Lower coronavirus cases, higher IMF projections boosts GBP

The number of new coronavirus cases across the UK are falling and the Pound is rising. New cases have been falling since the last Monday, Freedom Day, when the government lifted all restrictions still in place from the coronavirus. In addition, as a result of the expected spike in demand and spending in the UK, the IMF upgraded the growth for 2021 to 7% from 5.3% in April. This was good news for Boris Johnson who said, “good signs that our economy is bouncing back faster than expected, but there are still challenges ahead.” Chancellor Rishi Sunak also commented that they “remain focused on protecting and creating as many jobs as possible”. In addition, according to the FT, England will begin to allow double vaccinated US and EU tourists back into the country, which will hopefully create additional jobs.

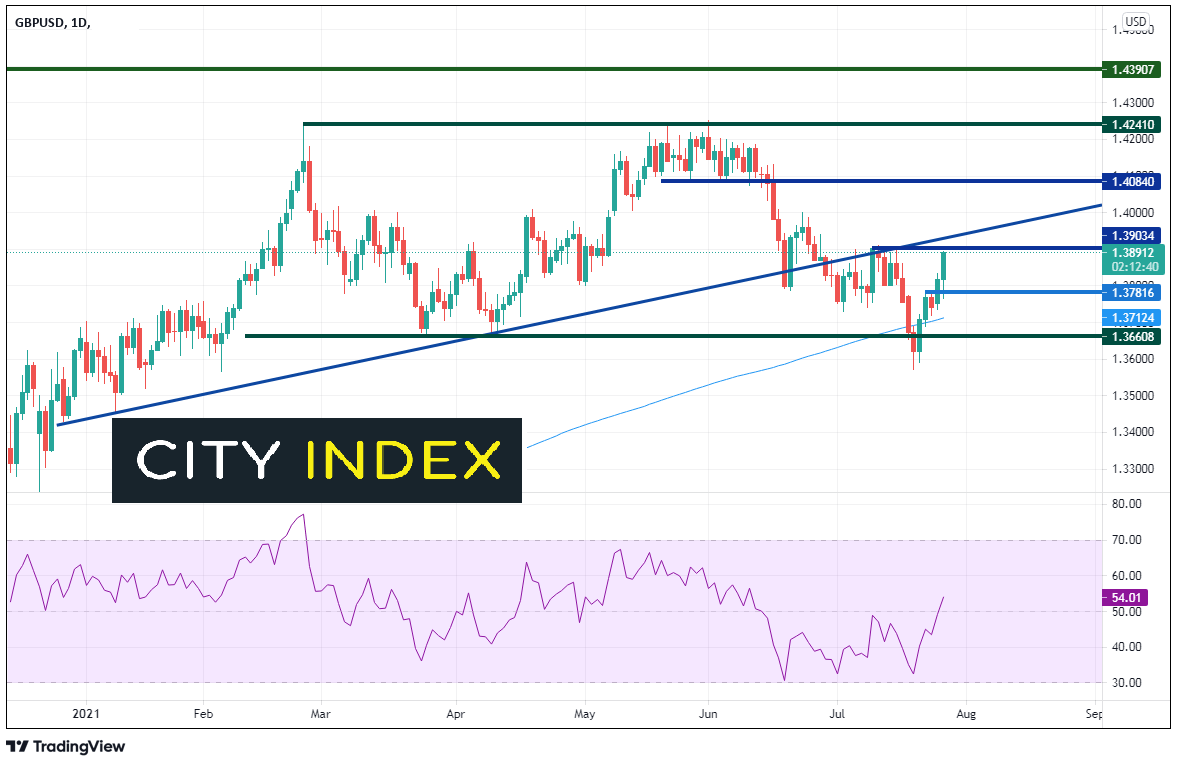

GBP/USD has been in a large trading range since February between 1.3660 and 1.4210. On the day of the reopening for the UK, price had moved lower and pierced through the 200 Day Moving Average at 1.3712. The next day, GBP/USD broke through the bottom trendline of the channel and traded as low as 1.3571. However, since then, the pair has been on a one-way move higher, currently trading near 1.3890! Horizonal and trendline resistance are just above at 1.3900/1.3920, followed by additional horizontal resistance near 1.4080. Minor horizontal support is below at 1.3780 followed by the 200 Day Moving Average, currently at 1.3712. The 1.3571 recent lows provide additional support below.

Source: Tradingview, City Index

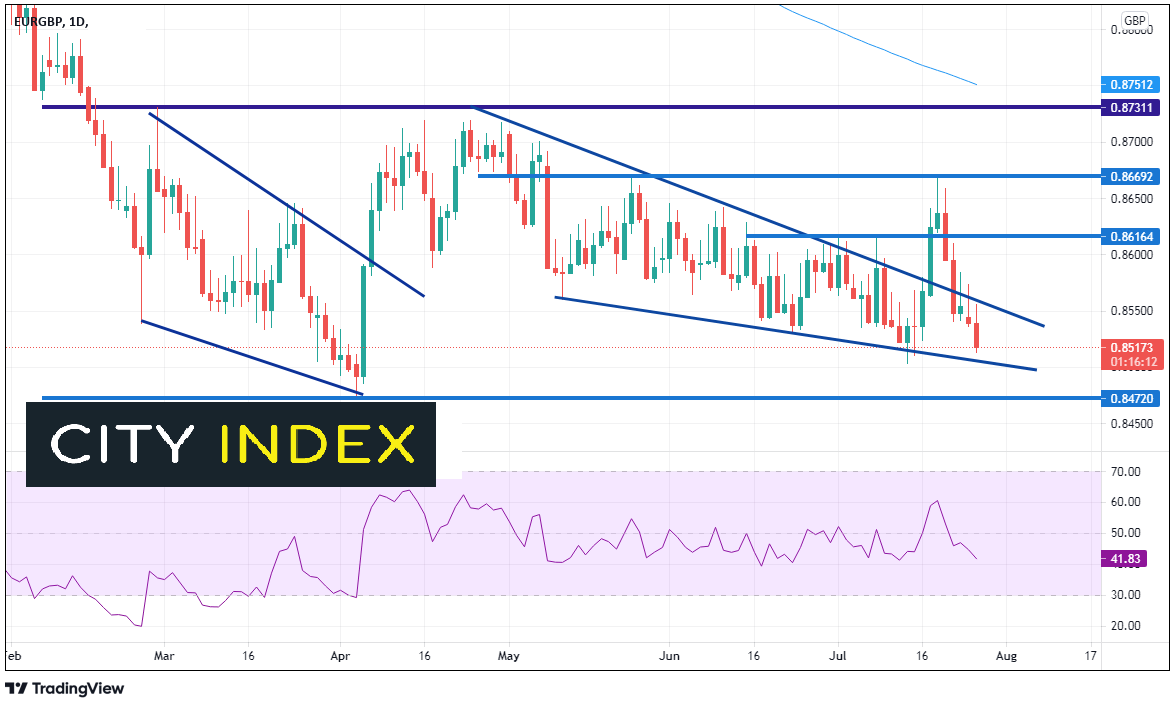

With the FOMC on Wednesday, some may attribute the strength in GBP/USD to the weakness in the US Dollar, as yields continue to fall ahead of the statement. However, the Pound is stronger against the Euro as well. EUR/GBP has been trading within a range since mid-February between 0.8472 and 0.8731. Within that range, the pair has been moving lower in a descending wedge formation since late April. However, on Freedom Day and the day after, the Pound was weaker, and EUR/GBP bounced out of the descending wedge (as expected) but halted at horizontal resistance near 0.8673. Since then, the Pound has been stronger and EUR/GBP has fallen back into the wedge and the pair is currently testing the bottom trendline, near 0.8505. Horizontal support is at the bottom of the range is below, near 0.8470. Horizontal resistance is above the top, downward sloping trendline of the wedge near 0.8560, then again near 0.8616 and the July 20th highs of 0.9670.

Source: Tradingview, City Index

With a dovish FOMC expected this week, along with a dovish ECB last week, the Pound could continue to see more upside. Next week, the BOE will get its chance in the spotlight. Will they continue to taper based on the new IMF forecast?

Learn more about forex trading opportunities.