The gains come despite a continuation of the awful humanitarian news flow over the weekend from the Russian - Ukraine War and concerning reports that Russia requested Chinese military assistance for its war in Ukraine.

As war threatens crops from Europe's vital grain-growing regions and as governments worldwide scramble to secure food supplies and curtail food exports, the UN's benchmark index of world food and agricultural prices has surged to a multi-decade high.

Building on this and a bullish trading update, agribusiness company Elders (ELD) is the day's best-performing stock, trading +11.08% higher at $13.33.

A strong session for the Financial Sector, adding 2.13% ahead of tomorrow's RBA meeting minutes. The minutes are likely to be scrutinised for more clues around how the bank sees the war in Ukraine impacting the economy. The interest rate market is fully priced for RBA rate hike "lift-off" in June, followed by another four rate hikes before the end of 2022.

ANZ is the best of the big four banks, adding 2.61% to $26.52, Commonwealth Bank (CBA) added 2.44% to $101.80, taking it to its highest level since mid-January. Westpac (WBC) lifted 1.66%, National Australia Bank (NAB) added 1.55%, while Macquarie Group (MQG) added 2.53% to $186.94.

The Healthcare Sector is the next best performer today, adding 1.9%. Cochlear (COH) has added 1.74% to $217.96, Ramsay Health Care 1.28% to $61.49 and Biotech giant CSL has added 2.3% to be trading at $262.39.

Crude oil has slipped 2.50% to be trading at $106.63, building on last week's 5.5% decline as the market appears to be adjusting to the loss of Russian oil imports. As well as hopes of increased supply from some members of OPEC+. Woodside Petroleum (WPL) is trading 0.88% lower at $31.70. Santos (STO) has fallen 0.53% to $7.53. Beach Energy (BPT) has bucked the trend to add 0.63% to $1.61.

Gold has extended its decline from last week's double top at $2075 to be trading -0.67% lower at $1975, weighing on key ASX200 goldies. Newcrest Mining (NCM) -1.15%, Northern Star Resources (NST) -0.65% while Evolution Mining (EVN) is trading 0.68% higher at $4.46.

Despite news over the weekend that Guinea has suspended work at the giant Simandou iron ore mine after parties failed to agree to terms financing a port and railway, the three big Australian iron ore producers are all trading lower on the day. BHP Group has fallen -0.80% to $47.31, Rio Tinto has declined 1.11% to $110.46, while Fortescue Mining fell 1.29% to $18.00.

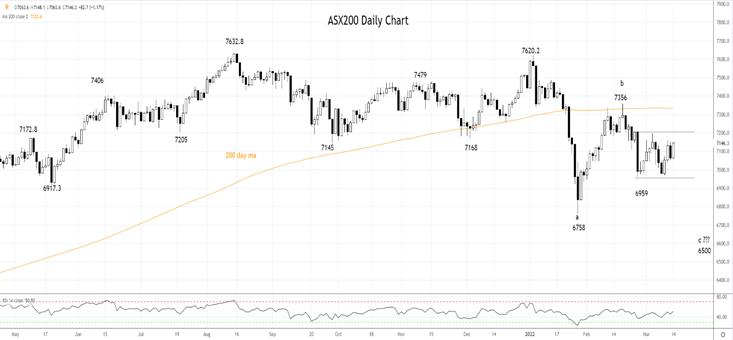

Source Tradingview. The figures stated are as of March 14th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade