US Futures flat, watch LLY, AA, DAL, LVS

The S&P 500 Futures are flat after they rebounded yesterday as investors were relieved by oil prices recovering from record lows.

Later today, investors will focus on U.S. reports on Initial Jobless Claims for the week ended April 18 (4.20 million expected), the Markit U.S. Manufacturing Purchasing Managers' Index for April (preliminary reading, 38.0 expected), and New Home Sales for March (an annualized rate of 645,000 units expected).

There are no directional trends in the European equity markets this morning. Research firm Markit has published preliminary readings of April Composite PMI for the Eurozone at 13.5 (vs 25.0 expected), an historic low.

Asian indices closed broadly in the green. Australian government reported that preliminary retail sales in the country rose 8.2% on month in March, the largest monthly increase since 2000 but April Composite PMI fell to a record low at 22.4, vs 38.0 expected.

WTI Crude Oil Futures continue to show signs of relief from dramatic losses in prior sessions, as investors expect demand for fuel to rebound along with the U.S. economy reopening. Oil prices were also boosted by heightened tensions between the U.S. and Iran. President Donald Trump said he has ordered the U.S. Navy to shoot down and destroy Iranian gunboats if they provoke U.S. ships in the region.

Gold gained 17.9 dollars (+0.94%) to 1756.20 dollars, hitting a one-week high, still benefiting from weakening equity markets.

On the forex front, EUR/USD fell 43pips to 1.078 as Eurozone business activity hit a record low in April. USD/CAD declined 19pips to 1.4142 on bouncing oil prices.

US Equity Snapshot

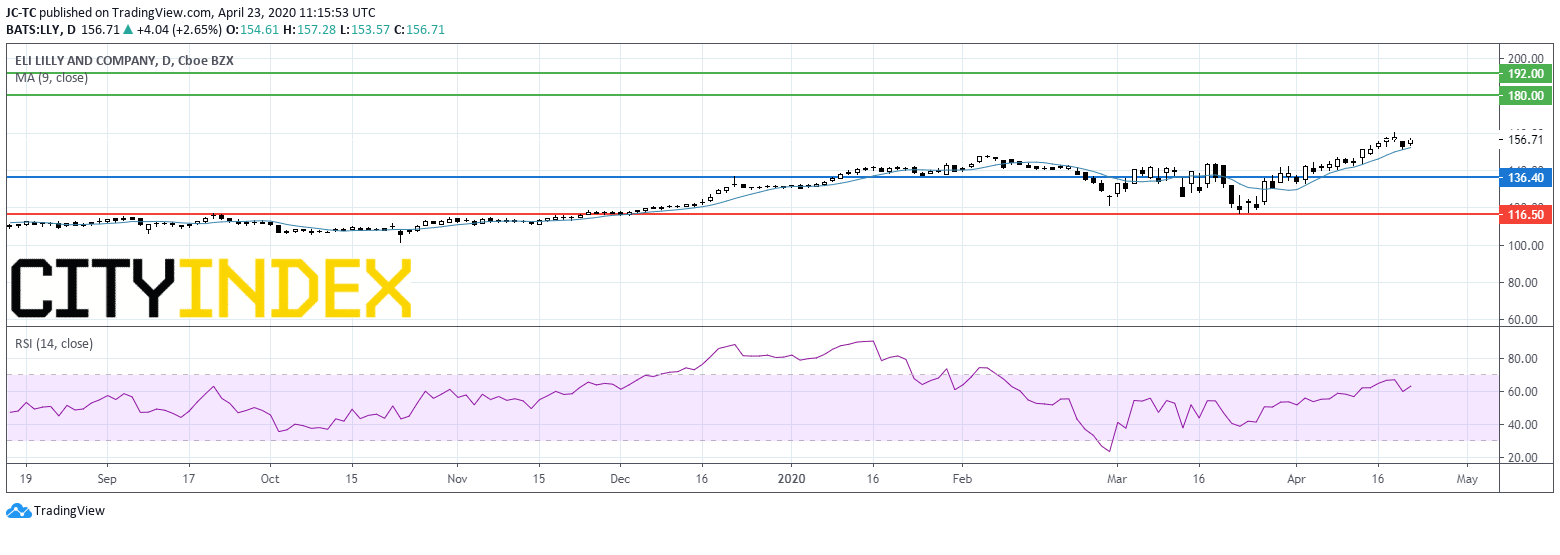

Eli Lilly (LLY), the pharma company, posted better than expected first quarter adjusted EPS up to 1.75 dollar from 1.33 dollar a year earlier. Sales were up 15% to 5.86 billion dollars, also beating estimates. The company expects full year adjusted EPS to be 6.70 to 6.90 dollars vs a previous estimate of 6.70-6.80 dollar.

Alcoa (AA), a giant aluminum producer, reported first quarter adjusted LPS of 0.23, as expected and flat year on year, on revenue down 12.4% to 2.38 billion dollars. Also, adjusted EBITDA declined 31.3% to 321 million dollars. Those figures were above consensus. The company said it has suspended its quarterly projections on global supply and demand balances for bauxite, alumina, and aluminum, due to the uncertainty regarding the COVID-19 pandemic.

Delta Air Lines (DAL), an airline group, announced plans to commence a private offering of 1.5 billion dollars of senior secured notes due 2025 and to enter into a new 1.5 billion dollars term loan B facility due 2023. The company said it intends to use the net proceeds to bolster its liquidity position.

Las Vegas Sands (LVS), a global operator of casino resorts, reported first quarter adjusted LPS of 0.03 dollar, lower than anticipated, vs an EPS of 0.91 dollar a year ago, on net sales down to 1.8 billion dollars, exceeding estimates, from 3.6 billion dollars last year.

CSX (CSX), an international freight transportation company, announced first quarter EPS down to 1.00 dollar, better than expected, from 1.02 dollar a year ago, on sales down of 2.9 billion dollars, as expected, from 3.0 billion dollars in the previous year.

Kinder Morgan (KMI), one of the largest midstream energy firms in North America, disclosed first quarter adjusted EPS down to 0.24 dollar, just below the consensus, from 0.25 dollar a year ago, on sales down to 3.1 billion dollars, below estimates, down from 3.4 billion dollars a year earlier.

Later today, investors will focus on U.S. reports on Initial Jobless Claims for the week ended April 18 (4.20 million expected), the Markit U.S. Manufacturing Purchasing Managers' Index for April (preliminary reading, 38.0 expected), and New Home Sales for March (an annualized rate of 645,000 units expected).

There are no directional trends in the European equity markets this morning. Research firm Markit has published preliminary readings of April Composite PMI for the Eurozone at 13.5 (vs 25.0 expected), an historic low.

Asian indices closed broadly in the green. Australian government reported that preliminary retail sales in the country rose 8.2% on month in March, the largest monthly increase since 2000 but April Composite PMI fell to a record low at 22.4, vs 38.0 expected.

WTI Crude Oil Futures continue to show signs of relief from dramatic losses in prior sessions, as investors expect demand for fuel to rebound along with the U.S. economy reopening. Oil prices were also boosted by heightened tensions between the U.S. and Iran. President Donald Trump said he has ordered the U.S. Navy to shoot down and destroy Iranian gunboats if they provoke U.S. ships in the region.

Gold gained 17.9 dollars (+0.94%) to 1756.20 dollars, hitting a one-week high, still benefiting from weakening equity markets.

On the forex front, EUR/USD fell 43pips to 1.078 as Eurozone business activity hit a record low in April. USD/CAD declined 19pips to 1.4142 on bouncing oil prices.

US Equity Snapshot

Eli Lilly (LLY), the pharma company, posted better than expected first quarter adjusted EPS up to 1.75 dollar from 1.33 dollar a year earlier. Sales were up 15% to 5.86 billion dollars, also beating estimates. The company expects full year adjusted EPS to be 6.70 to 6.90 dollars vs a previous estimate of 6.70-6.80 dollar.

Alcoa (AA), a giant aluminum producer, reported first quarter adjusted LPS of 0.23, as expected and flat year on year, on revenue down 12.4% to 2.38 billion dollars. Also, adjusted EBITDA declined 31.3% to 321 million dollars. Those figures were above consensus. The company said it has suspended its quarterly projections on global supply and demand balances for bauxite, alumina, and aluminum, due to the uncertainty regarding the COVID-19 pandemic.

Delta Air Lines (DAL), an airline group, announced plans to commence a private offering of 1.5 billion dollars of senior secured notes due 2025 and to enter into a new 1.5 billion dollars term loan B facility due 2023. The company said it intends to use the net proceeds to bolster its liquidity position.

Las Vegas Sands (LVS), a global operator of casino resorts, reported first quarter adjusted LPS of 0.03 dollar, lower than anticipated, vs an EPS of 0.91 dollar a year ago, on net sales down to 1.8 billion dollars, exceeding estimates, from 3.6 billion dollars last year.

CSX (CSX), an international freight transportation company, announced first quarter EPS down to 1.00 dollar, better than expected, from 1.02 dollar a year ago, on sales down of 2.9 billion dollars, as expected, from 3.0 billion dollars in the previous year.

Kinder Morgan (KMI), one of the largest midstream energy firms in North America, disclosed first quarter adjusted EPS down to 0.24 dollar, just below the consensus, from 0.25 dollar a year ago, on sales down to 3.1 billion dollars, below estimates, down from 3.4 billion dollars a year earlier.

Source : TradingView, GAIN Capital

Latest market news

Today 08:15 AM

Yesterday 10:44 PM