Reviewed by Patrick Foot, Senior Financial Writer.

What are indices?

Indices are single markets that are made up of a selection of stocks. An index's price tracks the combined value of every stock listed within it. Comprised of some of the largest global companies, they are seen as indicators of stock market and economic performance.

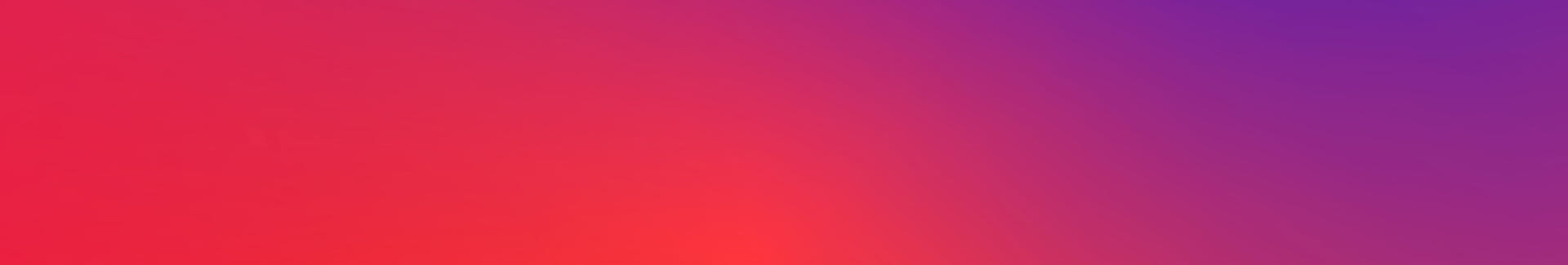

Let's take the Dow Jones as an example.

The Dow consists of 30 large US companies, including Apple, IBM and Microsoft. If the stock prices of these companies go up overall, the Dow will go up too. If they go down, the Dow will fall. By measuring the performance of 30 major stocks, the Dow gives an impression of the overall market.

If the US economy is booming, it's likely these major companies will also be performing well. This is because typical characteristics of a strong economy - such as positive consumer sentiment, high spending and strong GDP output - will also benefit stocks within that economy. So looking at the Dow Jones can give a quick snapshot of how the US economy is performing.

How do indices work?

Indices work by combining the performance of multiple stocks into one single market. An index's price tracks the values of every stock listed on it. Often, a weighting is applied to the stocks, meaning that price movement in some companies will have a greater overall impact on the index than others.

Weightings differ depending on the index, with the most popular being a market capitalisation weighting.

Here is a breakdown of the main types of index weightings:

Market capitalisation

Most indices use a market capitalisation (market cap) weighting, which is where the largest stocks by market cap will have the greatest impact to the index's price. Market cap is calculated by multiplying the number of outstanding shares a company has by its share price. Most major benchmarks are calculated by market cap: including the S&P 500, FTSE 100 and DAX.

Price

Price weighting is where stocks with a higher share price will have more impact on an index than those with a lower share price, regardless of how many shares are available. Very few indices use a price weighting methodology, with one notable exception: the Dow Jones.

Fundamental

A fundamental weighting is where one or more factors, such as sales or earnings, are chosen. The stocks that then have the highest sales figures or largest earnings will impact the index's price more than those stocks that have lower sales or earnings figures.

Equal

An equal weighting is where every stock holds the same significance to the index's price. For instance, if an index was comprised of 100 stocks, each stock would represent exactly 1% of the index, regardless of market cap or share price.

How an index chooses stocks

Another key aspect about how indices work is the stocks themselves, known as components.

For the most part, an index's components will be reviewed at regular intervals to determine whether or not new stocks should be added. Some indices have set rules that make it clear if, when and what stocks will be added. For instance, the FTSE 100 simply lists the top 100 stocks by market cap from the London Stock Exchange.

However, some indices are far more subjective. For example, the components of the S&P 500 are selected by a committee. Certain eligibility criteria exist, such as needing a minimum market cap of $13.1 billion and a monthly trading volume of at least 250,000 shares, but a stock isn't automatically listed just by hitting these milestones.

What are the major indices?

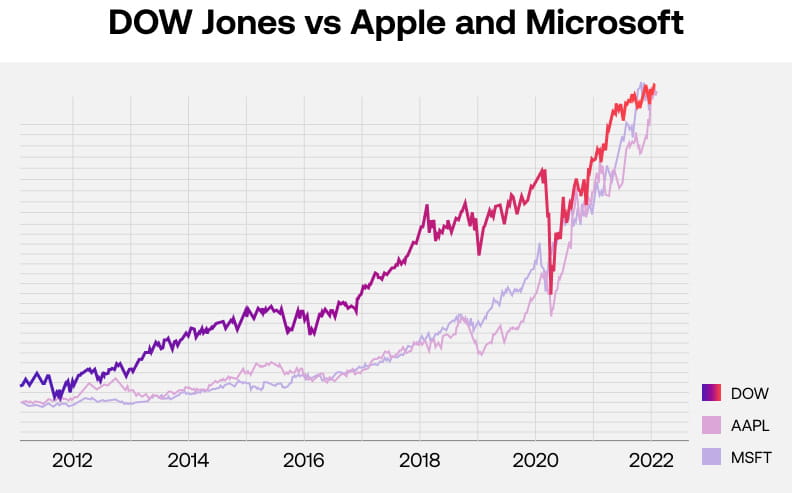

The major indices are known as benchmarks - the stock indices that are used to give an at-a-glance snapshot of an economy. Let's take a look at a few notable examples: the Dow Jones, S&P 500, Nasdaq 100, FTSE 100 and DAX.

To see the live price movements of all these indices and more, sign up for your free City Index demo. Or if you're ready to trade markets with real capital, get a live account.

Dow Jones (Wall Street)

Created in 1896, the Dow Jones Industrial Average is the second oldest index in the US. Its name is derived from its two founders, Charles Dow and Edward Jones. Initially consisting of just 12 stocks, it's since grown to list 30 and has become one of the most-watched stock indices in the world.

Although its accuracy is debated, the index was launched to be a measure of economic health in the US. Editors of the Wall Street Journal and S&P Dow Jones Indices representatives decide which stocks are listed. A stock might be delisted from the Dow if, for example, that stock has become less relevant and no longer fits the latest economic trends. Proctor and Gamble is the longest standing constituent of the index, having been listed since 1932.

The Dow applies a price weighting, meaning stocks with a higher share price are more significant to the index's price than lower-priced stocks.

S&P 500 (US SP 500)

The S&P 500, short for 'Standard and Poor 500' is an index that lists 500 of the largest companies listed in the US. This covers approximately 80% of the total stock equity in the entire US economy, which is why some people believe the S&P 500 to be the most accurate index to measure US economic performance.

It was formed in 1941 as a merger between Poor's Publishing, which at the time published an investor's guide to the railroad industry, and Standard Statistics Company which ran its own stock index. In March 1957, the S&P 500 index took the form that it has today as it expanded from a 90-stock index to listing 500 stocks.

The S&P 500 is market-capitalisation weighted.

Nasdaq 100 (US Tech 100)

The Nasdaq 100 is an index comprised of 100 of the largest stocks on the Nasdaq stock exchange. It was created in 1985 and is rebalanced once a year every December, when new stocks are considered for listing.

The index typically includes many of the major tech stocks in the US economy, which is why it's also known as the US Tech 100. Despite this, there are stocks from other industries listed on the index, such as retail and health care, but significantly, no financial stocks are admitted. They're instead listed on the Nasdaq-100's sister index, the Nasdaq Financial-100.

FTSE 100 (UK 100)

The FTSE 100, short for the Financial Times Stock Exchange 100, is an index that lists the 100 largest stocks from the UK economy based on market capitalisation. The index represents over 80% of the total market capitalisation of the London Stock Exchange.

It was launched in 1984 and is reviewed quarterly to ensure it always lists the top 100 companies. Although a UK-based index, non-UK companies can be included in the FTSE 100 as long as they are listed on the London Stock Exchange. Because of this, the strength of the pound has a major impact on the FTSE's price.

DAX 40 (Germany 40)

The DAX is made up of the 40 largest and most liquid German companies listed on the Frankfurt Stock Exchange. The DAX's 40 components equate to over 75% of the total market capitalisation of the Frankfurt Exchange.

The stocks listed on the index are reviewed regularly, and if a company is no longer one of the top 4 companies on the Frankfurt Exchange based on market capitalisation, it can be removed. Equally, if a stock not listed on the DAX breaks into the top 25 companies on the FSE, it can be added.

Germany's main index is also known for its diverse range of stocks. The DAX includes companies from the healthcare, automobile, footwear, financial services, real estate, utilities, energy, industrials and technology industries.

Other notable indices include CAC 40 from Europe and the ASX 200 from Australia. The Hang Seng Index and Japan’s Nikkei 225, meanwhile, are major Asian indices.

Index |

Country |

Notable Stocks |

Overview |

2021 Open Price |

|---|---|---|---|---|

| Dow Jones | US | Apple, Coca-Cola, Goldman Sachs, Microsoft, Nike, Visa, Walt Disney | 40 large US stocks selected by a committee of Wall Street Journal editors and S&P Dow Jones indices representatives | 30590 |

| S&P 500 | US | Alphabet, Apple, Coca-Cola, Facebook, Microsoft, Nike, Tesla, Visa, Walt Disney | 500 large stocks on the NYSE or Nasdaq | 3757.1 |

| Nasdaq-100 | US | Alphabet, Amazon, Apple, Facebook, Microsoft, Netflix, Tesla | 100 largest non-financial stocks listed on the Nasdaq exchange | 12902.4 |

| FTSE 100 | UK | AstraZeneca, Barclays, BP, HSBC, ITV, Lloyds, NatWest, Royal Dutch Shell, Sainsbury's | 100 largest stocks on the London Stock Exchange | 6472.8 |

| DAX 40 | Germany | Adidas, Deutsche Bank, E. ON, Merck, Siemens, Volkswagen | 40 of the largest German stocks | 13695 |

| CAC 40 | France | Airbus, AXA, Carrefour, L'Oreal, Michelin, Orange, Renault | 40 of the largest stocks in the French economy | 5571.9 |

| Euro Stoxx 50 | Eurozone | Adidas, Airbus, Alliance, Banco Santander, BNP Paribas, L'Oreal, Siemens. | 50 large companies operating within the eurozone | 3567.2 |

| Hang Seng | Hong Kong | Bank of China, HSBC, Sinopec | A selection of the largest companies listed on the Hong Kong index | 27192 |

| Nikkei 225 | Japan | Honda, Konami, Mitsubishi, Nissan, Nikon, Panasonic, Sony, Toyota, Yamaha | 225 of the top stocks listed on the Tokyo Stock Exchange | 27556 |

Why trade indices?

Indices are popular markets to trade due to their significance within the wider financial world and frequent volatility. Let's take a look at a few key reasons why you might want to trade them:

- Exposure to expensive markets

- Long-term trends

- Unmanipulated markets

- Correlation with the economy

Exposure to multiple stocks

Trading indices can give you exposure to hundreds of companies at once, without paying for each individual stock.

For instance, if you trade the Dow, you have an interest in the likes of Apple, McDonald’s, Microsoft, Nike and Visa, without having to pay the full share price for each.

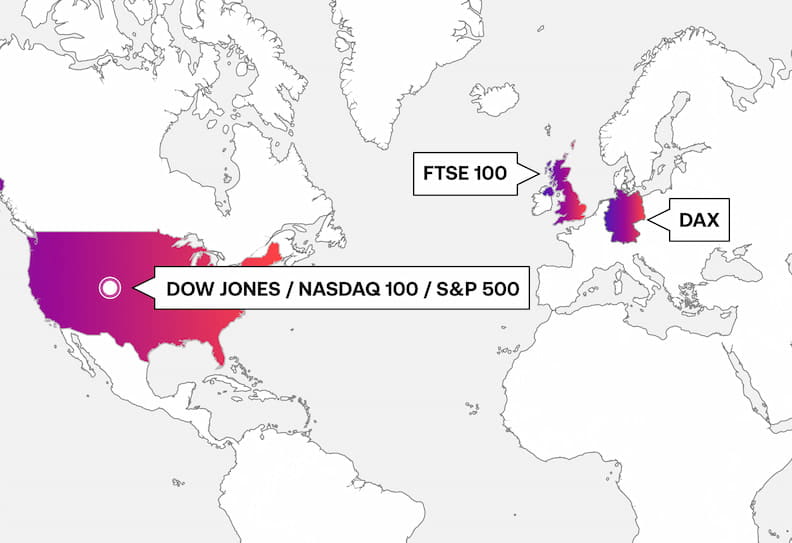

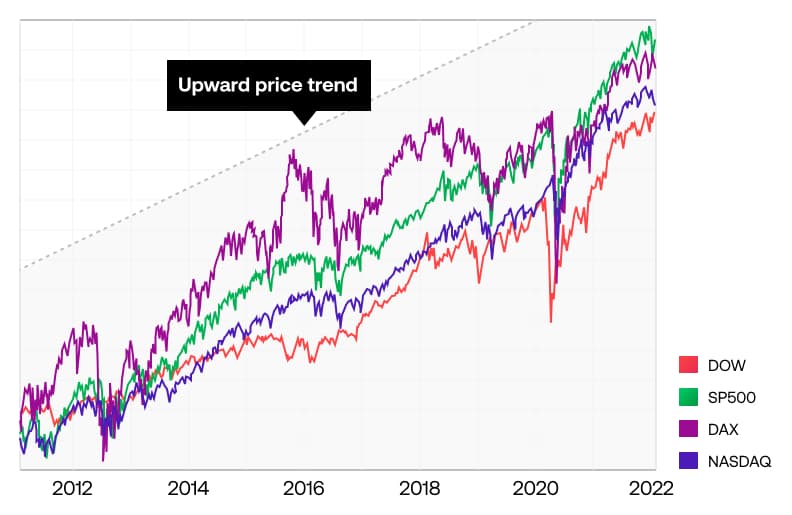

Long-term trends

Indices will usually only include the biggest companies in an economy. Because of this, the long-term trend for almost every index is upwards, which is why many investors choose to hold stocks for long periods.

However, indices won’t always move upwards. Short and long-term bear runs will occur.

Unmanipulated markets

Indices are extremely difficult to manipulate. To do so, you'd have to impact the price of all the top stocks on the index. This is hard enough to do with one stock - to have any significance on the overall index price you'd have to do this across multiple different markets.

Correlation with the economy

If the economy is experiencing a clear downtrend that looks likely to continue in the near future, traders can infer that a corresponding index is also likely to fall and trade accordingly. Of course, you never know how a market's price will move going forward, but this correlation between an economy and its index enables traders to attempt to accurately predict price movement.

Now it's time to learn how indices trading works.