Stock market snapshot as of [4/6/2019 3:03 PM]

- To understand why risky assets are rallying on Tuesday, it helps to bear in mind that the grinding month-long stock market sell-off has clearly gone hand-in-hand with a rally in U.S. Treasurys of similar magnitude

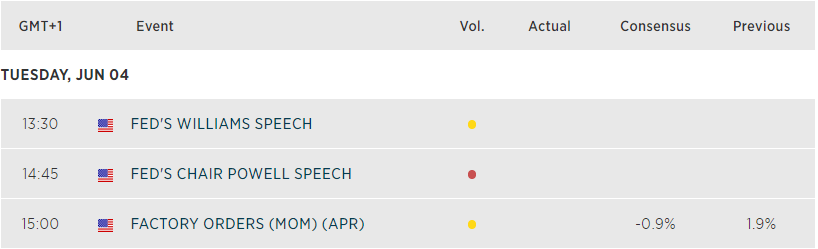

- With the chair of the Federal Reserve speaking as this article is being published, bond investors are alert to the risk that Jerome Powell might damp rate-cut talk

- So far, the chairman sounds only slightly dovish: highlights include that he said the Fed is ready to act “as appropriate” – Treasury prices are trimming some of Tuesday’s falls

- The 10-year yield was up 6 basis a little earlier, at a still depressed 2.12%, approaching the July 2017 cycle low of 2.03%

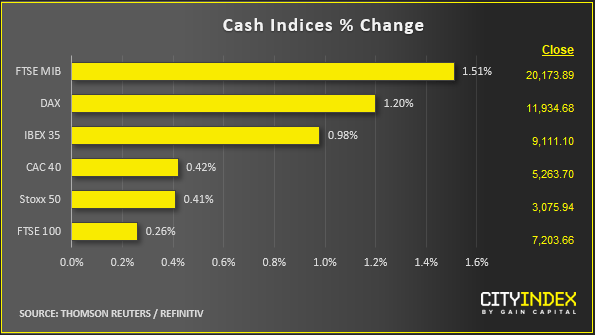

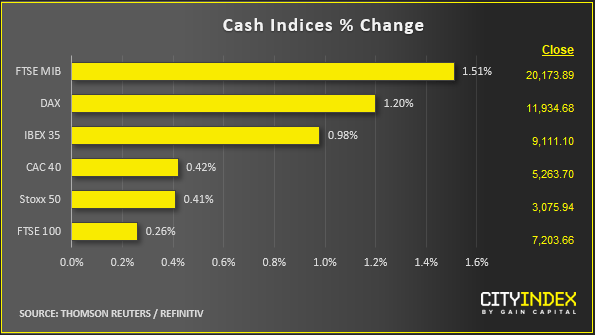

- Lightened sentiment encourages buyers into Wall Street indices, with much of Europe rallying too

- The Reserve Bank of Australia’s possible leading-edge cut this morning may be another factor

- Talk that Congressional Republicans might block tariffs on Mexico may also be in the frame

Corporate News

- European shares are being led by Germany’s BASF heavyweight. The chemical company contributes most to the region’s STOXX 600 index with a 3% rise on speculation that it could sell its construction chemicals arm for $3bn

- U.S. shares are partly unwinding Monday’s sharper-than-market sell-off in big techs, in reaction to looming probes by the Department of Justice and Federal Trade Commission

- Navistar is among the heavier U.S. risers as the truck maker hoists revenue forecasts

- Uber was up 2% a little earlier after getting a buy rating from Goldman Sachs

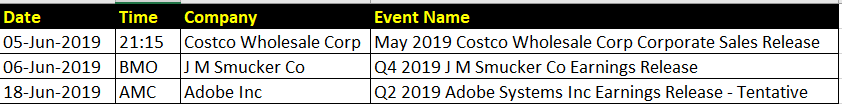

Upcoming corporate highlights

Upcoming economic highlights

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM