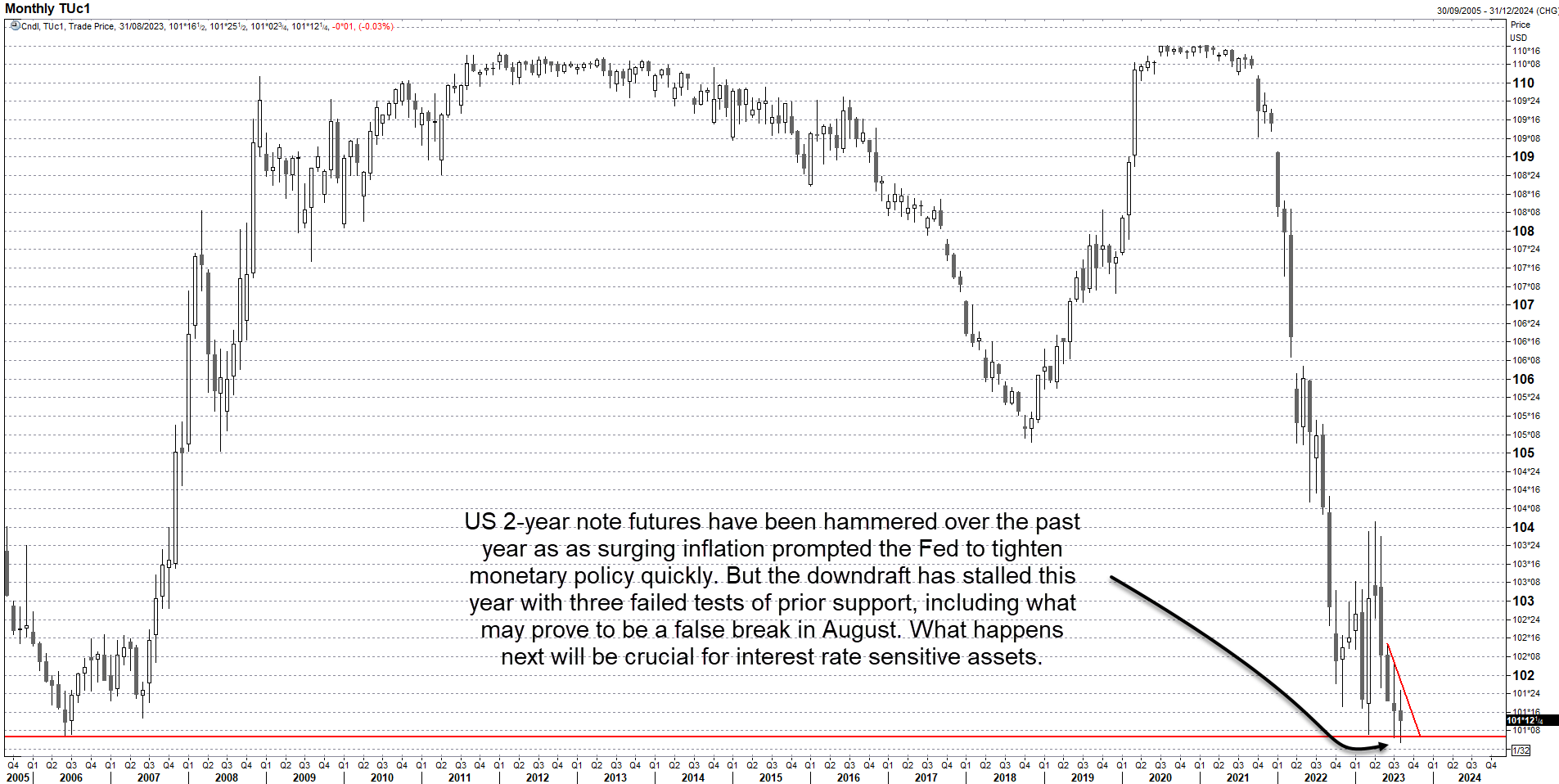

The most important chart in the world right now (arguably)

Source: Refinitiv

If you’re not watching developments in US 2-year Treasury futures right now, you should be. As a highly liquid contract gauging sentiment on the outlook for the Fed funds rate, what happens next will be felt by almost every asset class. After a brutal selloff over the past two years, futures have stabilised recently, bouncing off support extending back to before GFC. But that will mean nothing if futures break lower as chart is warning, implying another leg higher for yields. However, with some US data starting to soften, a reversal of the prevailing trends cannot be ruled out earlier. What happens next is therefore very i9mporant for risk-sensitive asset classes.

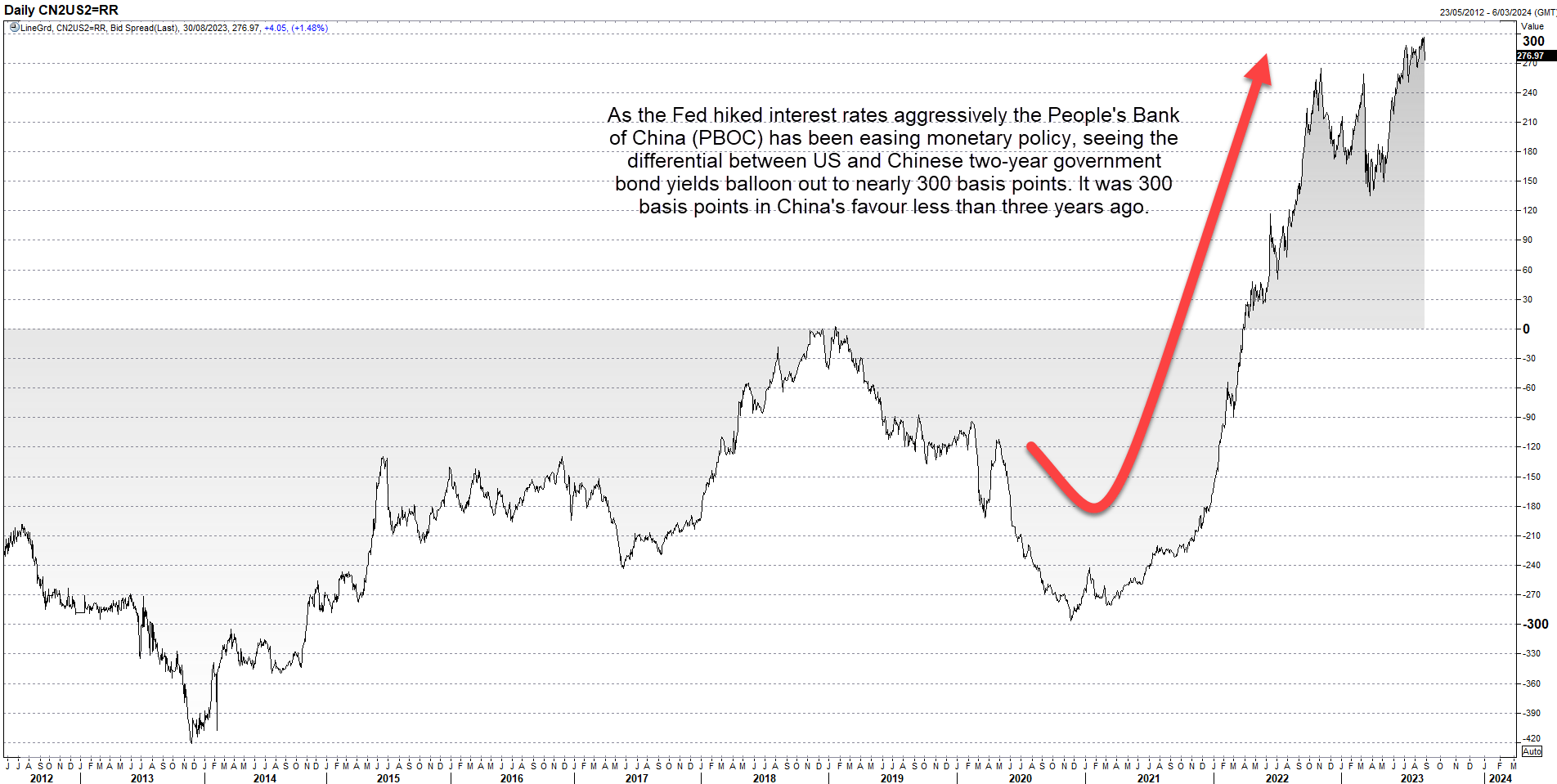

US bond yields are now far higher than China

Source: Refinitiv

A consequence of the decline in 2-year Treasury notes has been the United States’ yield advantage over other nations has soared. Here’s the differential been the US and China for a 2-year duration. Chinese bonds used to command a 300-basis point pickup over the US but that’s now swung around to a discount of the same magnitude. While monetary policy easing from China has contributed to the abrupt turnaround, it mostly stems from the lift in US interest rates.

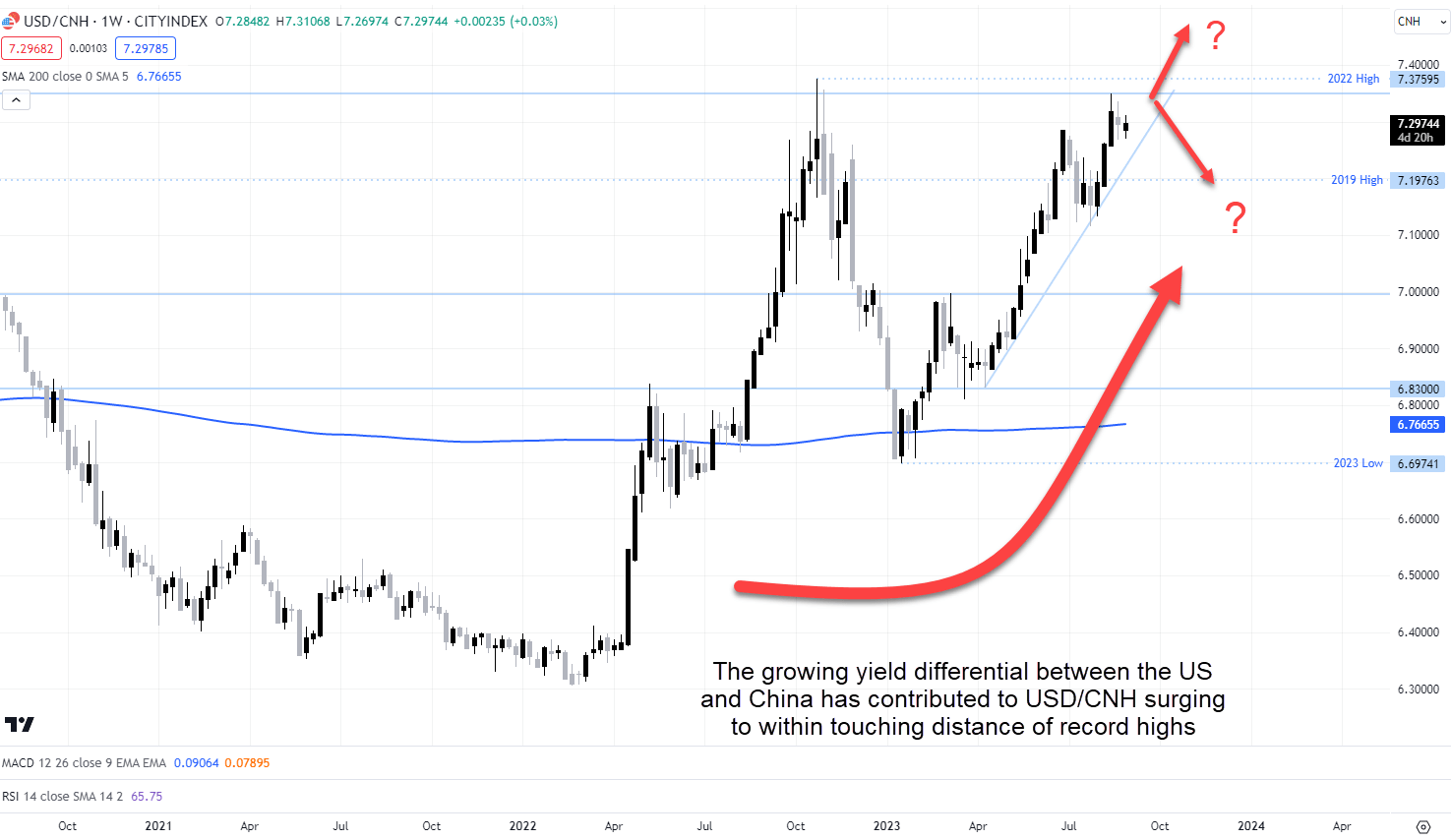

USD/CNH soars on widening yield differentials

Source: Trading View

The widening in yield differentials between China and the US has seen the USD/CNH lift back towards record highs. Given the strong relationship the pair has with yield differentials, what happens next in US 2-year Treasuries will likely dictate what USD/CNH will do, even with continued intervention from the People’s Bank of China (PBOC) as we’re seeing right now. Higher US yields will add to upside pressure for the pair while a reversal in yields could easily see the yuan strengthen against the USD.

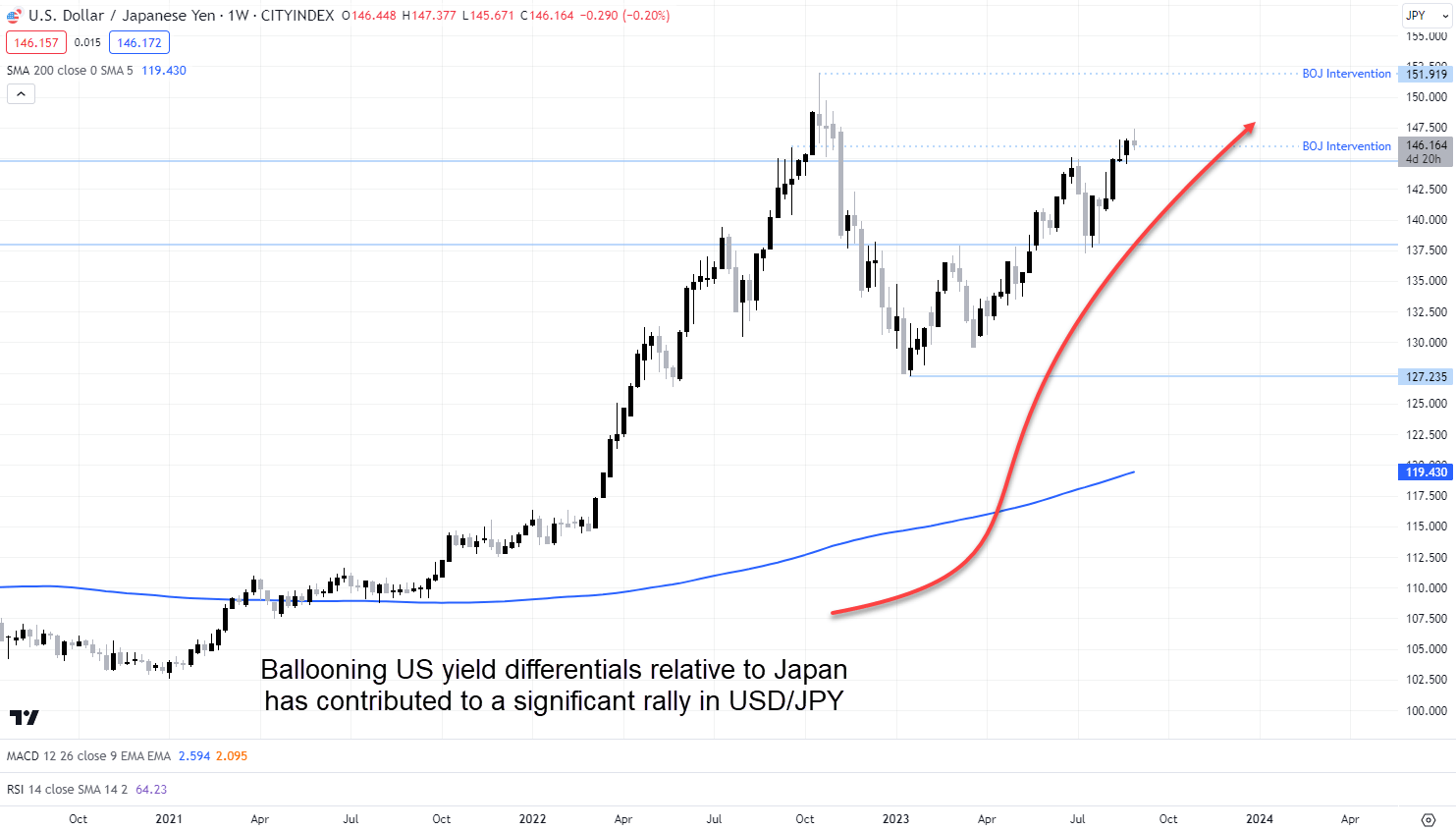

USD/JPY in much the same boat as USD/CNH

Source: Trading View

It’s an almost identical story for the USD/JPY as the USD/CNH . With the Bank of Japan (BOJ) suppressing Japanese bond yields out to a 10-year tenor, the subsequent yield advantage commanded by US bonds has seen USD/JPY rise rapidly. Take that away, the pair will struggle to stay at these lofty levels.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade