The big news this morning came from the OPEC+, with Saudi deciding to extend its voluntary cuts of 1 million barrels per day through August and Russia saying it will cut its exports by 500K bpd in August. The news sent oil prices spiking higher this morning, with Brent jumping around $1.80 (or 2.45%) in initial reaction from the day’s low, before easing off their highs.

Will it be different this time?

The key question remains as to whether oil prices will buck the recent trend of being unable to maintain their OPEC-related gains. Every time prices have jumped on the back of supply cuts from the group, traders have sold into that move amid scepticism over the efficacy of these cuts when Russia has consistently produced and sold more oil than agreed. Will it be different this time?

Well, judging by the somewhat muted response, traders clearly want to see evidence that Russia will be complying.

What else is holding back crude oil?

There are also ongoing concerns about demand, as evidenced, for example, by this morning’s release of the latest or revised PMIs, showing falling activity across the global manufacturing sector.

Fears about the strength of the global economy intensified after major central banks tightened monetary policy further in recent weeks, with some pushing interest rates higher than had been expected just a month or so ago.

Crude oil outlook is positive

But the efforts of the OPEC+ will not go to vain. Supply should continue to tighten as we go deeper in the second half of this year. I think it is a matter of time before we see oil prices start to trend decisively higher. That is assuming members of the group will comply with their cuts and there are no major demand shocks. So, our crude oil outlook remains bullish.

Crude oil outlook: Technical analysis

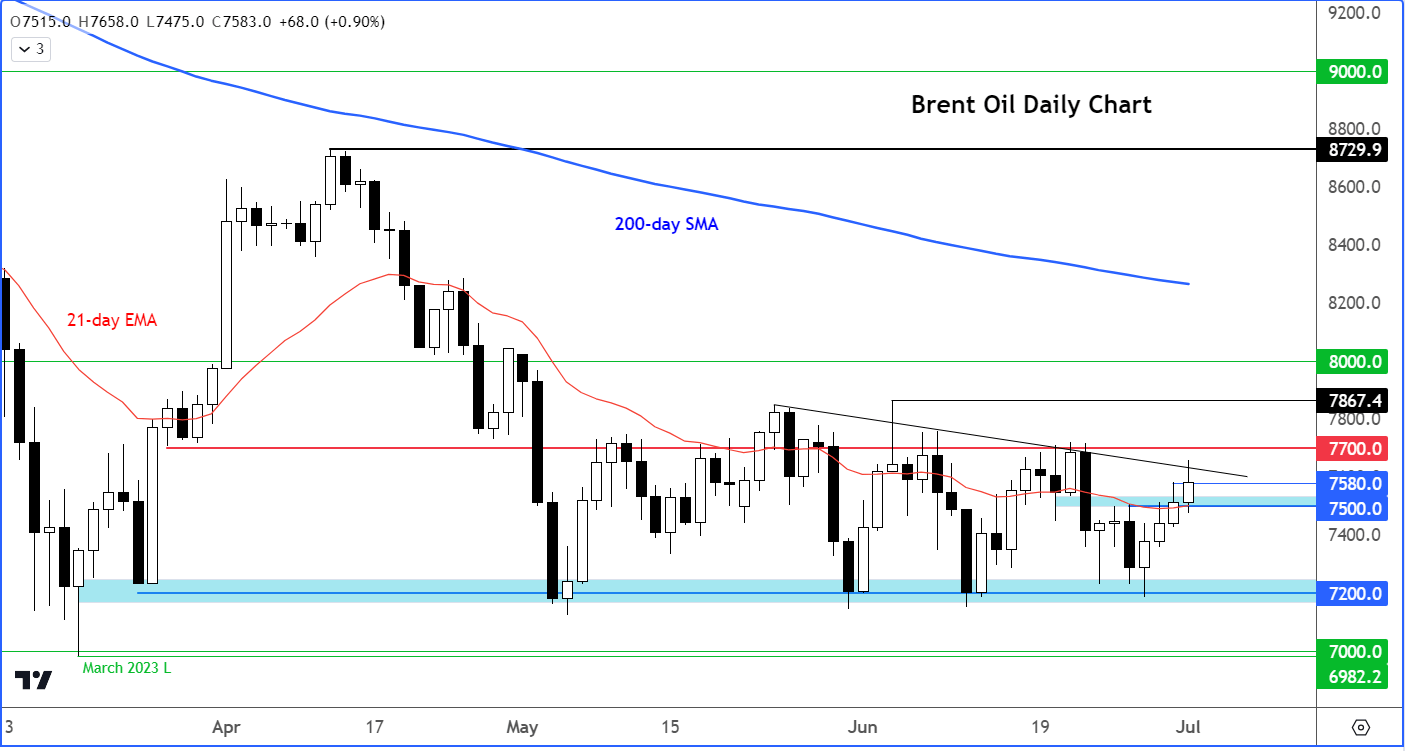

Brent oil broke – on a daily closing basis – above the key $75 level on Friday, before extending higher on the back of Saudi/Russia news this morning. A positive close today would appease the bulls – especially if we also see a break above the $77.00 resistance level, where Brent oil has consistently struggled. A decisive move above $77.00 could pave the way for follow-up technical buying towards $80.00 or even higher.

It is worth noting that oil prices have been fairly stable over the past couple of months or so, with Brent finding consistent support around the $72.00 level and resistance circa $77.00. With the market expected to tighten further in the months ahead, a bullish breakout from this $5 range would give us a projected measured target of $83.00 ($77.00 + $5). In other words, a rally back to the 200-day moving average.

In short, the crude oil outlook remains positive after much of the selling pressure was absorbed successfully in June, and in light of the ongoing OPEC+ intervention.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade