S&P 500 and Amazon takeaways

- Amazon's revenue keeps growing despite challenges, but increasing costs lead to a seventh consecutive quarter drop in EPS.

- AWS growth slows, but overall revenue growth is expected to outpace costs from Q2, while subscription and advertising segments show promise.

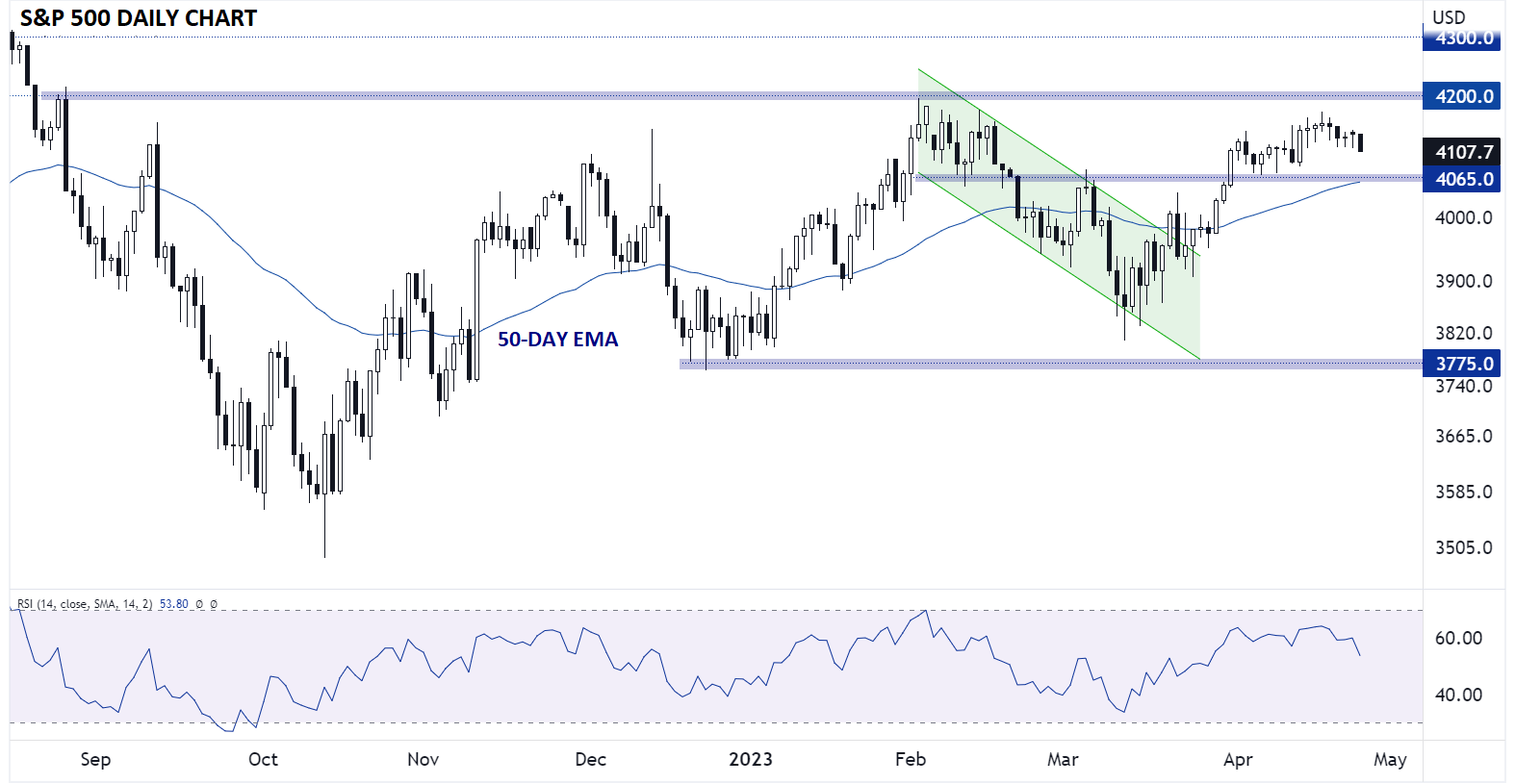

- The S&P 500 has lost momentum this month – watch for a breakout of the 4065-4200 range to signal the next trend.

When does Amazon report earnings?

Amazon reports its Q1 2023 earnings after the closing bell on Thursday, April 27.

What are analysts expecting for Amazon’s Q1 earnings?

Amazon is expected to report $0.22 in EPS on $124.6B in revenues according to analyst estimates.

Amazon earnings preview

Despite the decline in e-commerce demand, Amazon's revenue keeps growing due to its cloud-computing arm, subscription services, and rapidly expanding advertising business. However, rising costs are outpacing revenue growth and impacting margins, leading to an anticipated seventh consecutive quarter drop in EPS during the first three months of 2023.

Amazon Web Services (AWS), the main profit driver, is predicted to report a 14% revenue growth in Q1, which is less than half the growth rate from the previous year, as businesses become more cautious with their cloud spending. This slowdown is expected to persist, contributing to lower margins and profits. Nevertheless, Amazon is willing to forgo profits to maintain its leadership position and support clients during challenging times.

The slowdown in AWS may prompt Amazon to better control costs across the entire company. Although expenses have exceeded revenue growth for some time, Wall Street analysts project that the top line will grow faster than costs starting from Q2, resulting in a rebound in margins after they reach their lowest point in the three months leading up to June.

In e-commerce, third-party sales growth is slowing down but still expected to continue, while online sales decline. Analysts anticipate online sales to recover in Q2 and accelerate in H2 as the company faces easier comparisons.

Since the pandemic-driven boom, Amazon's subscription growth has slowed but remained steady (forecasted 10.9% increase in Q1), indicating the high value customers place on its Prime service. Advertising, one of the fastest-growing segments, is expected to see a 15.8% revenue increase in Q1; however, this growth rate has also slowed due to the broader downturn.

S&P 500 technical analysis

Amazon accounts for nearly 3% of the overall S&P 500, the third highest weight among all stocks behind just Apple and Microsoft, so the e-commerce giant’s results will have a big impact on the index. Looking at the S&P 500 chart, volatility has dried up in April, with March’s strong bullish momentum evaporating ahead of key resistance at 4,200.

Source: TradingView, StoneX. This product may not be available in all regions.

For now, the technical outlook for the index is neutral, though a break below previous-resistance-turned-support at 4065 would flip the near-term outlook in favor of the bulls. Meanwhile, it will likely take a rally above 4200 to reinvigorate the bullish narrative for a continuation toward 4300+

-- Written by Matt Weller, Global Head of Research

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade