- US dollar analysis: FOMC minutes, Thanksgiving and global Flash PMIs

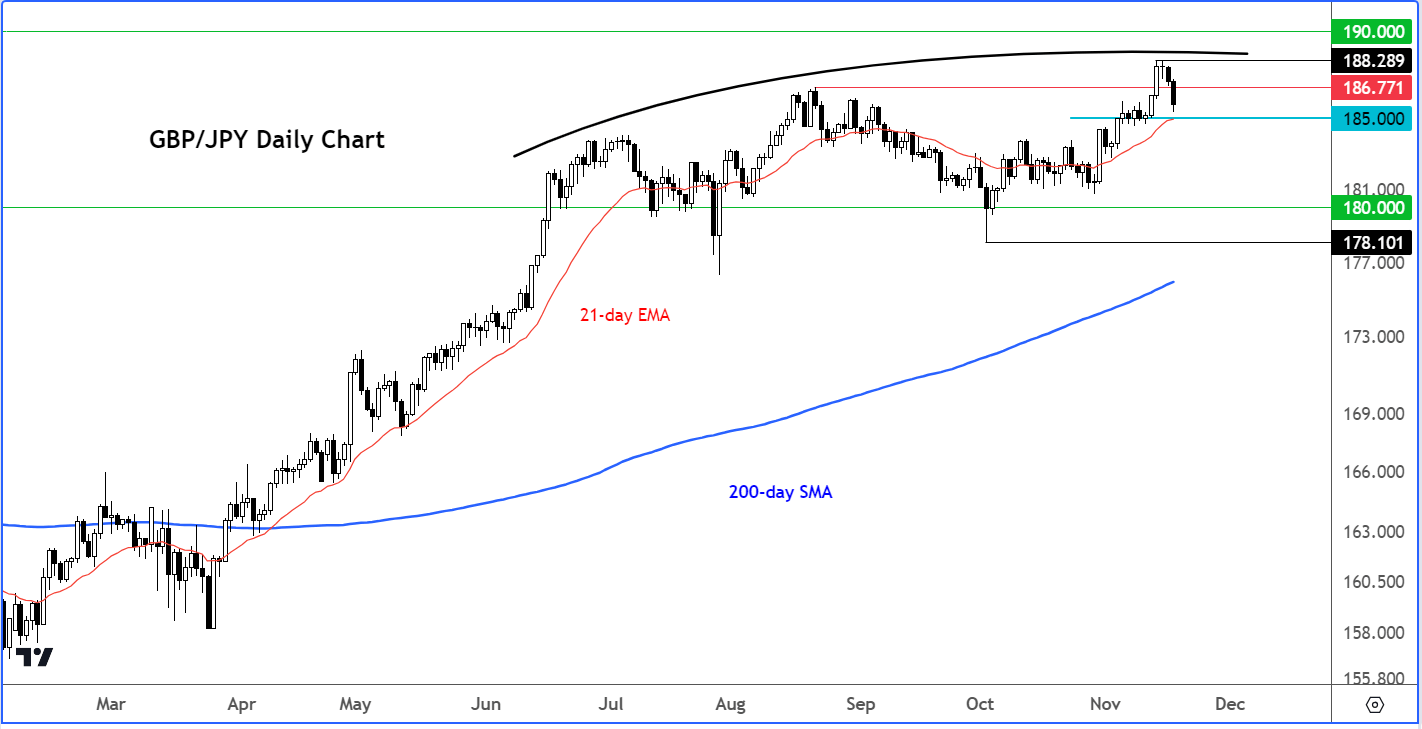

- GBP/JPY analysis: Guppy hurt by UK retail sales, falling yields

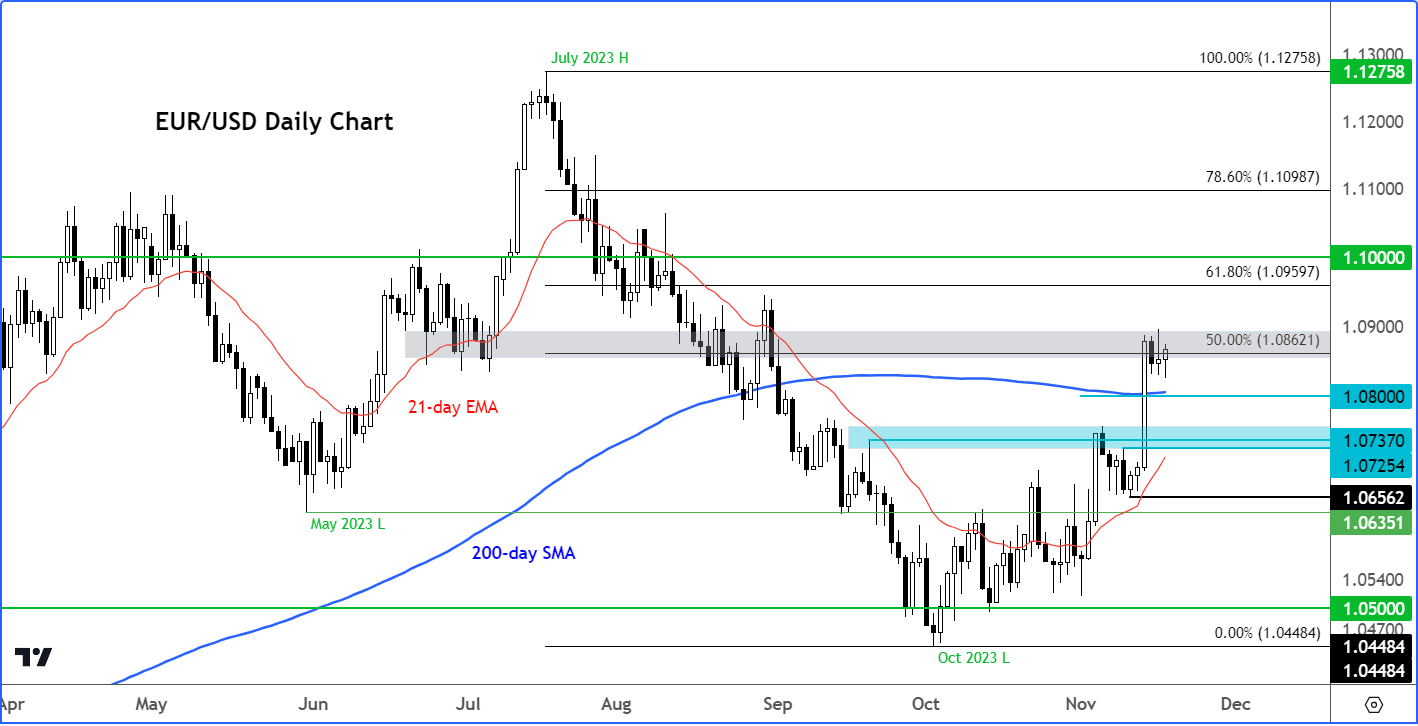

- EUR/USD analysis: Technical levels to watch

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes.

The big story this week has been on the inflation front, with CPI in the US and UK both falling faster than expected, cementing expectations that the Fed and other central banks will no longer raise rates further. With a couple of other key US economic pointers also coming in weaker this week, such as industrial production and jobless claims data, as well as a sharp drop in oil prices, this has led to speculation that the Fed may start cutting rates sooner than expected in 2024. While the CPI-inspired dollar sell-off helped to fuel a rally in the likes of the GBP/USD and EUR/USD earlier in the week, the subsequent days have seen these pairs gave back some of those gains. This is because economic indicators from Europe have remained dire, although some improvement in forward-looking ZEW sentiment data was observed for Germany. In the UK, another unexpected drop in retail sales offset earlier optimism about inflation finally falling more forcefully than expected. This meant that the GBP/USD’s stay above 1.25 handle was short-lived while the EUR/USD remained below 1.09 handle. Watch out for weakness to come in some GBP crosses owing to weakness in UK data. The GBP/JPY comes to mind, now that global bond yields are falling, which should help keep the yen supported.

US dollar analysis: FOMC minutes, Thanksgiving and global Flash PMIs

Whether the US dollar and bond yields will have more downside to go next week remains to be seen, but as we saw this week, a lot will depend on incoming data. Some investors will be expecting the slowdown in US inflation will have much more to go as higher borrowing costs increasingly weigh on economic activity while housing rents slow further down in the coming months. Unfortunately, we won’t have an awful lot of market-moving data next week, but there are still at least three key macro highlights to look forward to.

FOMC meeting minutes

Due to the Thanksgiving holiday on Thursday, US data will be pushed forward by a day and the minutes of the FOMC’s last meeting will be published on Tuesday instead of the usual slot on Wednesday. Since their last meeting, Fed Chair Jerome Powell has spoken along with several other policymakers, suggesting that the Fed is in no hurry to further raise interest rates because of evidence that inflation pressures are continuing to ease at a gradual pace. We then had a weaker CPI report followed by a PPI miss this week, both pointing to waning price pressures. The FOMC minutes may therefore have limited impact, unless they reveal the Fed was already more dovish than expected, in which case we could see the dollar drop in reaction. Otherwise, the bulk of next week may well be characterised by consolidation in what will be a quieter week for data and given the shortened week for US and Japan.

Global Flash PMIs

The latest PMI data will be released between Thursday and Friday.

Despite positive signs on inflation front, growth remains a big concern for most European countries, which may limit the upside potential for the likes of the EUR/USD and GBP/USD in the slightly longer-term outlook. We have seen mild improvement of late in some forward-looking pointers like the German ZEW survey and Sentix investor confidence index for Eurozone. But PMI have remained downbeat throughout the year, while backward-looking data have been mostly negative. However, if surveyed purchasing managers in the manufacturing and services industries indicate conditions have improved in November, then we could see the euro and pound make back further ground against the dollar, with the latter falling this week because of the sharp drop in bond yields amid peak interest rates narrative.

Unlike Europe, US PMIs rose back above the expansion threshold of 50.0, if only just. We have seen resilience in other US data, too, while inflation has started to fall more rapidly. So far, it looks like the US may avoid a recession despite high interest rates. But let’s see if the resilience of the world’s largest economy will continue, or high interest rates will take a toll on it. The flash PMI data will give us a snapshot of the health of the US economy on the final day of the week. But with many US investors expected to be on holiday, volatility might be on the thin side come Friday.

GBP/JPY analysis: Guppy hurt by UK retail sales, falling yields

The GBP/JPY has been among one of the best pound crosses to trade on the long side, owing to the fact Japanese yen has been one of the weakest currencies out there. Until now. What has changed this week is that yields have fallen across the board, and this has boosted the appeal of zero and low yielding assets like the yen and gold. We have seen all the yen crosses retreat as a result, with the USD/JPY falling back below the 150.00 handle. Given that we are continuing to see weakness in UK data, the GBP/JPY could be heading further lower along with global bond yields in the coming weeks.

The GBP/JPY found fresh selling momentum this morning after UK retail sales unexpectedly fell in October by 0.3% m/m, following a 0.9% drop the previous month. The ONS says that sales volumes have fallen to their lowest level since the 2021 COVID lockdown. Retailers report that the cost-of-living pressures reduced footfall and poor weather have hit them hard. Hardly surprising. The weaker retail sales, cooling inflationary pressures and falling job vacancies all point to a struggling economy. The Bank of England’s next move could well be a rate cut. The market is pricing in a 60% probability of the first cut coming in as soon as May and is pricing in almost four 25-basis point cuts between now and February 2025.

EUR/USD analysis: Technical levels to watch

After Tuesday’s big rally, the EURUSD as not shown any desire to move much in either direction. The buying momentum has faded and will probably need fresh macro stimulus to drive it further higher from here. Still, given the interim higher highs and higher lows, and despite the struggles in the second half of the week, we are expecting any short-term dips back to support to find buyers, even if the upside will likely be capped. But what this bullish consolidation has done is it has allowed short-term ‘overbought’ conditions to be worked off through time than price action.

Anyway, the area around 1.08 is now the first level of defence for the bulls, where we also have the 200-day average coming into play. The next big level of support, should we get there, is around 1.0725-1.0755. This area was the previous resistance zone, and the base of this week’s breakout.

On the upside, the 50% retracement level just below the 1.09 handle is the middle of the almost year-long consolidation range that the EUR/USD has been stuck inside. Should the bulls reclaim this zone, a move up to 1.10 handle could be on the cards next.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade