Mergers can be a great option for companies for many reasons, such as being able to expand into new business sectors, increase their market share or expand their reach.

However, mergers and acquisitions are, of course, rather costly and aren’t necessarily always successful.

When a merger is announced, stock prices of the companies involved can fluctuate before the merger and may experience more volatility afterwards depending on its success. CFD trading allows traders to speculate on the price movements of the shares involved without taking ownership of the underlying asset - enabling them to trade regardless of whether prices are rising or falling.

We’ve taken a look into some of the biggest mergers in the last 50 years, including which companies were involved and how much the merger cost.

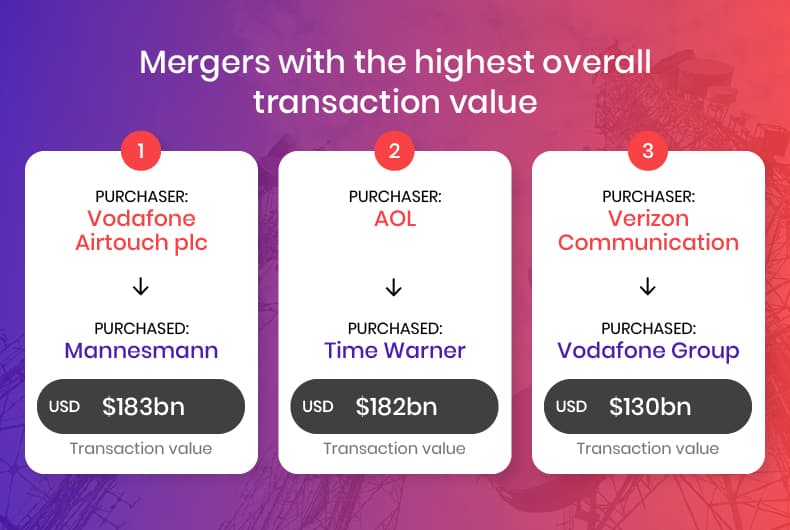

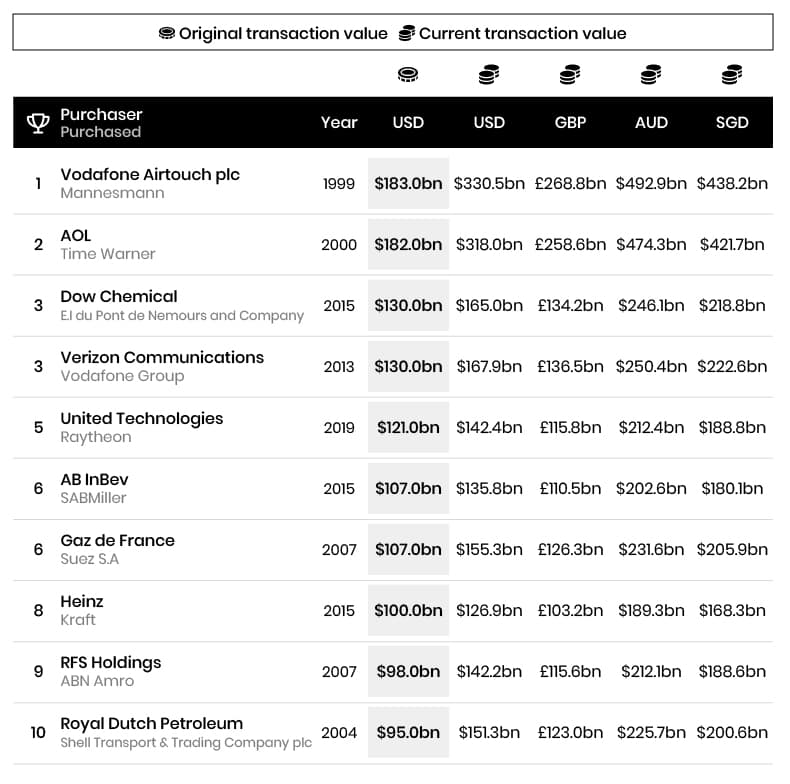

Mergers with the highest overall transaction value

1. Vodafone Airtouch plc and Mannesmann - $183 billion transaction value

The largest merger to date is that of Vodafone Airtouch plc and Mannesmann, with a huge transaction value of $183 billion. Adjusted for inflation, this would be around $330.5 billion in 2023.

In November 1999, the UK-based mobile phone group Vodafone Airtouch plc placed a bid for the German industrial conglomerate company Mannesmann. Mannesmann initially rejected this bid and the takeover brought a lot of protests. However, in February 2000, the board at Mannesmann agreed to an increased offer.

In the weeks and months after the merger was announced, the shares of both companies increased as the market responded positively to the news. The merger was completed in February 2000 and the share price of the new group continued to rise.

In the long term, Vodafone became a major global player in the telecoms industry. While it suffered following the dot-com bubble burst in 2002,1 it remains one of the main telecom companies, recording revenues of €45.58 billion in 2022.2

2. AOL and Time Warner - $182 billion transaction value

Following closely behind, the second largest merger to date is that of AOL and Time Warner, with a transaction value of $182 billion. This would amount to approximately $318 billion today.

In January 2000, online service provider AOL announced that it would be purchasing the mass media and entertainment conglomerate Time Warner.3 However, the merger soon proved to be unsuccessful, due to culture clashes and a lack of knowledge about the industry.

This led to a $99 billion loss just one year after the merger4 and an 80% decrease in stock price by the end of 2002.5 The decline continued in the years that followed, and AOL was eventually spun off as a separate entity in 2009.6

Time Warner went on to become part of WarnerMedia, which merged with Discovery, Inc. last year,7 and AOL is part of Yahoo! Inc.8

3. Verizon Communications and Vodafone Group - $130 billion transaction value

The third largest merger to date is that of Verizon Communications and Vodafone Group, with a transaction value of $130 billion. Today, this would be equal to around $165 billion.

In September 2013, American telecommunications company Verizon Communications announced that they had purchased a 45% stake in Verizon Wireless, which was previously owned by Vodafone Group. The deal was closed in February 2014 and provided Verizon Communications with the sole ownership of Verizon Wireless.

The share price of Verizon initially showed little change, before steadily increasing and peaking at around $55 a share in December 2020.9

However, while Vodafone’s stock price also initially rose, over time, it declined due to concerns about the company's future growth prospects and fell below its pre-merger price.10

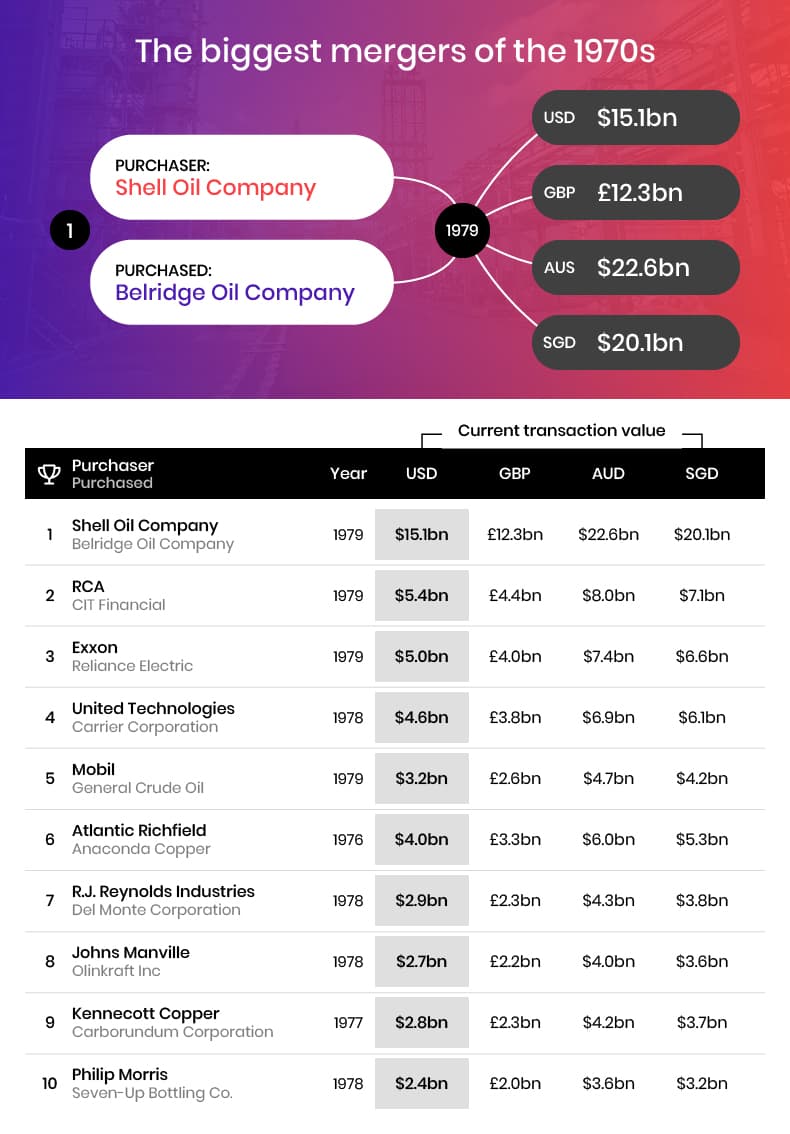

The biggest mergers of the 1970s

The biggest merger that took place in the 1970s was that of Shell Oil Company and Belridge Oil Company, with a transaction value of $3.65 billion. Adjusted for inflation, this would be equal to approximately $15.1 billion in 2023.

In September 1979, Shell Oil Company presented Belridge Oil Company with three different merger plans, ranging from a 59% to a 100% share in Belridge’s stocks. The $3.65 billion deal to purchase the entire company was agreed upon three months later.

Shell was already a large and well-established company at the time, but in the long term, the acquisition of Belridge and other companies helped Shell to expand its operations and increase its profits.

Acquiring Belridge Oil Company gave Shell access to new sources of oil and gas, which helped to increase its reserves and production capacity. It also diversified its operations, gave access to new technology and enabled it to make cost savings.

In 2022, Shell Oil Company reported its highest profits ever in its 115-year history, hitting $39.9 billion.11

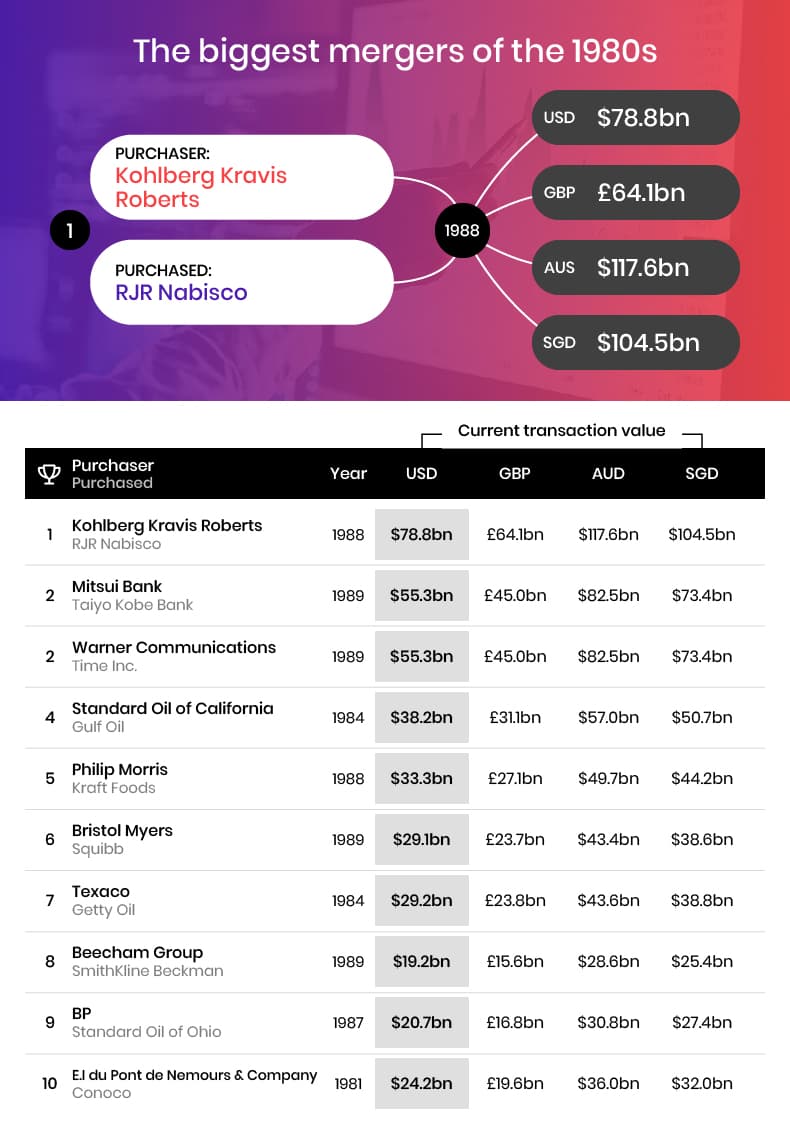

The biggest mergers of the 1980s

The biggest merger to take place in the 1980s was that of Kohlberg Kravis Roberts and RJR Nabisco, with a transaction value of $31 billion. Today, this would amount to approximately $78.8 billion.

In 1988, investment management company Kohlberg Kravis Roberts purchased the tobacco company RJR Nabisco. However, this meant being left with an unsustainable amount of debt and forced many job and division cuts.

The company was purchased by Phillip Morris in 2000 for $14.9 billion and was integrated into Kraft General Foods before Nabisco eventually became part of Mondelez International Inc. in 2012.12

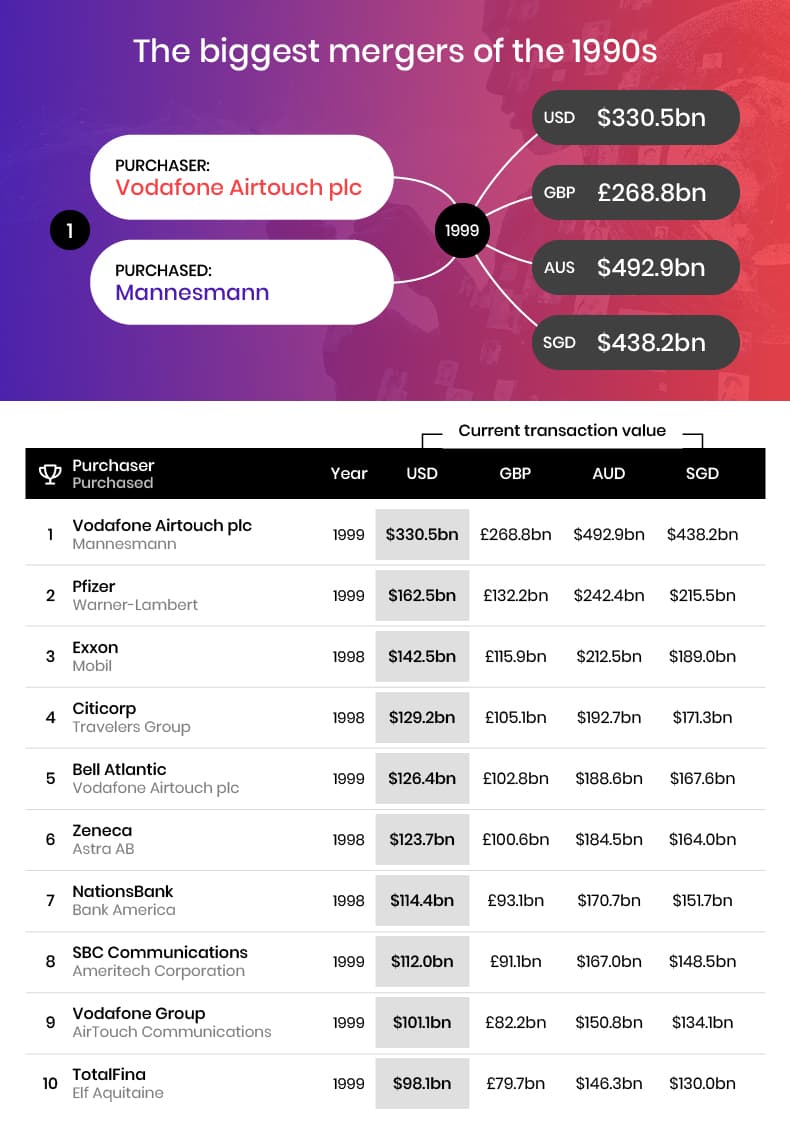

The biggest mergers of the 1990s

The biggest merger of the 1990s was, of course, that of Vodafone Airtouch plc and Mannesmann in 1999, which had a transaction value of $183 billion. The second biggest merger, however, was that of Pfizer and Warner-Lambert, with a transaction value of $90 billion. Today, the transaction value would be equal to $162.5 billion.

In 1999, the pharmaceutical company Pfizer initiated a merger with their competitor Warner-Lambert, following their alliance in 1997 to bring the drug Lipitor to the market.13 In February 2000, the deal was completed and Pfizer bought Warner-Lambert, as well as all of the company’s subsidiaries.

The merged company became the largest pharmaceutical company in the world as of 2022.14

In the aftermath of the merger, shares in Pfizer initially fell but recovered in the following months and in the long-term, the deal helped to increase the company’s size, scale and market share.15

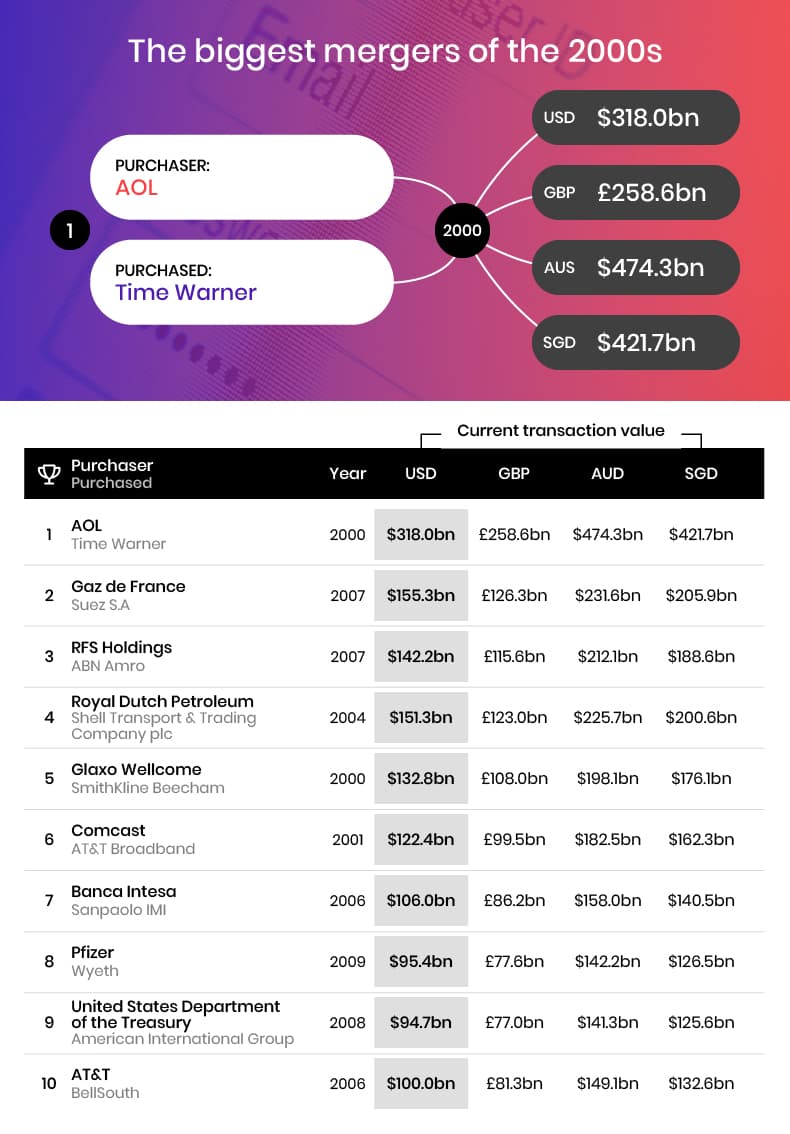

The biggest mergers of the 2000s

As previously mentioned, the biggest merger of the 2000s was that of AOL and Time Warner in 2000, with a transaction value of $182 billion. The second biggest merger of the decade, however, was that of Gaz de France and Suez S.A, with a transaction value of $107 billion. Adjusted for inflation, this would be equal to $155.3 billion in 2023.

In 2007, it was announced that energy company Gaz de France and public utility company Suez S.A had agreed to merger terms. The terms were negotiated based on the exchange of 21 Gaz de France shares for 22 Suez S.A shares. Following the merger, in 2008, the two companies became GDF Suez. The company was rebranded as Engie in 2015.16

It was estimated that Engie had made $2.16 billion in excess profits from its Belgian nuclear reactors in 2022.17

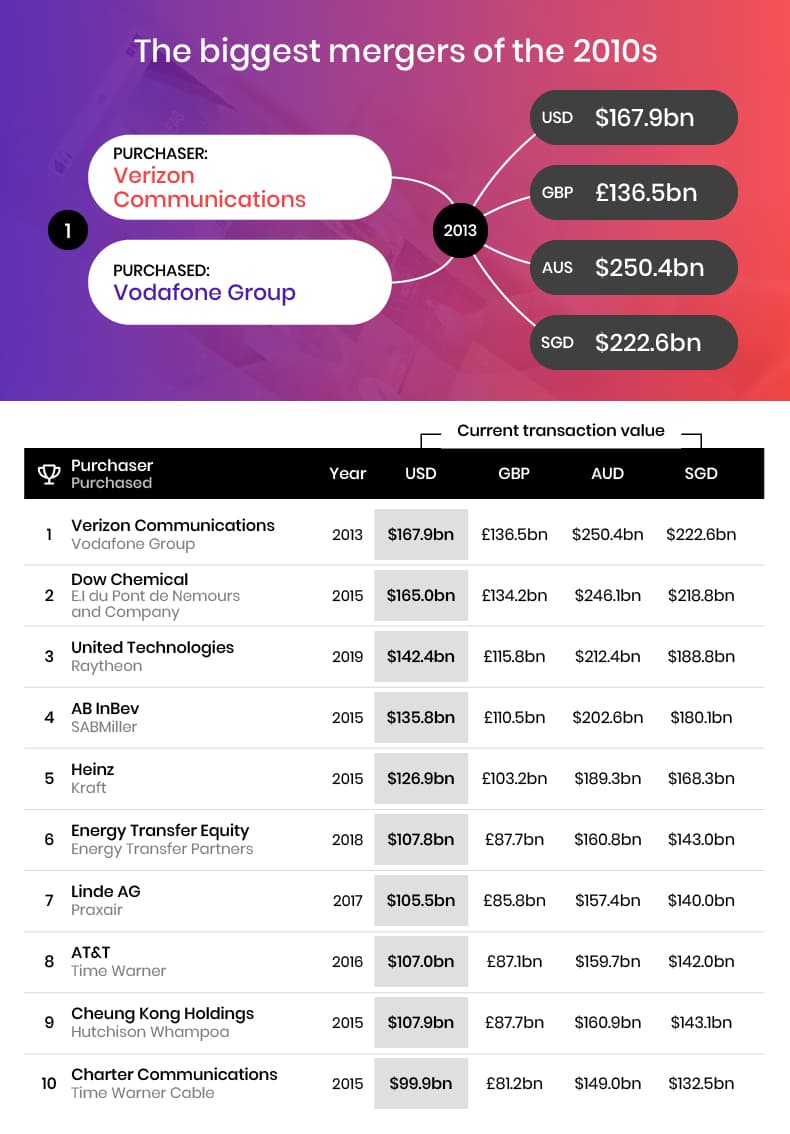

The biggest mergers of the 2010s

The biggest merger that took place in the 2010s, as we mentioned earlier, is that of Verizon Communications and Vodafone Group in 2013, with a transaction value of $130 billion. Two years later, Dow Chemical and DuPont announced that they would be merging for the same transaction value.

The two chemical companies became known as DowDuPont, which was equally held by the shareholders of both Dow Chemical and DuPont. The board of directors from both companies decided that DowDuPont would be separated into three independent, publicly-traded companies: the agriculture business, Corteva, Inc., the material sciences segment, Dow Inc. (trading as Dow Chemical Company), and the speciality products unit, DuPont. This separation was finalised in 2019, four years after the initial merger took place.

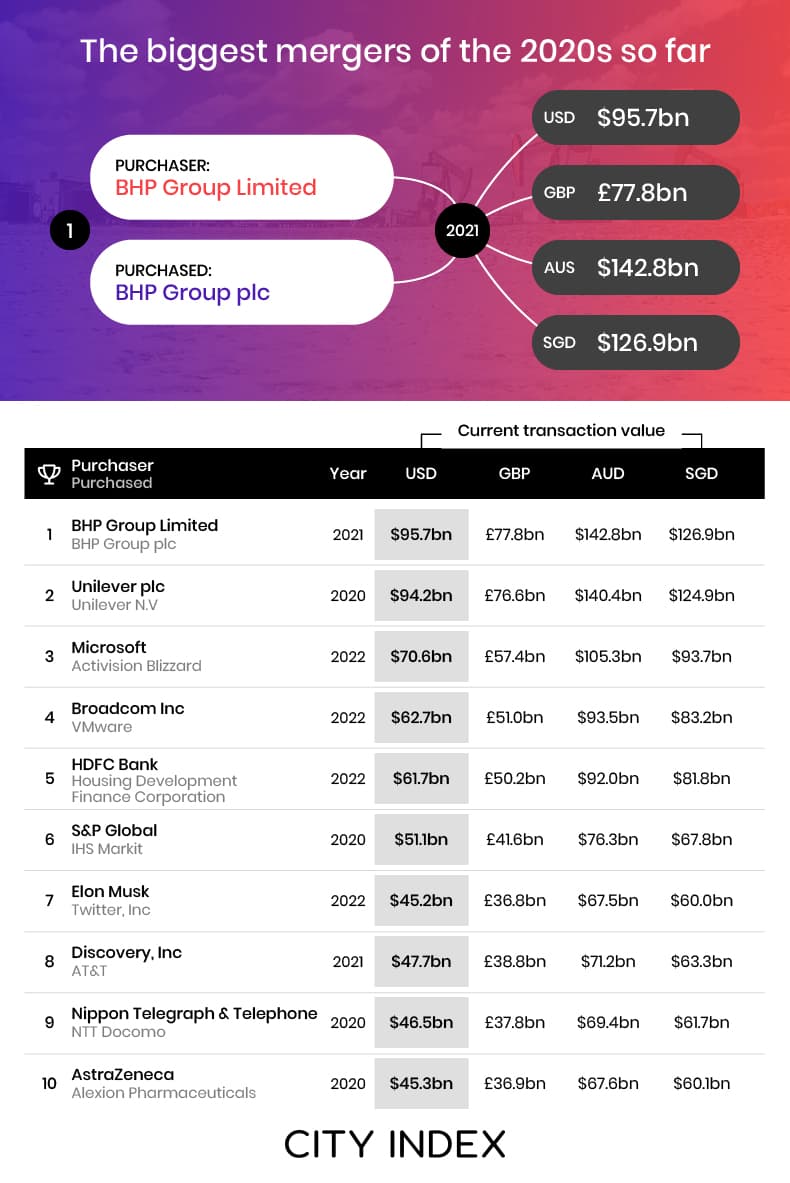

The biggest mergers of the 2020s so far

Although we’re only a few years into the 2020s, there have already been plenty of mergers. Currently, the biggest merger is that of BHP Group Limited and BHP Group plc, with a transaction value of $86.2 billion.

BHP Group Limited is the Australian branch of the company and BHP Group plc operated on both the Australian Stock Exchange (ASX) and London Stock Exchange (LSE). In 2021, it was proposed that BHP should end its LSE listing and the deal was finalised in January 2022.

In 2022, BHP Group reportedly made an annual gross profit of $54.6 billion.18

Methodology

Details of all mergers from the last 50 years were sourced from various contemporary news articles and press releases, which can be viewed here.

Transaction values are given in the US dollar value for the year of the merger. These were then adjusted for inflation using a US Inflation Calculator and converted to GBP, AUD and SGD using our currency converter, as of March 23, 2023.

All mergers and acquisitions are notated with the year the transaction was initiated, not necessarily completed.

Additional sources

1 http://news.bbc.co.uk/1/hi/business/1920832.stm

2 https://investors.vodafone.com/sites/vodafone-ir/files/2022-05/vodafone-2022-annual-report.pdf

3 https://money.cnn.com/2000/01/10/deals/aol_warner/

4 https://www.latimes.com/archives/la-xpm-2003-jan-30-fi-aol30-story.html

5 https://uk.investing.com/equities/time-warner-historical-data

6 https://investors.att.com/stockholder-services/time-warner-stockholders/aol-separation

9 https://www.macrotrends.net/stocks/charts/VZ/verizon/stock-price-history

10 https://www.macrotrends.net/stocks/charts/VOD/vodafone-group/stock-price-history

11 https://www.cnbc.com/2023/02/02/shell-earnings-oil-giant-reports-record-annual-profits.html

12 https://www.investopedia.com/articles/stocks/09/corporate-kleptocracy-rjr-nabisco.asp

13 https://www.pfizer.com/about/history/pfizer_warner_lambert

14 https://www.proclinical.com/blogs/2022-6/who-are-the-top-10-pharma-companies-in-the-world-2022

15 https://www.macrotrends.net/stocks/charts/PFE/pfizer/stock-price-history

16 https://www.energyvoice.com/other-news/77875/gdf-suez-changes-its-name-as-the-company-rebrands/

17 https://www.brusselstimes.com/282421/engie-makes-e2-billion-in-excess-profits-thanks-to-nuclear

18 https://www.macrotrends.net/stocks/charts/BHP/bhp-group/gross-profit