds vs shares

- Trading bonds

- Why trade bonds?

- How to trade bonds?

- Bonds FAQs

What are bonds?

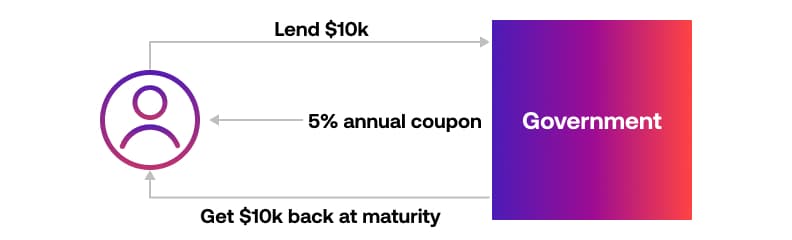

Bonds are units of debt issued by companies or governments to raise capital. When you buy a bond, you’re essentially loaning capital to the seller and earning interest on your investment until the bond reaches it's maturity date. At this point, the final interest payment is made along with the money initially paid for the bond.

There are three key aspects to bonds you should be aware of: maturities, yield, credit ratings and selling bonds. Let’s take a look at each.

Maturities

The maturity date of a bond is the time at which the bond issuer must pay back the value of the bond to the buyer. This initial investment in the bond that’s paid back on the date of maturity is known as the principal.

Bonds’ maturity dates vary greatly and can be anything from a few days to 30 years. The bond issuer will pay interest to the investor in regular instalments until it hits the maturity date.

Yield

A bond’s yield is the return on investment that a buyer of a bond receives through regular interest payments until the maturity date is reached.

In general, bonds with higher yields will be more attractive to investors. However, bonds with attractive yields tend to come with greater risk as well. Bonds with smaller yields will likely be safer investments.

Credit ratings

A credit rating is a measurement of how likely a company or government is to repay its debt, including interest payments, to a bond buyer. When buying a bond, you’re trusting the issuer with your money. Credit ratings give you an idea of how likely you are to get your capital back.

If a company has a very poor credit rating, the chances of it going bankrupt – and defaulting on its bond payments – are higher. If this happens, you can lose all of the money you initially invested. Those with strong credit scores will be less likely to default, but will probably offer lower yields as a result.

Selling bonds

You don’t have to hold a bond until maturity. Instead, you can sell it on to another investor who will then receive the coupon – and the principle when the bond matures.

Bond prices are constantly moving up or down as the investment looks like better or worse value. In periods of high inflation, for example, long-term bonds can lose out because your principle will drop in purchasing power as the bond matures.

As bond prices move, their yields will move to. Here’s an example to show how.

Examples of bonds

Let’s say you invest $5,000 in a five-year government bond that pays 2% interest each year.

Assuming you wait until the maturity date, you will receive a total of five interest payments. At 2% of $5,000, these will equate to $500 ($5,000 x 0.02 x 5 annual payments). At the maturity date, you will also receive your principal (initial cost of the bond) of $5,000 back as well.

So, across the five years, you would have made a profit of $500 from the interest payments, a return of 10% on your investment.

But what if you sold your bond on?

Let’s say you’ve bought our bond above, but after two years you see a more attractive investment with a higher interest rate payment. So you decide to sell your bond.

However, your bond now has an unattractive 2% interest rate that is far less than other investments available. Therefore, you can’t sell it for the full $5,000, and instead may have to settle for $4,500.

The buyer will still receive 2% interest payments on $5,000, but their yield would be higher as they’ve paid less for the bond and still earn the same income back.

Government bonds vs corporate bonds

Government bonds and corporate bonds are very similar in concept, with the purpose of both being for the bond issuer to raise financial capital and the bond buyer to earn money via interest payments. The main difference between the two is the issuer:

- Government bonds are issued by countries

- Corporate bonds are issued by companies

In general, government bonds are considered a more secure investment.

Although it’s not unheard of for governments to experience serious financial issues, they have a lot of preventative measures that companies don’t to avoid bankruptcy. For instance, if a government is seriously running out of money, it can choose to raise taxes or print more money via quantitative easing.

Therefore, the chances of a government defaulting on your payments is very low – but not impossible, as we saw during happened was the 2008 Greek economic crash - Due to the lower risk, the rate of interest received is also lower compared to riskier corporate bonds.

Bonds vs shares

It main seem like buying shares and buying corporate bonds are very similar, but they work in very different ways. Shares and bonds are both ways for corporations to raise money in the short term and investors to potentially make money, but the similarities end there.

When buying bonds, you never actually own any part of the company you’re investing in – you simply own the bond which you will be paid back for at the date of maturity. When buying shares, you literally own a ‘share’ of the company.

Other differences between buying bonds and buying shares are highlighted in the table below.

Bonds |

Shares |

|

Ownership |

Never own a stake in the company. |

Own a stake in the company. |

Income |

Regular interest payments, plus the principal paid at the maturity date. |

Only make money from dividends, or if the value of the shares rise and you sell them. |

Length |

Typically long term, with some lasting for up to 30 years, but can sell early for current market value. |

Can buy and sell at any time as long as you can find a buyer or seller. |

Costs |

No specific costs, although buying bonds via a broker may involve commission fees. |

Commission is usually taken when buying shares. |

Benefit to the Company |

Selling bonds allows companies to raise instant capital without giving away any equity. |

Selling shares allows companies to raise instant capital, but at the cost of giving away equity. |

Dividends |

You won’t receive dividend payments. |

You will receive any dividends payments the company issues. |

Drawbacks of bonds

However, there are two major flaws to investing in bonds. The first is the length of time you need to hold them until they reach maturity and receive the principal payment. Although you can get bonds with short-term maturity dates, ‘short-term’ in the context of bonds can still be considered as years.

If a bond’s maturity date is three years away, this means you’ll need to hold it for the full three years to receive the principal payment. Bond maturity dates are commonly 10 years, and up to 30 years.

Secondly, though regular interest rate payments may sound appealing, most bonds are not adjusted based on any change in interest rates or inflation. A bond with a coupon rate of 2%, for example, will plummet in value if interest rates rise to 3% – your capital could earn a better return in a savings account.

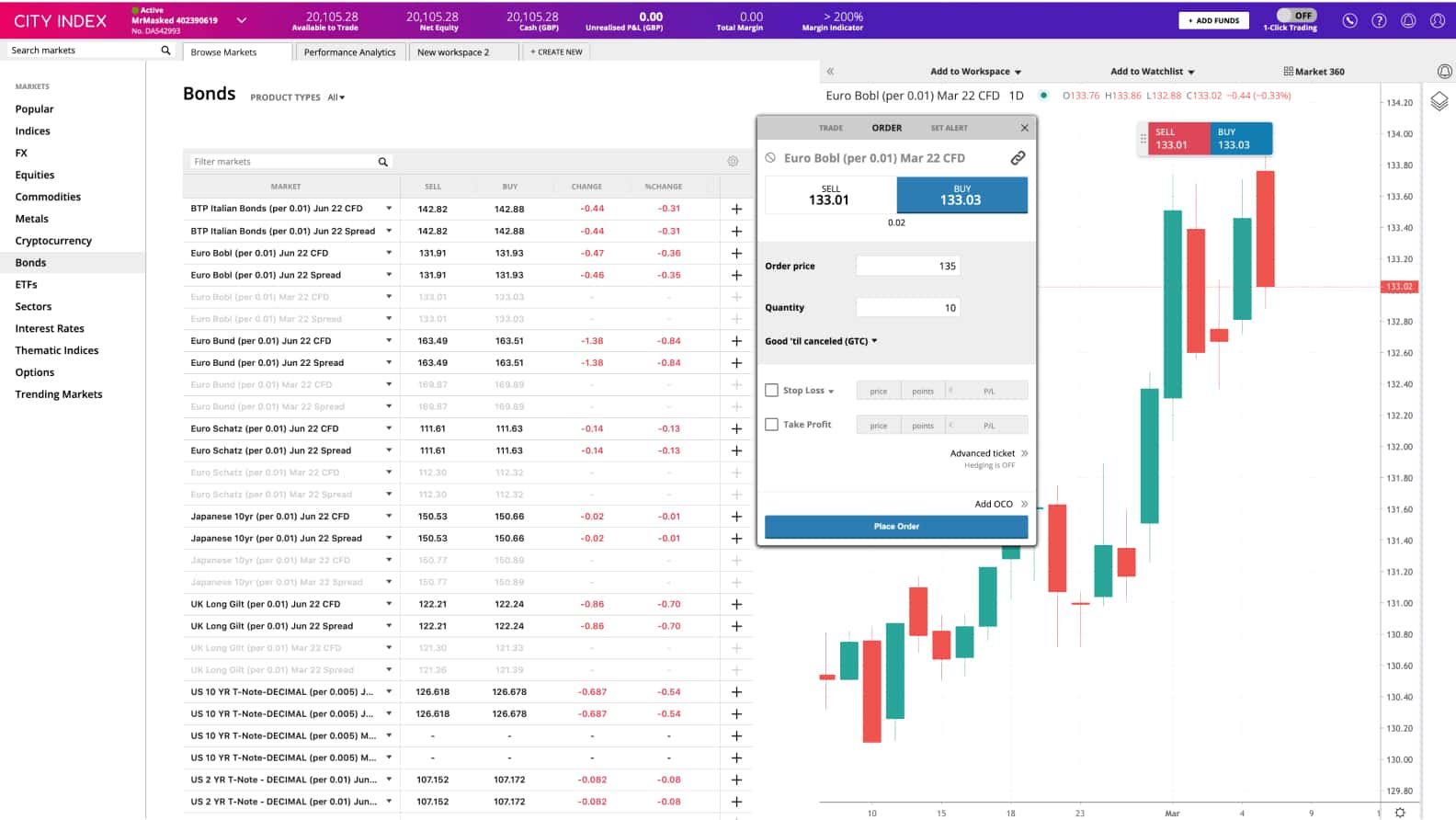

Trading bonds

One popular method of buying and selling bonds without investing in them is to trade on bonds prices. This means you can gain exposure to the bonds markets as if you were buying them, but without the need to wait till maturity to cash them out.

With City Index, you can choose to trade CFDs on bond markets such as UK Long Gilts and US T-Bonds. To get started, open a City Index account.

When trading bonds, you never actually own the coupon or receive any interest payments on your investment. You’re simply speculating on whether the bond price will rise or fall. A bond might be more valuable further away from the maturity date as more interest payments are due to be paid, and this will be reflected in the price of a bond market when trading it.

Why trade bonds?

Let’s cover three main reasons to trade bonds instead of investing in them: leverage, lack of maturities and shorting.

-

Leverage

Firstly, bond CFDs are a leveraged product.

This means that you only need to stake a small amount of money upfront as margin to place your trade. Despite not needing to pay the full price of a bond to trade it, you still gain full exposure to that market and benefit fully from any price move in your direction. While leverage will increase your profits, though, it will also increase your risk. -

No maturity

When trading bonds, you don’t need to wait until the maturity date to realise any profit from your position.

Instead, you can choose to ‘cash out’ your full exposure on a bond market at any time during market hours. So, if you think specific a long-term bond is going to go up in price in the short term, but don’t want to have to wait years to see a profit, you can trade it instead. -

Shorting

When you trade a bond, you choose whether to go long or short at the outset, allowing you to take advantage of both falling and rising prices.

Bond prices are moving all the time – particularly as on interest rates go up or down.If the rate of interest paid back to a bond’s buyer is far greater than the interest rates set by a central bank, the bond is going to be far more attractive to investors as they can get a greater return on their money. However, if a bond’s rates are far lower than the general interest rate, they will be less desirable and will depreciate.

How to trade bonds

To trade bonds with City Index, follow these simple steps:

- Open a live City Index account

- Explore our bonds markets and discover your next trading opportunity

- Choose whether to buy or sell, and set your trade size

- Place your stops and limits

- Click ‘Place Trade’ and your position will be opened

Not quite ready to commit real capital? Open a risk-free demo and trade our full range of bond markets risk free.