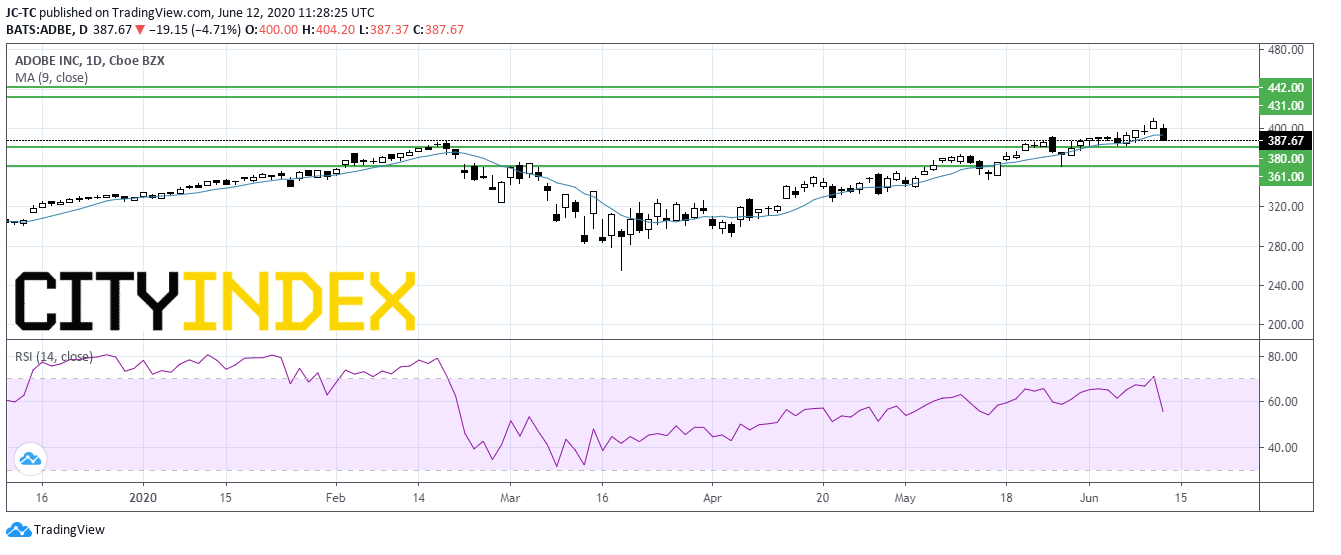

US Futures bounce, watch ADBE, TSLA, GM, PVH, LULU

Later today, the U.S. Labor Department will release May import price index (+0.7% on month expected). The University of Michigan will publish its Consumer Sentiment Index for June (75.0 expected).

European indices are posting a rebound after a gap-down opening. The European Commission has posted April industrial production at -17.1% (vs -20.0% on month expected). France's INSEE has released final readings of May CPI at +0.4% (vs +0.2% on year expected). The U.K. Office for National Statistics has reported April GDP at 20.4% (vs -18.7% on month expected), industrial production at -20.3% (-15.0% on month expected) and manufacturing production -24.3% (vs -15.6% on month expected).

Asian indices closed in the red except the Chinese CSI. New Zealand's Business NZ Manufacturing PMI bounced to 39.7 in May from 25.9 in April.

WTI Crude Oil Futures are rebounding after they posted a huge drop yesterday. A slight recovery in demand for risky assets could be contributing to the technical bounce.

Gold continues to gain ground on falling equities. Gold rose 8.65 dollars (+0.5%) to 1736.36 dollars.

Risk currencies try to recover after a drop yesterday. EUR/USD rose 17pips to 1.1316 while GBP/USD gained 33pips to 1.2635.

US Equity Snapshot

Adobe Systems (ADBE), a developer of software products, reported second quarter adjusted EPS of 2.45 dollars, beating estimates, up from 1.83 dollar a year ago, on sales of 3.1 billion dollars, just shy of the consensus, up from 2.7 billion dollars in the previous year. The company expects third quarter sales of 3.15 billion dollars and adjusted EPS of 2.40 dollars. Adobe withdraws its full year guidance.

Tesla Motors (TSLA), the electric-vehicle maker, was downgraded to "neutral" from "buy" at Goldman Sachs, and to "underweight" from "equal-weight" at Morgan Stanley.

General Motors (GM), the carmaker, was upgraded to "buy" from "neutral" at Goldman Sachs.

PVH (PVH), a designer and global marketer of branded apparel, disclosed first quarter adjusted LPS of 3.03 dollars, worse than expected, vs an EPS of 2.46 dollars a year ago, on sale of 1.3 billion dollars, as expected, down from 2.4 billion dollars in the same period of last year.

Lululemon Athletica (LULU), a designer of athletic accessories and apparel, revealed first quarter EPS of 0.22 dollar, below forecasts, down from 0.74 dollar a year ago, on revenue of 652.0 million dollars, missing consensus, down from 782.3 million dollars a year earlier.

Source : TradingVIEW, Gain Capital