- FTSE analysis: Time for catch up with global indices?

- DAX analysis: Outperforming German index tests key resistance

- US indices lead global stock markets on peak inflation and interest rates hopes

At the time of writing on Wednesday, the global stock market rally had come to a halt. The initial excitement surrounding the possibility of central banks adopting a more dovish stance faded, and results on the earnings calendar from several companies fell short of expectations. Burberry Group, for instance, experienced a significant drop of up to 9% in its shares, attributing it to diminished demand for high-end products, which could potentially hinder the company from achieving its sales forecast. HelloFresh also faced a setback, with its shares plummeting nearly 20% following a reduction in its sales projections. Additionally, Cisco Systems saw a 10% decline in premarket trading after reporting a slowdown in new product orders.

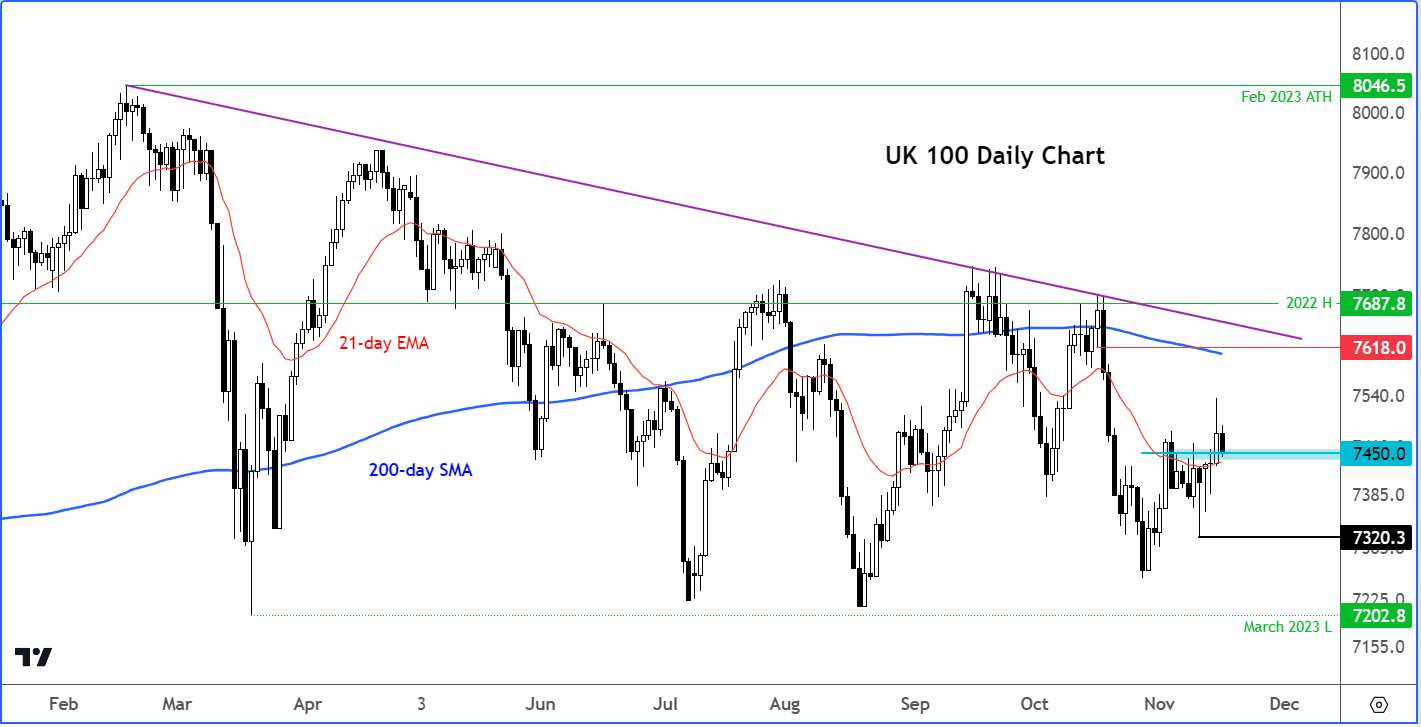

FTSE analysis: Time for catch up with global indices?

After hitting a new all-time high in February, the FTSE has struggled to find any sustainable support, hurt by concerns over China, UK’s struggling economy and high interest rates across the world. But we have had some positive data out of China, the UK and US this week, which may mean the worst days are behind us. Indeed, the fact that UK inflation fell sharply to an annual pace of 4.6% from 6.7% previously created a bit of a relief rally on Wednesday. Though most of those gains have since been lost, there are some technical signs to suggest the FTSE may be able to start pushing higher again amid diminished macro concerns.

Frustratingly for the bulls, the FTSE has been unable to enjoy the same bullish momentum we have seen across other European and US stock markets over the past three weeks or so. In this regard, the FTSE has a lot of catching up to do. But in recent days, the FTSE has managed to climb back above the 21-day exponential moving average and resistance at 7450ish. So, there has been some indications of bullish momentum coming back into the UK markets. This 7450 level was being tested from above at the time of writing, meaning there was a chance the bulls would show up here to lift the index heading into the second half of the day.

Despite the fact that the UK index has been making a series of lower highs throughout this year, it hasn’t exactly sold off either, holding, for most part, in a wide consolidation range. In fact, the index has managed to hold above the low of 7202 it had formed in March following several bearish attempts to drive it beneath that level – twice in the summer and again in October. The bullish resilience in the face of all the macro risks is quite impressive. If it has been able to weather the storm with minor damage, the index may be able to start rising on any piece of good news now. I reckon there is a good chance we may see a rally to test the 200-day average and prior resistance in the 7600-7620 area next.

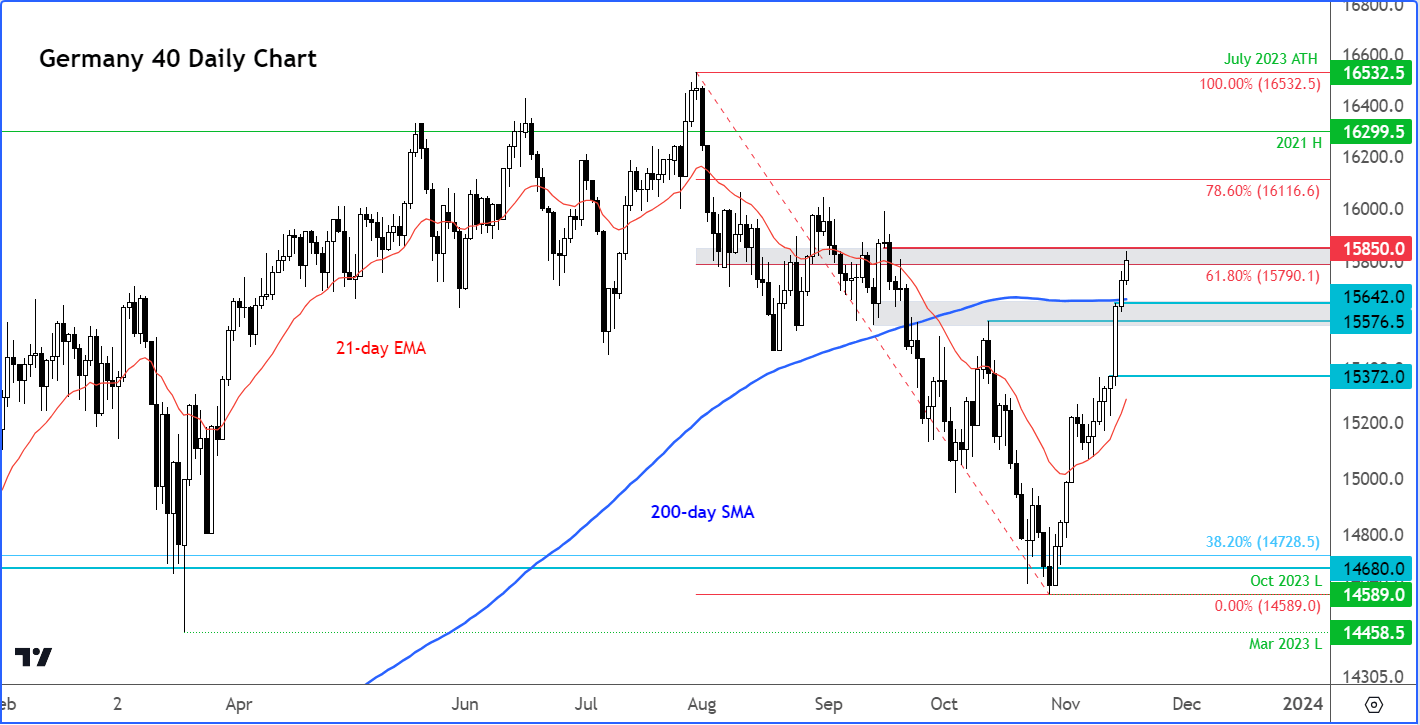

DAX analysis: Outperforming German index tests key resistance

In contrast to the FTSE, the DAX is a lot closer to potentially reaching the all-time high it had hit in July. What’s more, from its low point in October, the German index was up more than 8% compared to just 3% or so the FTSE has gained during the same period. Clearly, the DAX has been a better index for the bulls to trade, but this doesn’t mean the outperformance will necessarily continue moving forward. The German index has now reached a potential resistance area around 15800 to 15850. Here, the 61.8% Fibonacci retracement level against the all-time high meets the point of origin of the previous breakdown area. Nevertheless, given the recent bullish momentum across the global stock markets, and the fact that several support levels have broken down, we may only see a modest pullback and consolidation rather than a sharp sell-off to suggest the trend has turned bearish again. So, I would be more inclined to look for dips to be bought near support levels. The next key support area to watch is around 15575 to 15640. This area was previously resistance, and we have the 200-day average coming into play here.

US indices lead global stock markets on peak inflation and interest rates hopes

We are now in mid-November and US stock markets are enjoying one of their best phases this year, all thanks to optimism that interest rates will start to come down in the not-too-distant future now that inflation is on a downward trajectory. The US markets do appear a little overbought though after a sharp three-week rally, especially the tech-heavy Nasdaq, so there is a risk of a short-term pullback. But with so many resistance levels having broken down in this melt-up, any potential short-term weakness should not be confused with a bearish reversal, unless the charts tell us otherwise and/or the Fed starts to push back against rate cut expectations forcefully. The latest gains this week have been in response to data on Wednesday showing further signs of abating inflationary pressures as prices paid to US producers unexpectedly declined in October by the most since April 2020. This followed a soft US CPI print from the day before, which had triggered massive moves across financial markets. A sharper-than-expected inflation decline in the UK also helped to lift sentiment in Europe, as too did signs that China’s recovery is starting to take hold. Meanwhile the slightly stronger-than-expected US retail sales and Empire Manufacturing Index shows the world’s largest economy is continuing to defy recession expectations.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade