At its last meeting in August, the RBNZ was expected to become one of the first major central banks to raise interest rates following the recovery from the Covid pandemic.

On account of a run of hot activity and inflation data, the interest rates market had fully priced in a 25 bp hike, and there was a non-negligible 30% chance of a 50 bp hike.

However, on the afternoon before the meeting, a solitary case of Covid in Auckland that has since triggered seven weeks of lockdowns and 1314 cases nationally saw the RBNZ elect to keep rates on hold at 0.25%.

The vaccination rate since that point has almost doubled from 25% to 46% and allowed the government's Covid elimination strategy to pivot to one that considers the higher vaccination rate. Reflecting this, Auckland's Covid lockdown restrictions will begin to ease in three stages starting this evening.

Based on previous lockdowns, the expectation is that economic activity will rebound as restrictions are eased, allowing the RBNZ to increase the official cash rate tomorrow by 25bp to 0.5% and signal another rate hike before year-end.

The chance of a 50bp hike tomorrow is slim after RBNZ Governor Michael Hawkesby's speech a fortnight ago called for a more cautious rate hiking cycle.

Nonetheless, with 80% of a rate hike priced and an expectation the RBNZ will take yields above those of other major economies, the NZDUSD should receive some short-term support.

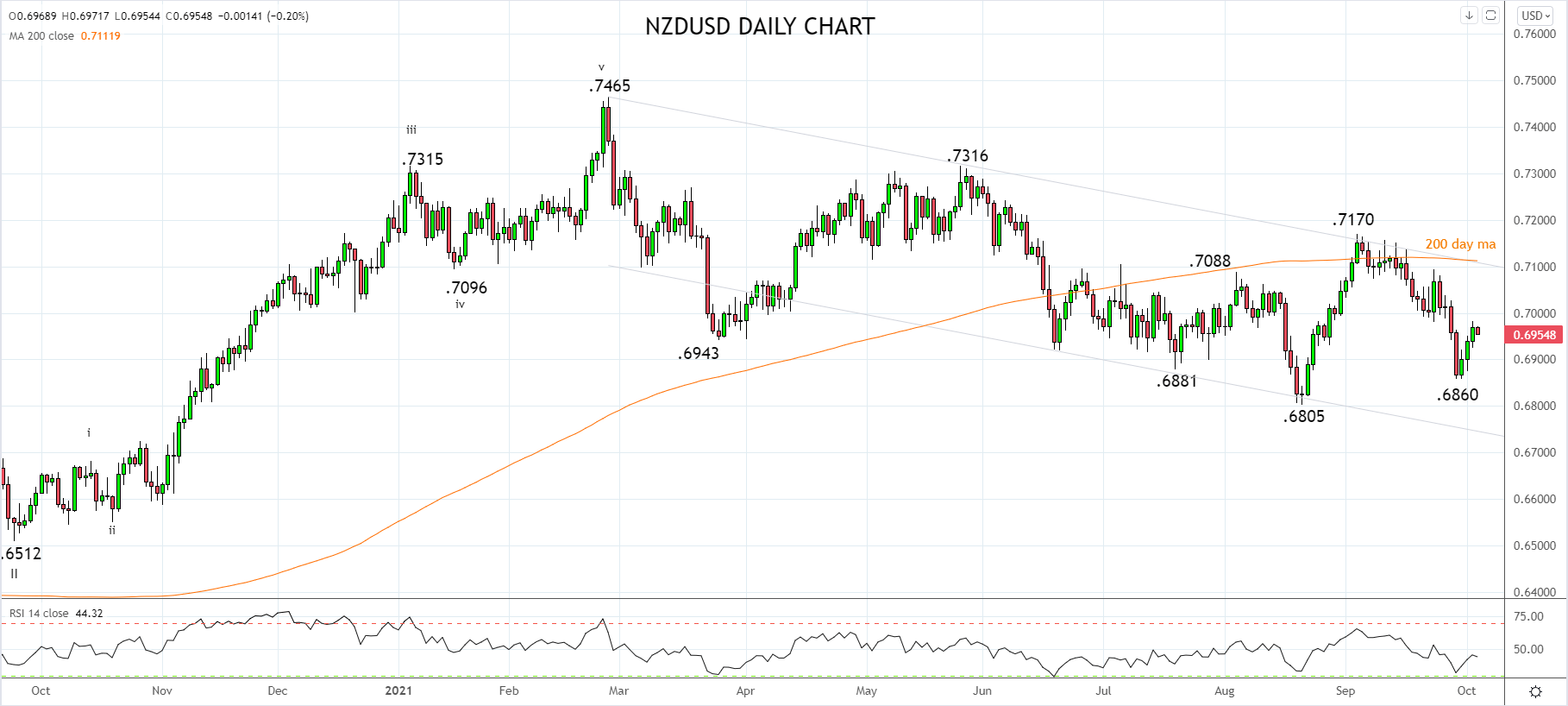

Last week the pullback from trend channel resistance and the 200 day moving average .7120/50, accelerated lower likely a position wash of NZD longs ahead of tomorrows RBNZ meeting.

After testing and rebounding from ahead of the bottom of the range, the bias now is for the NZDUSD to rally towards resistance coming from the 200-day ma and trend channel resistance near .7110.

Aware that the NZDUSD needs to break and close above .7110 to indicate the correction from the February .7465 high is complete, and the uptrend has resumed.

Source Tradingview. The figures stated areas of October 5th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation