The Dax has plunged a further 3.5% across the morning session on Friday, extending losses of 1.5% from the previous session, as coronavirus fears escalate. The morning of losses comes following another volatile session and steep losses on Wall Street.

The number of global cases is closing in on 100,000, whilst the death toll reaches 3,385. The number of cases in Germany has increased to 534. With the number of cases, particularly in Europe rising rapidly increasingly severe measures are being put in place to attempt to safeguard the public. As a result, fears of a huge economic hit are growing, investors are dumping riskier assets such as stocks and flocked towards safer haven bonds.

This week’s 50 basis point rate cut by the Federal Reserve, instead of calming the markets as hoped, the move has reinforced the seriousness of the situation. The response from the Eurogroup and the ECB has been underwhelming.

Data Ignored

Data Ignored

Investors have completed ignored the impressive German factory order data. Factory orders surged in January, jumping 5.5% mom. Well up from December’s -2.1% decline. Despite these figures indicating that the German economy was starting to turn around, this is irrelevant in the face of the hit that the is expected to come from coronavirus.

Not a single stock is moving higher. Travel stock Lufthanza unsurprisingly is the biggest decliner dipping over 5% as bookings dive, auto makers and banks were also tanking hard.

Export Demand & Domestic Demand To Drop

The Dax is particularly vulnerably given that China is its principal trading partner. The economic slowdown in China on the back of coronavirus will result in a decline in German exports. At the same time, the rising number of cases in Germany could see domestic demand slump as well.

Levels to watch

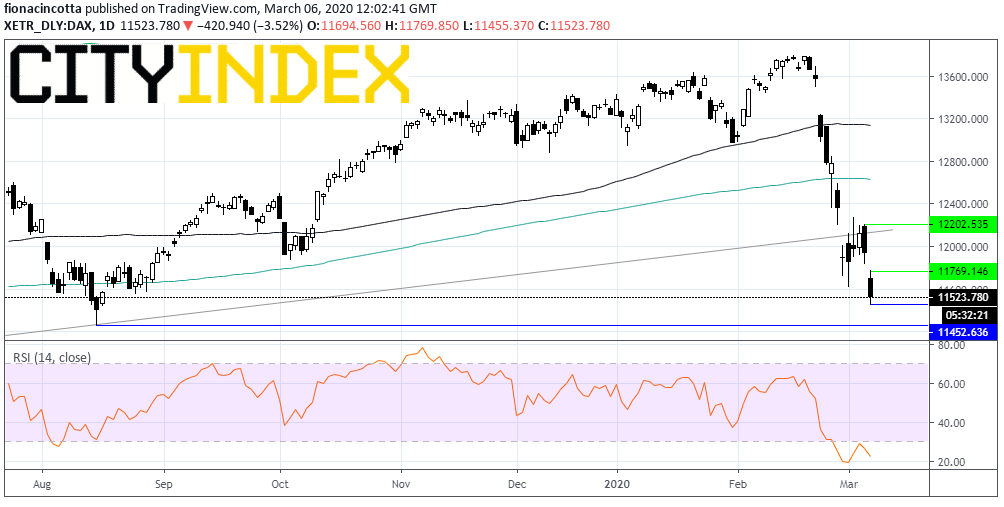

The Dax has dropped over 15% since its all-time high the 20th February. It broke through the ascending trend line which has been in tact since late December 2018 and failed to retake it, in a clearly bearish chart.

Immediate support can be seen at 11455 (today’s low). A break-through here could see the price tumble to 11266 (low 15th August).

On the upside, resistance can be seen at 11769 (today’s high) prior to 12150 (trend line support) and 12200 (yesterday’s high).

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM