The ASX200 trades 49 points higher at 7014 at 3.00 pm Sydney time.

Behind todays rebound, month-end rebalancing flows, as well as a thumping earnings report from energy giant Woodside which included a 414% increase in NPAT to $1.81bn and its biggest interim dividend payout since 2014.

Woodside and the broader ASX200 energy sector have benefited from surging energy prices. With the price of crude oil trading at $97.00, 13% above its mid-August $85.73 low and looking buoyant, the good times for Australian energy stocks look to continue.

Woodside's share price is currently trading at $35.95 (1.7%), above the downtrend resistance, coming in at $35.60 from the 2014 $43.74 high. A weekly close above $35.60 would allow the share price to retest the $39.38 high of October 2018 before a move towards the all-time $43.74 high.

Tech stocks have attempted to make amends after a cleanout in the sector yesterday. Novonix added 4.3% to $2.32, EML Payments added 4.1% to $0.90c, Wisetech Global added 4.11% to $58.58, Altium added 3.7% to $35.96 and Sezzle added 2.5% to $0.63c.

Material stocks have had a mixed day as the market digests the implication of the Fed Chairs' "higher for longer" message from Jackson Hole. BHP fell 0.84% to $41.83. Rio fell 0.4% to 95.88, FMG added 0.85% to $19.06. Mineral Resources climbed by 5.25% to $67.35, a record high after it committed to a new $3bn iron ore mine in the Pilbara.

A sharp 17.2% fall in Australian Building Approvals for July has not stopped the share price of the big banks from recording gains. ANZ added 1% to $22.67, NAB added 0.8% to $30.09 CBA added 0.4% to $96.71 and Westpac added 0.25% to $21.32.

Consumer Discretionary stocks have also rebounded, led by Webjet, which added 4.6% to $5.12, Kogan added 4% to $3.39, Flight Centre added 3.3% to $17.31 on speculation the company is looking at buying Altour International, a travel management company based in the U.S.

A2M is now up almost 15% in two days to be trading at $5.62, after yesterday's earnings report suggests the worst is now behind for the company. Going the other way, BUBS Australian tumbled by 4.1% to $0.58c. Despite reporting a 127% increase in Revenue to $89.3m, the company still recorded a full-year loss of $11.4m.

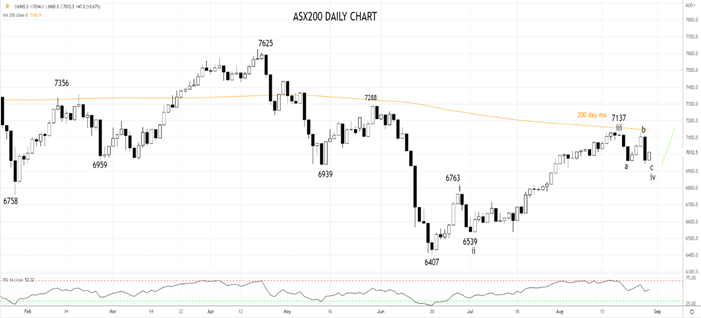

After holding and bouncing from the solid band of support 6960/40 area, we look for a retest of resistance and the top of the range, 7130/50 area.

Source Tradingview. The figures stated are as of August 30th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade