Coinbase (COIN) earnings preview: When will profit margins get squeezed?

It seems like just yesterday that Coinbase (COIN) had its ballyhooed direct listing, though in reality, it was almost exactly a month ago now. Regardless, in our current market environment a month feels more like a decade, so traders will be eager to see the latest figures from the US’s most popular cryptoasset exchange.

See the key facts, themes, and price levels to watch for this week’s key earnings report below:

When are Coinbase earnings?

Thursday, May 13 after the closing bell

Coinbase earnings expectations

$3.01 in EPS on $1.81B in revenues in Q1

What to watch from Coinbase earnings

There are no two ways about it: Coinbase is in the midst of absolutely booming business conditions. After setting massive records for volume, users, revenues, and profits ahead of its IPO, the company is poised to report another strong quarter this week. While the price of bitcoin, the world’s largest cryptoasset, has held generally steady in the upper-$50k range since COIN’s IPO, the #2 cryptoasset Ethereum has gone absolutely gangbusters, nearly doubling to $4,000 over the same period. The big bull run in ETH may be one of the factors that has driven Coinbase to become the top app in Apple’s App Store for the first time since late 2017.

The other two key themes to watch from the Coinbase earnings report will be institutional volume and competition. In its pre-IPO earnings release, Coinbase shared that institutional volume made up nearly two-thirds of the company’s trading volume, though these large traders accounted for a far smaller proportion of overall profits. Continued growth in this segment would show that the company is diversifying its user base, potentially building resiliency against a decline in major cryptoassets and potential for a mass exodus of retail traders.

Meanwhile, competition is likely to start squeezing COIN’s profits sooner rather than later. While Coinbase has been able to rely on its first mover advantage and brand familiarity so far, margins will continue to compress from competition with both “CeFi” brokerages like BlockFi and “DeFi” alternatives like Uniswap. Bulls are hopeful that these halcyon, high profit margin days can continue for a bit longer, so any signs that profit margins are already falling could lead to a selloff in the stock.

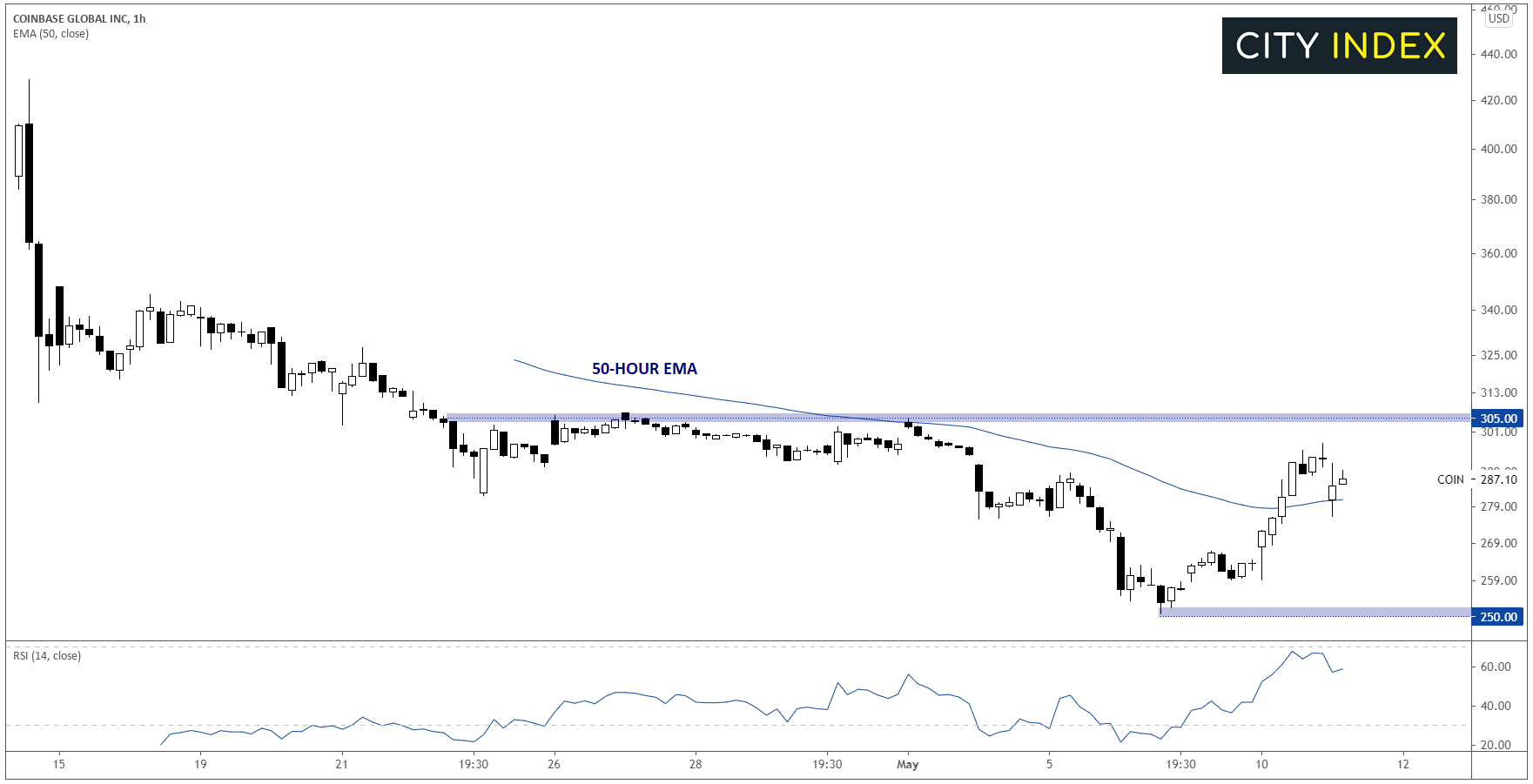

Coinbase (COIN) technical analysis

Technical analysis on any asset with less than a month of price history will always be fraught, but at a minimum, traders should be aware of the key resistance level from late April near $305 and the stock’s record low of $250 as potential levels to watch in the wake of the earnings release:

Source: TradingView, StoneX

If Coinbase is able to impress its new public investors with its first-ever public earnings report, traders will be looking for a sustained break above $305 to open the door for continued gains as we move into the summer.

Learn more about equity trading opportunities.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.