GBP/USD trades flat ahead of the BoE rate decision

- BoE expected to leave rates unchanged at 5.25%-5.5%

- The central bank’s growth & inflation forecasts are in focus

- GBP/USD trades in symmetrical triangle

GBP/USD is holding steady below 1.22 after gains in the previous session as investors digest the Federal Reserve's interest rate decision and look ahead to the Bank of England MPC rate announcement.

As expected, the Fed left rates on hold but hinted it could be done with its hiking cycle, putting the USD under pressure.

All eyes are now on the UK central bank to see whether it will take the lead from the Fed and the ECB and leave rates on hold.

The money markets are pricing in a 93% probability of a second consecutive hold after 15 back-to-back interest rate hikes as inflation shows signs of cooling and the economy and labour market weaken.

Given that no rate change is expected, the focus will be on the central bank’s forecasts.

Inflation is still high at 6.7% compared to other G7 countries, but recent PMI data has shown that growth is stalling. In October, business activity contracted for a third straight month, raising concerns that the UK could be heading for a recession.

The market believes that the next move from the Bank of England will be a rate cut, although this is not expected until the second half of next year. A downward revision to GDP and inflation forecasts could see the market bring forward rate-cut expectations and spark a sell-off in the pound.

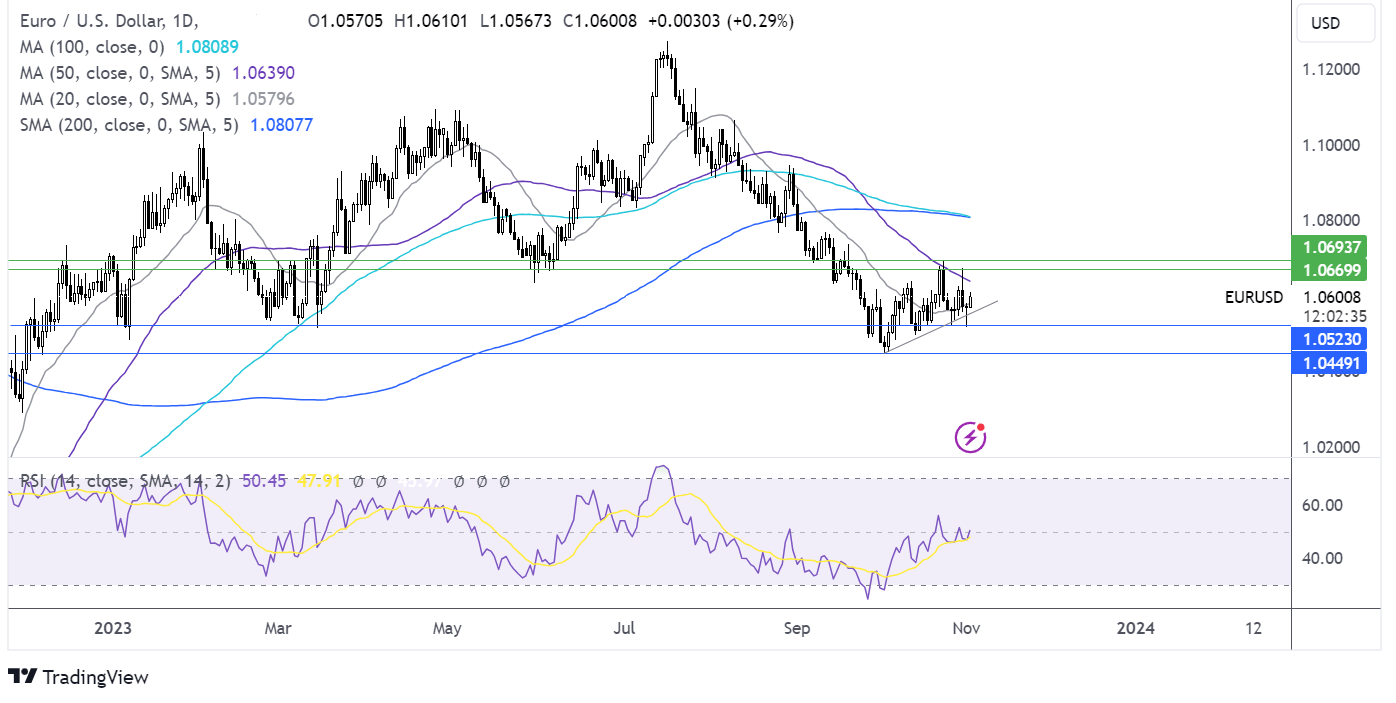

GBP/USD forecast – technical analysis

GBP/USD trades within a symmetrical triangle but has struggled to push above the 20 sma. Buyers would need to rise above the 20 sma to rest the falling trendline resistance at 1.22, also the weekly high. A rise above here could open the door to 1.2290, last week’s high and 1.23 the October high.

Should sellers successfully defend the 20 sma, bears could test 1.2090, the rising trendline support, before testing 1.2070 last week’s low and 1.2040, the October low.

EUR/USD rises after the Fed hints to peak rates

- Fed hinted that it had reached peak rates

- Eurozone manufacturing PMI expected at 43 vs 43.4 in September

- EUR/USD looks to resistance at 1.0670

EUR/USD is pushing higher for a second straight day after the Federal Reserve's interest rate decision and ahead of eurozone manufacturing PMI figures

The Fed, as expected, left the benchmark rate unchanged for a second straight month at 5.25% to 5.5% and hinted that the US central bank could have finished its most aggressive tightening cycle in decades.

Policymakers signaled to the recent increase in treasury yields doing some of the heavy lifting for the Fed, reducing the incentive to hike further. However, they left the door open for another increase should it be needed.

Following the meeting the 10-year treasury yield fell below 4.75% for the first time in two weeks. According to the CME FedWatch tool, the market is now pricing in a 20% probability of a rate hike in December, down from 30% a day earlier.

The Federal Reserve have followed in the footsteps of the ECB, which left rates unchanged in the October meeting after ten back-to-back hikes and signaled that they, too, were at the end of the rate hiking cycle.

Central banks have shifted down a gear, and investors will now be turning their attention to when rate cuts could be coming.

Given the strength in the US economy and the labour market, the Fed may be keeping rates on hold until the end of next year.

Meanwhile, the ECB may be looking to cut rates earlier, given the deteriorating economic outlook for the eurozone.

On the data front, attention will be on Eurozone manufacturing PMI data, which is expected to confirm that the PMI fell to 43 in October, down from 43.4 in September. This is well below the 50 level that separates expansion from contraction, suggesting that the manufacturing sector dragged the economy heading into the fourth quarter.

US jobless claims will also be in focus and is expected to show that initial claims held steady at 210k. The data comes ahead of tomorrow’s non-farm payroll figures.

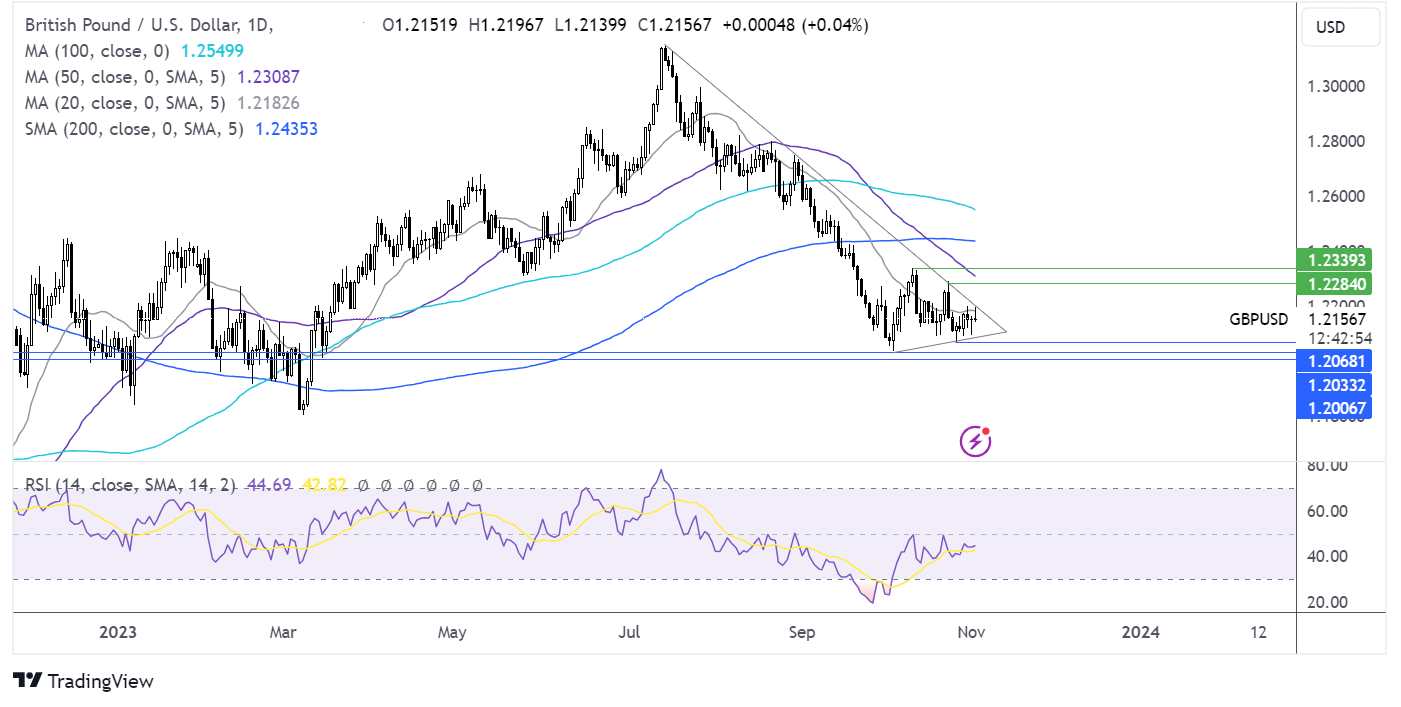

EUR/USD forecast – technical analysis

EUR/USD has extended its recovery from 1.0450 the October low, but gains have been capped by the 50 sma. Buyers will look to rise above this resistance at 1.0640 and the weekly high of 1.0670 to test the October high of 1.0695 to create a higher high.

Meanwhile sellers will look for a move below 1.0520, the weekly low to extend the selloff towards 1.05 round number and 1.0450 the October low.