- What is the DAX 40 index?

- DAX 40 companies

- How to trade the DAX 40

- DAX trading hours

- How is the DAX calculated?

- What moves the DAX''s price?

- DAX price history?

- DAX constituents by market cap

- DAX FAQ

What is the DAX 40 index?

The DAX 40, or Deutscher Aktien Index, is a stock index that tracks 40 of the largest German companies trading on the Frankfurt Stock Exchange. It is one of the most widely followed stock indices in the world, offering a glimpse into the health of the largest economy within the European Union (EU).

On the City Index platform, the DAX is referred to as the Germany 40.

In 2020, marketplace organiser Deutsche Boerse announced that the then DAX 30 would become the DAX 40 as of Q4 2021. This means a broader range of industries and a change to certain regulatory practices.

Created in 1988 with a value of 1,000, the DAX 40 index had surpassed 13,000 well before its 40th birthday. While it is only comprised of 40 stocks, those stocks make up around 75% of the Frankfurt Stock Exchange (FSE)

DAX 40 companies

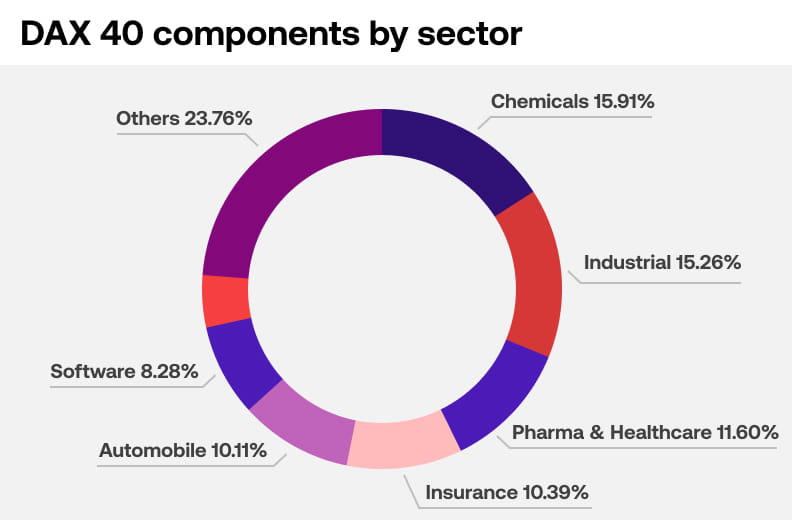

The DAX 40's companies are spread around a wide set of industries, with no single sector truly dominating the index. It’s home to many globally renowned blue chips, including:

SAP is the largest company on the index by market cap. Over its history, the index has seen remarkably little volatility in its constituents – on its 40th birthday, 15 companies had been present on the index since its inception.

Source: Siblish Research

Take a look at every company listed on the DAX in 2021.

How do companies list on the DAX 40?

To list on the DAX a company must meet its strict criteria, including:

- A minimum free float of 10%. This means that 10% of the company’s shares must be freely available to trade

- A legal or operating base in Germany

- A listing in the Prime Standard segment of the FSE. This segment has stringent transparency rules

Constituents are reviewed each quarter. Ongoing requirements for companies listed on the DAX are the submission of regular financial reports, audited earning reports, and minimum capital requirements.

How to trade the DAX 40

To trade the DAX, you'll need to use derivatives or ETFs that track the index's price - you can't trade it directly. Why? Because like any stock index, the DAX is only a calculation of the values of a group of stocks. There’s no market to buy or sell.

However, there are a number of ways to trade the DAX: including CFDs, spread betting, futures, options and ETFs.

DAX CFDs

DAX CFDs are contracts that track the price of the DAX 40. You can buy CFDs to take a long position on the index, or sell them to take a short position.

Learn more about trading indices with CFDs.

DAX spread betting

Here, you’re making a bet on where the DAX’s price is headed. Buy the DAX, and your profits will increase as it rises – but you’ll make a loss when it falls. Sell the DAX, and the opposite happens.

Start spread betting on indices.

DAX futures and options

When you trade a DAX future, you’re agreeing to buy or sell the index at a set price on a set date. With DAX options, you get the right to trade the DAX at a set price before a set date – but you don’t have to.

Learn more about options trading with City Index.

DAX stocks and ETFs

Remember that the DAX is only a number representing a group of stocks? An ETF is a fund that contains all those stocks, using them to track the price of the index itself. Alternatively, you can trade the individual DAX companies themselves.

Find out more about trading shares.

DAX trading hours

The DAX 40’s trading hours are between 09:00 – 17:40 in Central European (CET) time. However, out of hours prices are also calculated through the late DAX (17:40 – 22:00 CET time) and early DAX (08:00 to 09:00 CET time).

In the UK, that means the DAX is available to trade from 07:00 to 21:00 (UTC). With City Index, though, you can buy or sell the index from 23.00 Sunday until 21.15 Friday *with breaks.

All you need to get started is a live City Index account.

How is the DAX calculated?

The DAX is calculated using a free-float methodology, weighted by market cap. This means that it only takes readily available shares into account, disregarding any that can’t be traded. And that companies with larger market capitalisations will have a greater impact on its price.

Changes in the biggest companies on the DAX 40 – such as SAP, Volkswagen or Linde – will have a larger impact on the overall index than smaller cap firms like Fresenius, Continental or RWE.

An electronic trading system called Xetra calculates and publishes the DAX’s price each second. It is worth noting that the DAX 40 price factors in reinvested dividend payments, unlike other major indices.

Learn more about how indices work.

What moves the DAX's price?

The DAX’s price movements reflect the volatility seen by its constituents. If Germany’s biggest businesses are booming, the DAX should rise. If they struggle, the DAX should fall.

Lots of factors might affect German stocks, and there is no guarantee that any event will have the expected impact on the index itself. That said, here are a few of the key factors that are worth considering when trading the DAX 40.

Exchange rates

The DAX often shows a negative correlation to the euro. As the euro weakens against USD, the DAX 40 will often rise – if EUR/USD strengthens, it often falls.

This happens because German exports to the US, paid for in USD, are worth more in euros when EUR/USD is weak. This should buoy the profit margins of German multinationals, which make up most of the index.

Conversely, a stronger euro may dampen the DAX as international sales are worth less.

Key companies

As we’ve already covered, the DAX is capitalisation-weighted. Companies with higher market caps are more capable of moving the index than smaller constituents.

SAP, for example, was the largest company in the DAX 40 by market cap when it suffered a 20% dip in October 2020 – which was a major contributor to the wider index falling 2.6%.

Socio-political events

Events such as Brexit, the 2008 recession and the coronavirus pandemic are all capable of hitting market demand in one way or another. For instance, the pandemic in 2020 had a particularly outsized impact on key sectors such as aviation and banking, with Lufthansa and Deutsche Bank’s share prices plummeting in March 2020.

The DAX soon followed, writing off years of gains in just a few weeks.

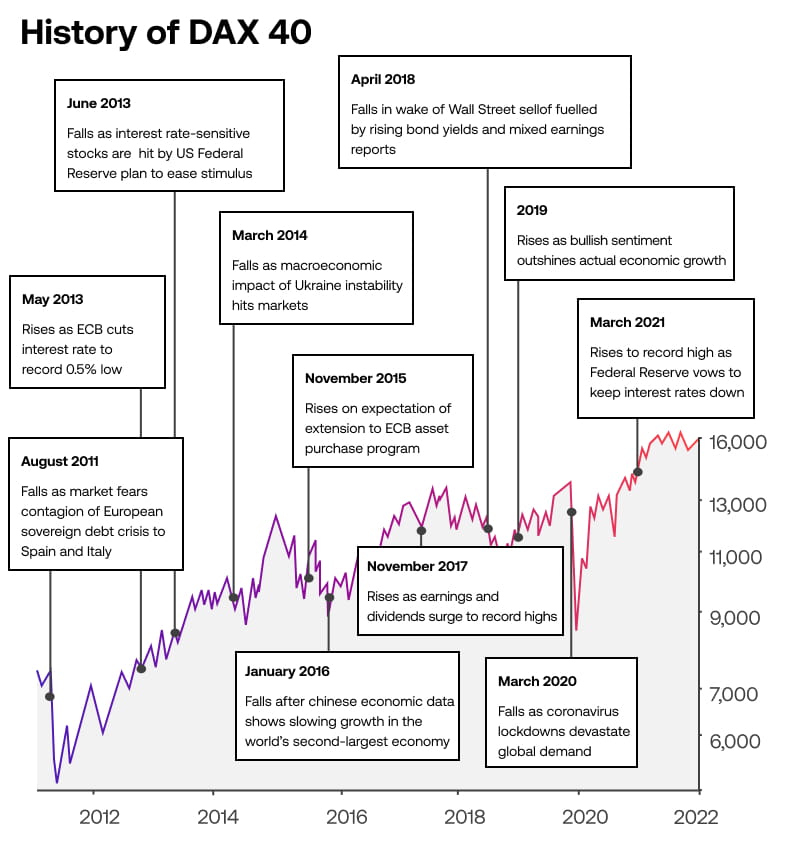

DAX price history

Take a look at the history of the DAX 40, previously known as the DAX 30, since 2011, documenting some of the fundamental drivers that impacted the index’s price movements.

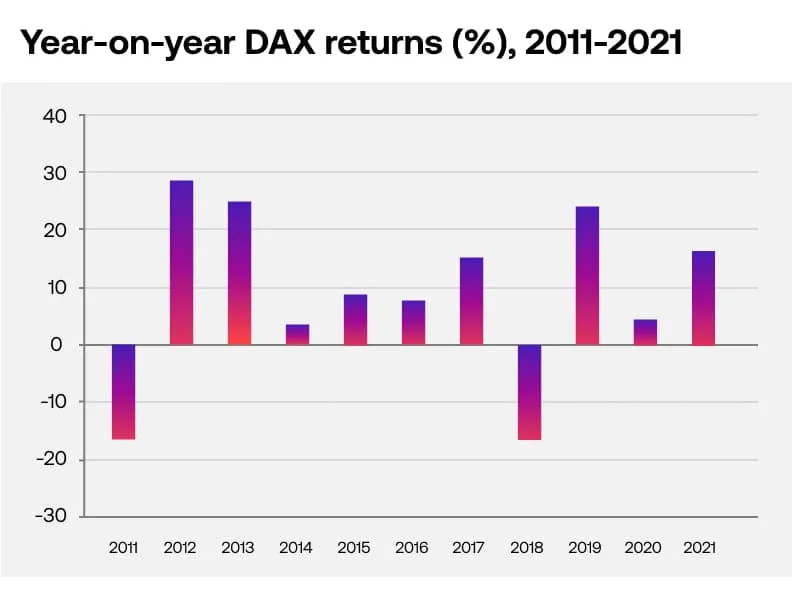

Average returns of the DAX 40

Between 2011 and 2020, the DAX produced an average annual return of 8.2%. Essentially, that means you would have earned an annual average return of 8.2% if you’d invested in the DAX from 2011.

You can see the yearly returns from 2011-2021 below. Remember, past returns are no guarantee of future performance.

DAX companies by market cap for 2024

Here is a list of the companies on the DAX 40 by market capitalisation as of May 2024.

| Rank | Ticker | Company name |

|---|---|---|

| 1 | SAP | SAP SE O.N. |

| 2 | SIE | SIEMENS AG NA O.N. |

| 3 | AIR | AIRBUS |

| 4 | DTE | DT.TELEKOM AG NA |

| 5 | ALV | ALLIANZ SE NA O.N. |

| 6 | P911 | Porsche AG Vz |

| 7 | MBG | Mercedes-Benz Group AG |

| 8 | MRK | MERCK KGAA O.N. |

| 9 | VOW3 | VOLKSWAGEN AG VZO O.N. |

| 10 | MUV2 | MUENCH.RUECKVERS.VNA O.N. |

| 11 | BMW | BAY.MOTOREN WERKE AG ST |

| 12 | SHL | SIEMENS HEALTHINEERS AG |

| 13 | IFX | INFINEON TECH.AG NA O.N. |

| 14 | DHL | DEUTSCHE POST AG |

| 15 | BAS | BASF SE NA O.N. |

| 16 | BASF SE NA O.N. | ADIDAS AG NA O.N. |

| 17 | HEN3 | HENKEL AG+CO.KGAA VZO |

| 18 | DB1 | DEUTSCHE BOERSE AG |

| 19 | EOAN | E.ON SE NA O.N. |

| 20 | BEI | BEIERSDORF AG |

| 21 | DTG | DAIMLER TRUCK HLDG JGE NA |

| 22 | DBK | DEUTSCHE BANK AG NA O.N. |

| 23 | BAYN | BAYER AG NA O.N. |

| 24 | HNR1 | HANNOVER RUECK SE |

| 25 | RWE | RWE AG |

| 26 | VNA | VONOVIA SE |

| 27 | RHM | RHEINMETALL AG |

| 28 | ENR | SIEMENS ENERGY AG |

| 29 | CBK | COMMERZBANK AG |

| 30 | HEI | HEIDELBERG MATERIALS |

| 31 | SRT3 | SARTORIUS AG |

| 32 | FRE | FRESENIUS SE+CO.KGAA O.N. |

| 33 | PAH3 | PORSCHE AUTOMOBIL HOLDING SE |

| 34 | SY1 | SYMRISE AG |

| 35 | CON | CONTINENTAL AG O.N. |

| 36 | MTX | MTU AERO ENGINES AG |

| 37 | BNR | BRENNTAG SE |

| 38 | QIA | QIAGEN NV |

| 39 | 1COV | COVESTRO AG O.N. |

| 40 | ZAL | ZALANDO SE |