Support has returned for the beaten-up interest rate sensitive tech sector. Block (SQ2) (the new Afterpay) added another 12% to be trading at $175.18, building on its rally following a strong earnings report last week. Xero (XRO) is trading 6.65% higher at $99.96, reclaiming a nice chunk of its 30% losses from the start of the year, while Seek (SEK) is enjoying the relief of lower interest rates to be trading at $28.27 (6.22%).

Elsewhere travel stocks have made good gains, supported by comments over the weekend from Qantas CEO Alan Joyce, who predicted that the airline's lucrative domestic travel routes would recover to pre-pandemic levels by the middle of the year. Qantas (QAN) is trading at $5.18 (2.17%), overshadowed by gains in Webjet (WEB) trading at $5.50 (3.77%) and Flight Centre (FLT) trading at $18.12 (3.25%).

Yesterday's outperformers, the materials and energy sector, have succumbed to a round of profit-taking today, led lower by mining heavyweight Fortescue Metals Group (FMG) trading at $17.85 (-1.65%) and Origin Energy (ORG) trading at $5.49 (-3.68%).

In the day's critical economic event, the RBA, as widely expected, left their key lending rate on hold at 0.1%. There was little change to the accompanying statement, apart from noting the uncertainty created by the Russian invasion of Ukraine.

The bank's comments on growth and employment remain upbeat; however, its forward guidance remains one of patience waiting for inflation and wages growth to satisfy its criteria that conditions for a rate rise are in place.

Next up is Australian Q4 GDP tomorrow at 11.30 am. he release of today's partial inputs were stronger than expected and suggest that the risks to this number are to the upside of market expectations of a 3.7% y/y gain.

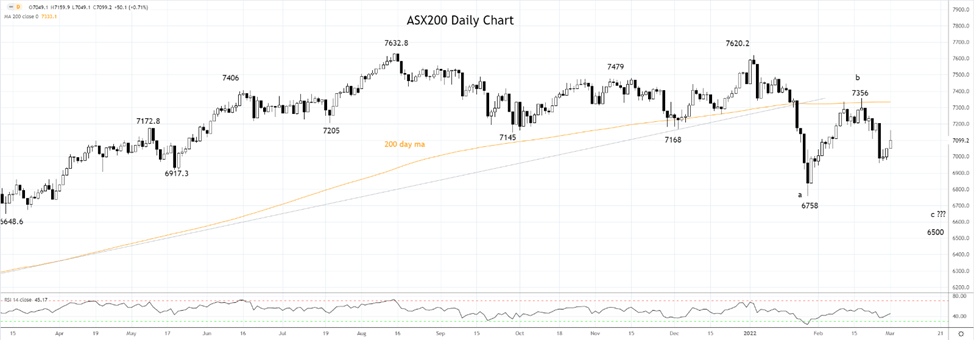

Source Tradingview. The figures stated are as of March 1st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade