FTSE, DAX Key Points

- Weak economic data and the Israel-Hamas war have driven European indices sharply lower this week.

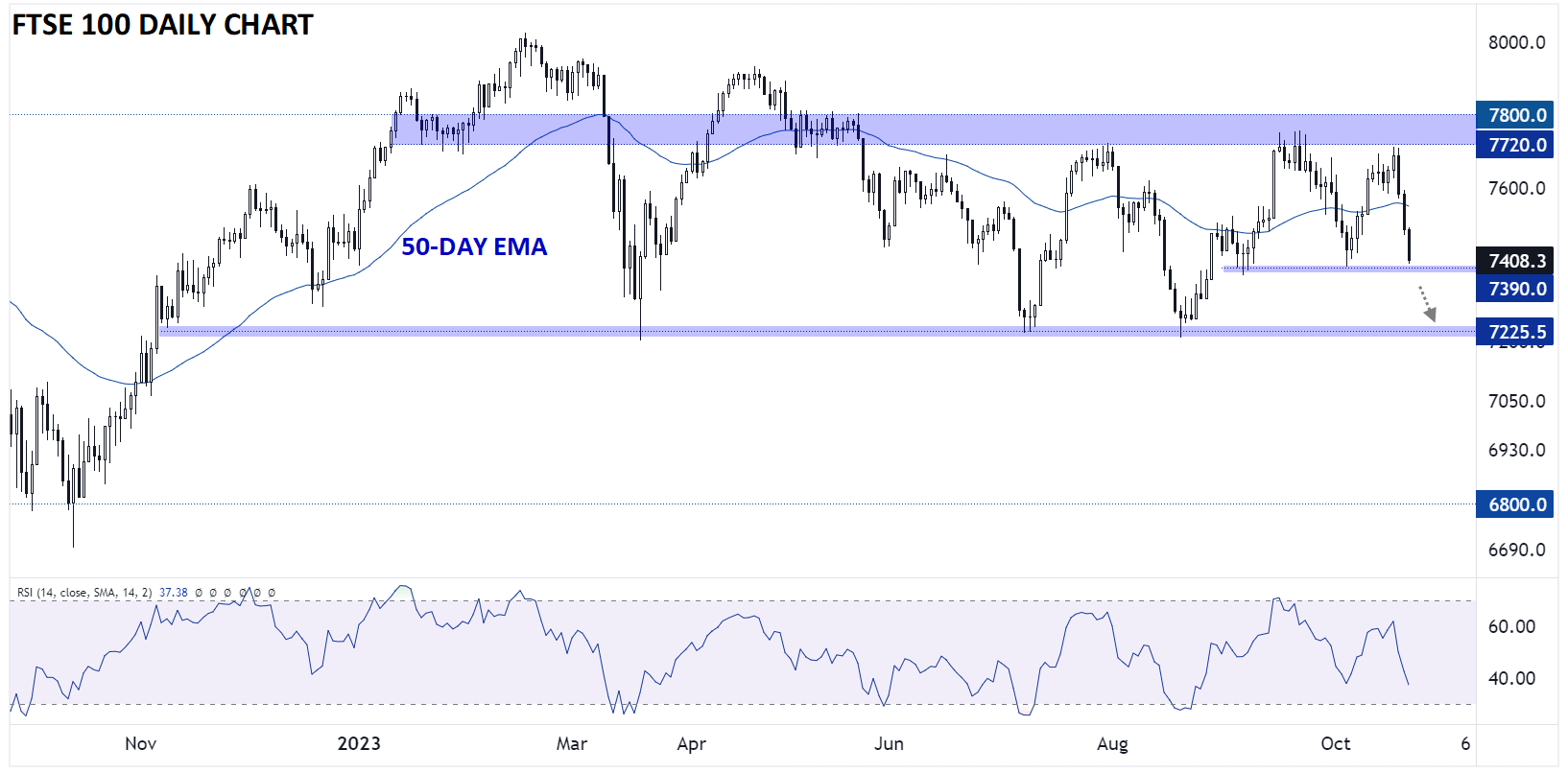

- The FTSE is testing support near the middle of its 6-month range at 7390, with room down toward 7225 if it breaks.

- The DAX’s 6-month rounded top pattern points to more downside toward 14,730 next.

FTSE, DAX Fundamental Analysis

Major European indices struggled to stem their slides this week, with the UK FTSE index falling -2.7% across the week while Germany’s DAX lost a similar -2.5%. Relatively weak economic data in both the UK and Germany drove fears of a recession, while the ongoing conflict between Israel and Hamas hurt risk appetite across the board.

While valuations are relatively attractive on the European continent, traders will want to see the current strong bearish momentum dissipate before feeling comfortable buying the relative value offered by European indices.

FTSE 100 Technical Analysis – FTSE 100 Daily Chart

Source: TradingView, StoneX

The UK’s benchmark index has held up relatively well compared to its global rivals so far this year, but the latter half of this week certainly tipped the tide in favor of the bears. As the chart above shows, the FTSE 100 fell from previous resistance in the 7720 area all the way down to the middle of its 6-month range near 7400. A break below the month’s low at 7390 would open the door for another leg down toward the year-to-date low in the 7225 area.

DAX Technical Analysis – DAX Daily Chart

Source: TradingView, StoneX

The performance of Germany’s main index has been even worse of late, with the DAX forming a broad “rounded top” pattern over the last six months. Assuming that pattern marks a medium- or longer-term top in the index, traders will be turning their eyes toward the Fibonacci retracements of the entire 2022-2023 rally for logical downside targets, starting with the 38.2% level at 14,730. If that level gives way, a continuation down to the 50% retracement in the lower 14,000s could be next.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX