When

Tuesday 2nd February after the closing bell

Expectations

Expectations are for EPS $7.00 on revenue of $112 - $121 billion.

What to watch

Amazon is expected to report some stellar Q4 numbers after blockbuster sales over the holiday period – a strong end to an impressive year for revenue.

However, covid related costs have also surged across this year with another $4billion expected in Q4 to deal with the challenges facing its retail operations. Amazon has taken on over 400,000 more staff in 2020. Higher costs could impact on profits.

Amazon web services will have also further benefited from the pandemic tailwind and has been a key contributor to revenue growth, now accounting for 12.1% of total revenue after the division saw revenue growth of 29% the previous two quarter. Although, growth here could start to slow given rising competition, potentially unnerving investors.

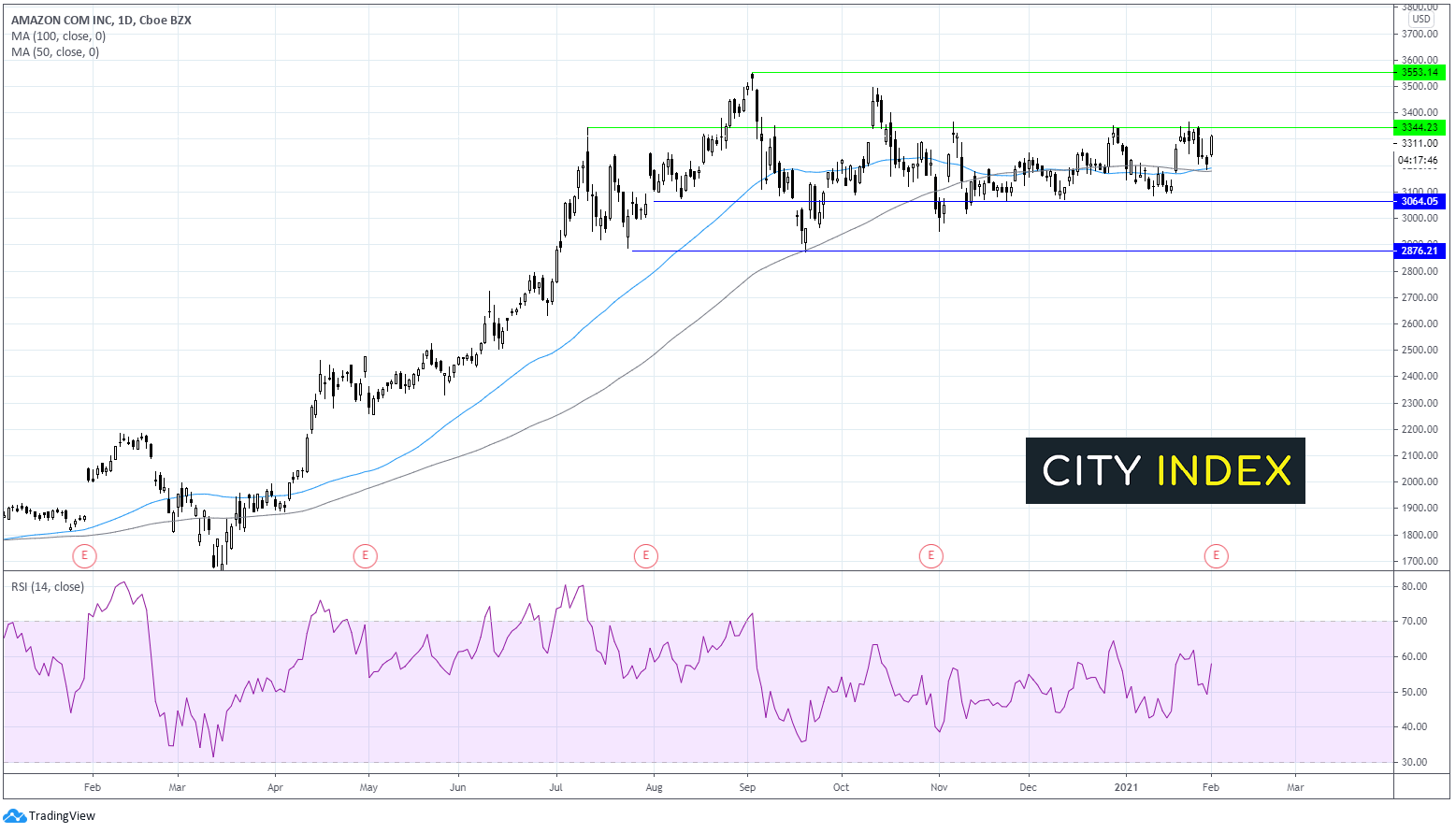

Amazon technical analysis

The share price rallied hard from mid-March lows. However, the rally ran out of steam and has been trading range bound with a neutral bias, capped on the upside by $3350 and $3060 on the lower side. Q4 earnings could be the catalyst to break the share price out of its current range with bulls looking to target the all time high of $3552 and the bears eyeing a break below $3060 towards $2875.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM