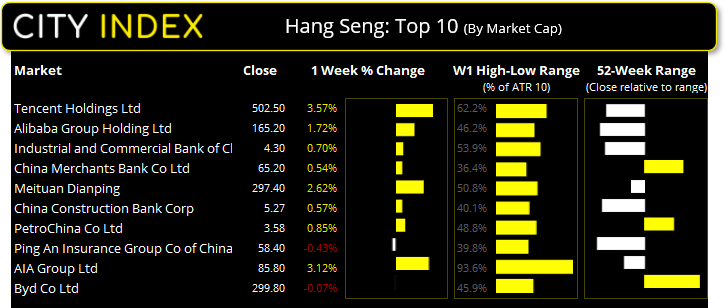

Tencent holdings has been a top performer among the Hang Seng mega-caps, rising 3.6% over the past five sessions. China’s retail sales and industrial output beat expectations, and news that President Xi and Joe Biden held an amicable meeting provided a boost to sentiment across Asian equity markets yesterday. It is the first time the two leaders have met ‘face to face’ since Biden was sworn in as president.

The Hang Seng also rose to a 13-day high by yesterday’s close, although technical resistance and looming earnings reports suggest the index is likely to pause around current levels before its next directional move.

Alibaba earnings set for tomorrow

Alibaba (9988 / BABA) are set to release their Q2 earnings tomorrow night, before the US market opens. You can read the full earnings preview by Joshua Warner here. And as the second largest company by market cap on the index, it’s an important one to watch for Hang Seng traders. According to Refinitiv, the mean analyst’s estimate is CNY 1.59 per, compared with CNY 2.25 per share for the same quarter last year. It remains a ‘buy’ overall (11 strong buys and 17 buys) with 2 analysts recommending a ‘hold’ and no sells. It currently trades at HKD $162 and the mean price target is $248.17, which leaves around +48% of potential should it deliver to expectations.

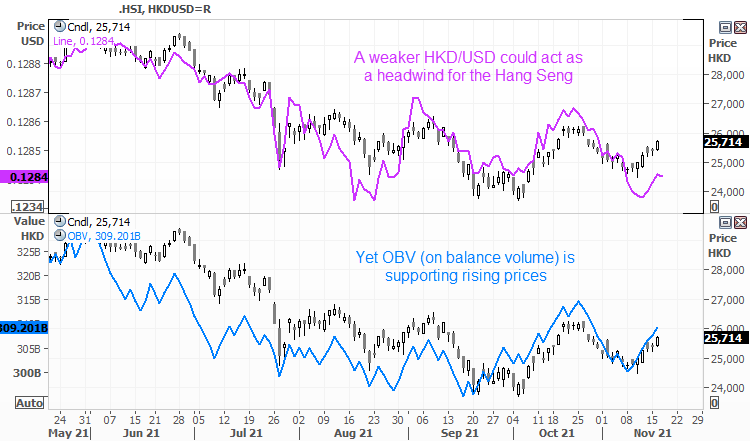

Weaker HKD acting as a potential headwind on HSI

We’re getting mixed signals from a couple of correlations with the Hang Seng. Volume analysis suggests prices could remain supportive as the OBV (on balance volume) is correlating with price action which shows bulls remains the dominant force overall. Moreover, as we noted in a previous report, the OBV managed to break a price cycle high ahead of price action – which is why we have favoured an eventual bullish breakout on the Hang Seng.

However, the HKD/USD correlation has broken down a bit lately as the surging US dollar has kept HKD under pressure. This has seen the index rise whilst HKD/USD remains near its lows, although it is trying to turn higher to re-establish its positive correlation. On balance we believe volumes remain bullish for the Hang Seng so it should remain supported, although it may meet resistance over the near-term. And another potential headwind for the index is if Alibaba’s earnings report disappoints on Friday.

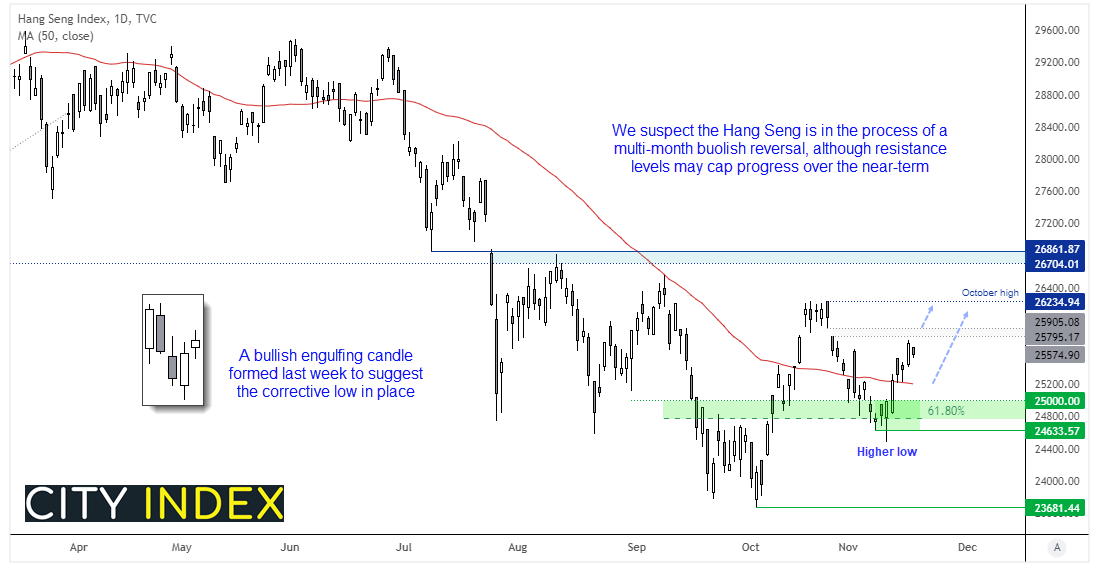

Hang Seng’s correction likely completed around 25,500

We can see on the daily chart that the Hang Seng has recovered back above 25k and formed a higher low, with a bullish hammer around the 61.8% Fibonacci level. The 50-day SMA has also been respected as support. Gap resistance resides around 29,500 and we may find it acts as resistance leading into Alibaba’s earnings report.

Our bias remains bullish above 25k, so would welcome any dips towards that level as we anticipate prices will eventually break above October’s high and target the 26,700 – 26,860 level.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade