Reviewed by Patrick Foot, Senior Financial Writer.

What are the indices trading hours?

Traditional indices trading hours vary depending on what stock exchange the index's constituents are listed on. Most European stock indices, for example, are calculated from 08:00 till 16:30 on weekdays, as that's when their stock constituents are open to trade.

Consequently, the index's price moves during this period as a result of the trading activity of its stocks. In the US, typical hours for indices is 14:30 until 21:00, as that's when US stocks trade.

Indices Markets |

Traditional Stock Market Hours (GMT)* |

|---|---|

| Dow Jones (Wall Street) | Mon-Fri 14:30-21:00 |

| Nasdaq-100 (US Tech 100) | Mon-Fri 14:30-21:00 |

| S&P 500 (US SP 500) | Mon-Fri 14:30-21:00 |

| FTSE 100 (UK 100) | Mon-Fri 08:00-16:30 |

| DAX (Germany 40) | Mon-Fri 08:00-20:00 |

| CAC 40 (France 40) | Mon-Fri 08:00-16:30 |

| IBEX 35 (Spain 35) | Mon-Fri 08:00-16:30 |

| FTSE China A50 (China A50) | Mon-Fri 01:30-07:00 |

| Nikkei 225 (Japan 225) | Mon-Fri 00:00-02:30 and 03:30-06:00 |

*Times are subject to change.

The majority of index trading takes place on futures exchanges, though, which means that most indices can in fact be bought and sold 24 hours a day.

Our indices trading hours

You can trade several major indices, such as the FTSE 100, DAX 40 and Nasdaq-100, 24 hours (with some breaks) a day from Monday to Friday with City Index.

Market hours may differ on certain days, such as public holidays, but our typical index trading hours can be found below.

Although you have all-day access, these markets are naturally busier during stock market hours - so the FTSE 100 could be more liquid and experience greater volatility between 08:00 and 16:30 when stocks are trading.

Ready to start index trading? Sign up for a City Index account today and access 21 major markets. Or, try out trading with a risk-free demo account.

Indices Markets |

City Index Trading Hours (GMT) |

|---|---|

| Dow Jones (Wall Street) | Sun 23:00 - Fri 21:15 |

| Nasdaq-100 (US Tech 100) | Sun 23:00 – Fri 21:15 |

| S&P 500 (US SP 500) | Sun 23:00 – Fri 21:15 |

| FTSE 100 (UK 100) | Sun 23:00 – Fri 21:00 |

| DAX (Germany 40) | Sun 23:00 – Fri 21:00 |

| CAC 40 (France 40) | Mon 07:00 – Fri 21:00 |

| IBEX 35 (Spain 35) | Mon 06:00 – Fri 18:00 |

| FTSE China A50 (China A50) | Mon 02:00 – Fri 22:00 |

| Nikkei 225 (Japan 225) | Sun 23:00 – Fri 21:15 |

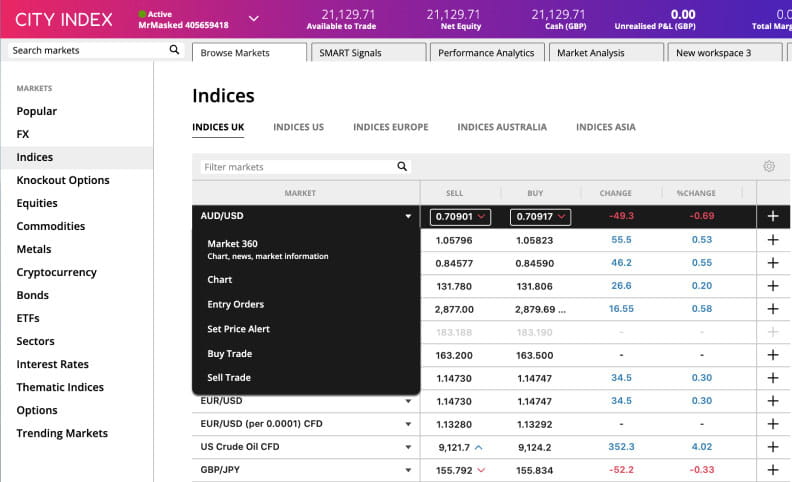

For a full breakdown of market hours for any index, simply visit our platform and go to your intended market. Then click the arrow to open the drop-down menu and select 'Market 360.' This will provide you with a full market overview. To then view the hours you can trade it, click 'Hours' from the left-side panel.

When is the best time to trade indices?

The best time to trade indices depends on your trading strategy. Some traders look to embrace volatility and make the most of strong moves in the markets. Others prefer much more stable markets where risk is less apparent, and they can make the most of smaller market moves.

There are also other factors like liquidity and correlation with other markets to consider when trying to identify the optimum time to trade your index market.

Here are some of the most popular times that traders choose to enter and exit indices markets.

Market open

Trading volume is usually at one of its highest points during market open, more so on a Monday morning as investors react to any news or events that happened over the weekend. Larger trading volumes can equate to a greater chance of volatility, so some enjoy entering the markets during these times to try make the most of strong price moves.

Another benefit of trading during periods of high liquidity is that spreads tend to be tighter, as higher market demand means the broker assumes less risk by accepting your trade. Similarly, trading when liquidity is high also means you’re more likely to match your orders at your intended price – there’s less chance of you not being able to open your position.

Overlapping markets

Another time when indices tend to be more liquid is when markets overlap. This is when two or more index markets are open at the same time.

With European indices in particular, opening hours are similar across the region due to there only being a one- or two-hour time difference between each country.

For instance, the FTSE 100, DAX and IBEX 35 all open at 08:00am (GMT). Therefore, at this point there’s likely to be higher liquidity as traders interested in several European markets start their trading day.

Earnings season

Earnings season occurs four times a year and is the period in which publicly traded companies release detailed reports about their earnings, sales figures and other relevant information about the quarter or year. Importantly, companies also provide future projections.

As such, this can have a significant impact on the volatility of stocks, which in turn can then impact indices. If a trader wants to gain exposure to several major markets during this time, instead of trading them individually they can simply trade an index that lists all their desired markets upon it – which will likely be both cheaper and easier to do.

Start trading all the most popular indices markets today with a City Index live account, or try them out risk-free with a demo account.