Key takeaways

- Value of the AI industry could rise 20-fold by the end of this decade, making it a megatrend that has got markets excited in 2023.

- AI-induced rally sent valuations to new highs, but we have seen conditions temper since the start of August

- NVIDIA is the only major player already reaping significant financial rewards from AI

- Palantir’s ability to handle large amounts of data bodes well, but it has pricey valuation

- Investors have bought into C3.ai’s story, but it is yet to convince Wall Street

- IonQ has a bright future, but markets have got ahead of themselves

- Upstart is at a more advanced stage, but has narrower applications

- All of these stocks are included in our AI Index, which provides an opportunity to trade the trend using a basket of AI stocks

Why are markets so excited about AI?

AI has gripped the imagination of the markets and is a megatrend that isn’t going away anytime soon. Unlike many of the exciting new horizons that have emerged over recent years, from NFTs to the metaverse, companies are already finding game-changing applications using AI that are influencing the world today, and it is a market already worth hundreds of billions of dollars.

There are some exciting numbers floating about. For example, Next Move Strategy Consulting predicts the value of the industry will rise 20-fold by 2030 to around $1.8 trillion and PwC has predicted AI will expand the global economy by 14%, or almost $16 trillion, by 2030.

While forecasts vary, there is unanimous agreement that AI will unlock a new era of technology that will have an impact on virtually every aspect of life. The labour market will undoubtedly be disrupted as AI fuels automation. Healthcare and scientific discoveries will advance quicker. All the future technology that was once limited to Hollywood, from self-driving cars and robots to drone delivery systems, are underpinned by AI. The list is endless.

With that in mind, it is unsurprising that markets have got so hyped-up about AI in 2023 considering the size of the opportunity.

Top AI stocks to watch

Let’s have a look at five of the top AI stocks that are included in our AI Index, all of which are operating in different segments of the market.

NVIDIA stock: Chipmaker of choice

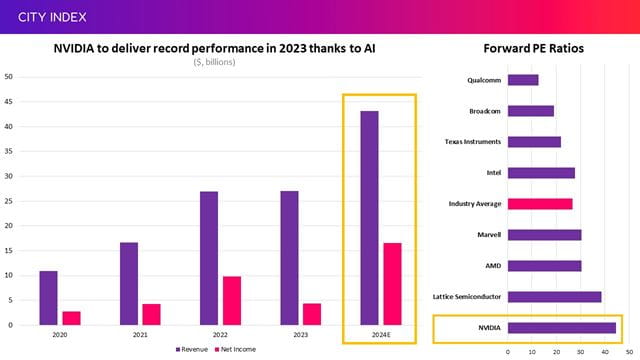

NVIDIA is the poster child of the AI world, having trebled in value after becoming the first company to signal it will reap significant financial rewards from the technology in 2023. NVIDIA is the leading provider of the advanced but pricey chips that are needed for data centres to be able to run powerful AI and machine learning applications.

It is the pick and shovel play providing the backbone of the technology and is currently the partner of choice for tech companies around the world. NVIDIA is one of the only companies making serious sums from AI right now, and this is what made it the first chipmaker to earn a $1 trillion valuation this year.

Sales of datacentre chips are forecast to double in 2023 from the record we saw last year and that should drive it to record earnings this year (with additional help from a recovery in more challenged markets like gaming). Another example showing the level of demand is that Chinese internet giants have reportedly ordered over $5 billion worth of NVIDIA’s advanced chips in fear of an escalation in rising US-China tensions after trade restrictions were imposed on the industry. NVIDIA reports second quarter earnings Wednesday August 23.

(Source: Estimates and valuations, based on forward earnings over the next 12 months, are taken from Bloomberg)

However, many years of NVIDIA’s future AI-fuelled growth have now been priced-in considering the stock has trebled in 2023, giving it a premium valuation over its rivals. Brokers remain convinced the rally has room to run and see any pullback as a buying opportunity, but the bar to meet lofty expectations will only move up the higher the share price goes from here. There are signs that rival semiconductor manufacturers like AMD are gaining ground as investors start to see better value elsewhere in the knowledge that AI is too big of a breakthrough for any one company to monopolise over the long-term. NVIDIA is likely to retain its premium but this will narrow if rivals start to catch up in 2024.

Where next for NVDA stock?

NVIDIA shares have been undergoing a correction since peaking at all-time highs in July. We have seen the stock set lower-highs since then to suggest we could be seeing a reversal, although the 7-week low hit a few days ago remained above the trough we saw in June.

A slip below $401 would mark a new lower-low, making this a key price to watch that could signal a reversal in fortunes. We can see buyers have happily returned to the market when the price has fallen to a range of $401 to $406, having rejected a selloff below here on seven consecutive occasions in the last two months alone. Notably, we could see a potential head and shoulders pattern form if it sinks back toward this level, although it is too early to tell.

The share price needs to reclaim the previous highs to climb back toward the peak of $475. That would require a move above $454 and then $467.50.

Palantir stock: Big Data

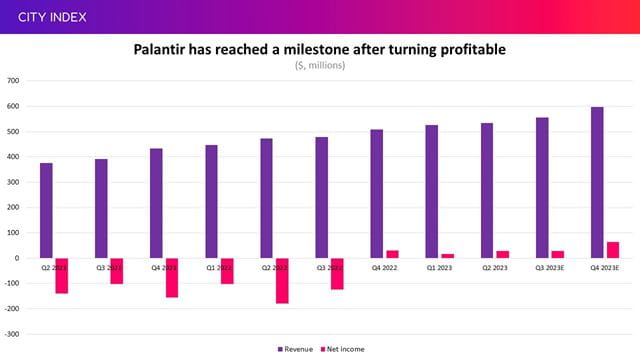

Palantir has been a well-known name among retail traders for years but interest has surged in 2023 due to its AI prospects. The company’s secretive work with government agencies of the US and its allies was what originally stirred interest, but it has since widened up to serve businesses and is now gaining attention for its ability to handle data.

Ultimately, Palantir provides software that provides key infrastructure used to process and analyse data for a wide array of sectors, including but not limited to healthcare, law enforcement, defence, insurance, automotive and compliance. These industries use Palantir’s variety of software platforms to filter through swathes of data, capable of pooling it from multiple different systems, and help them make informed decisions. Palantir is now unleashing those data-hungry systems toward AI models, hoping it can help improve them and accelerate their development.

Palantir is fast-growing and has recently turned profitable, although it boasts an expensive valuation. It is currently trading at over 63x forward earnings and we have already seen a big pullback since peaking at the start of August.

(Source: Company reports, with estimates from Bloomberg)

Where next for PLTR stock?

Palantir shares have been undergoing their sharpest correction in over a year since hitting a 19-month high at the start of August, following the unsustainable rally we saw begin in early May.

We can see that sellers have struggled to push the price below $15 without prompting buyers into action, suggesting this is currently providing support. It has slipped to as low as $14.60, but any move below here could trigger a sharper fall that could initially take it down to the June-low of $13.60.

The stock will need to regain significant ground if it wants to set new highs and get back on the right path after the 19-month high of $20 proved to be too irresistible for sellers, which appear to have been gradually accepting lower prices throughout this month. The rise in volumes during the recent correction suggests a lot of selling pressure was relieved considering we have seen the price stabilise since volumes have fallen back to more normal levels.

C3.ai stock: AI software provider

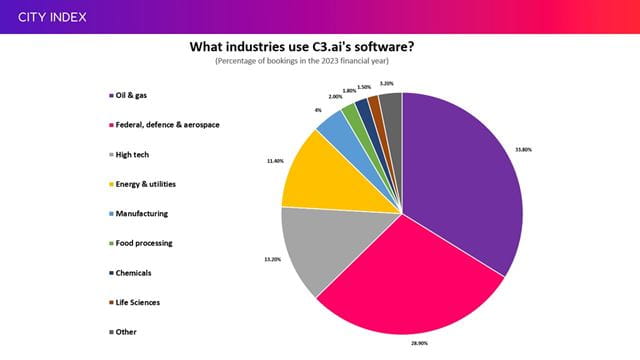

C3.ai is not a new kid on the block and is one of those companies that was touting the potential of AI long before it became a reality this year. The company floated back in 2020 and trades a just a fraction of its peak, but interest has been revived after a lengthy period in the shadows as AI starts to take off.

C3.ai provides AI software that offers over 40 different applications to businesses and organisations across a variety of industries, from manufacturing and utilities to farming and defence. For example, one calculates risk and analyses banking transactions to flag potential money laundering and ensure that banks and financial institutions are meeting regulations, while another is a customer relationship management tool that helps companies predict revenue and manage customer churn. Over half of its total business comes from the oil and gas sector or the defence and aerospace industries.

(Source: Company reports)

The company is loss-making, although it has started to generate cash. Growth remains the key element and Wall Street remains cautious despite management noting a marked acceleration in demand this year, suggesting it still needs to convince the markets.

Where next for AI stock?

We saw C3.ai shares break its rally that saw it more than quadruple in value after it hit a 20-month high back in June, having set a lower-high at the start of this month.

We are now waiting to see whether it sets a lower-low compared to the trough we in June of $31.69. Interestingly, we saw a fiercer battle between buyers and sellers yesterday and neither side could gain an upper hand as the stock closed at the same price it opened at that same level of $31.69, which is also aligned with the 100-day moving average. This suggests there is strong demand on both sides at this level, although we have seen a steady decline in trading volumes over the past two months. A close below here could trigger a sharper decline, potentially toward $28.50 or possibly toward $25 if it comes under severe pressure.

A return back above $37 is the immediate job on the upside to reclaim the floor that held throughout July. It would need to break $42.50 and then surpass the last high of $44 to show the bulls are back in charge.

IonQ stock: Quantum computing

IonQ is a relatively small player, but one that has grabbed attention this year after more than quadrupling in value. The company’s latest quantum computer, IonQ Forte, is the only system of its type that provides services through a variety of cloud services, giving it a niche that is allowing it to carve out a lead in an industry that is becoming all the more important in the era of AI. That has seen it secure investment from the likes of Amazon and Alphabet, while it counts Accenture, Hyundai, Airbus and Goldman Sachs among an impressive customer base.

IonQ has seen growth accelerate markedly in 2023, albeit from a low base, as the need for quantum computing to solve more complex problems increases. But, like many in the sector, markets have factored a lot of this in. IonQ is currently a $3 billion company that is expected to report revenue of less than $20 million in 2023, while remaining in the red and burning through cash. That means this is currently a story all about growth, which will need to consistently impress investors to keep its valuation aloft. IonQ believes its quantum computers will be able to handle machine learning in 2024 and is forecasting a rapid acceleration in power by 2028, with each phase predicted to unlock more value:

(Source: IonQ investor presentation, August 2023)

Where next for IonQ stock?

IonQ shares almost quadrupled in value between the end of March and the 20-month high hit at the start of August. It has since undergone a steep correction, setting lower-lows and lower-highs to suggest a reversal could be on the cards as markets temper their lofty expectations.

The stock is currently testing the 50-day moving average for the first time in over three months. It could continue to fall toward a range of $13.50 to $12.50, which was as low as sellers could push the price in July. Below here, we could see it slip back toward the ceiling of $11 that held throughout May and the majority of June.

The stock would need to set a higher-high and move back above to $16.50 in order to show that buyers are back in control before the 20-month peak comes back into the crosshairs.

Upstart stock: AI lending

Upstart Holdings has developed an AI platform that is used by over 100 banks and credit unions to help make decisions about whether applications for loans and auto finance should be rejected or approved, helping speed-up and improve the process while reducing risk for its bank partners. It says machine learning allows banks to approve more loans than versus the traditional model based on credit scores, helping widen access to finance. Over 80% of applicants that go through its system are approved instantly, allowing banks to issue more loans at lower rates in what Upstart describes as a win-win for all.

While banks find its technology useful, its narrow application means it is highly vulnerable to how the financial segment performs. For example, Upstart recently warned its performance was being impacted by more cautious lending standards being adopted by banks as the threat of a recession and provisions for bad credit rise.

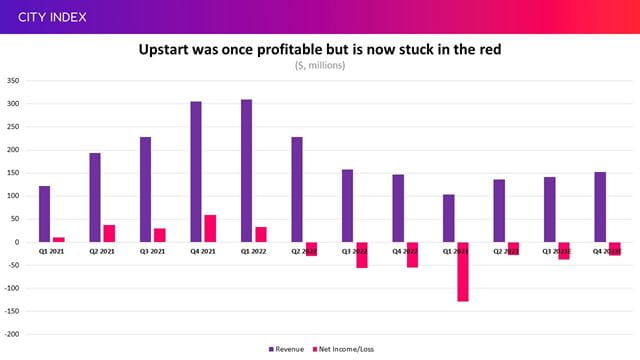

Upstart, which was founded in 2012 and launched its IPO in 2020, was initially profitable when it went public as it enjoyed more buoyant levels of borrowing, earning itself more fees. However, we have seen the number of loans going through its system fall since 2022, although they have started to rebound more recently. A rise in R&D spending has also pushed it back into the red.

(Source: Company reports, with estimates from Bloomberg)

Where next for UPST stock?

Upstart shares booked some of the biggest gains during the AI-induced rally that came to an abrupt end at the start of this month, having seen its value increase six-fold in the three months to the start of August.

We have since seen the rally unravel, and swiftly. The spike in volumes during the selloff, followed by the price finding some sort of floor over the past week as volumes declined, suggests the selling pressure has been exhausted, at least for now as buyers are showing an appetite to return at these levels.

We could see buyers re-enter between current levels and $31. Those that missed out on the buying opportunity at these levels back in June may be prompted into action. Notably, the 100-day moving average is currently providing some support at this range too. The RSI is in bearish territory but suggests the sharp pullback has brought its valuation down to more sensible levels after entering overbought territory when it hit those highs at the start of the month.

The immediate job for buyers is to push the price above $34.80, with sellers having accepted this price throughout the week. However, a much larger move would be needed to reinstall confidence.

What is the AI Index?

Our AI index is based on the BITA Artificial Intelligence Giants UST Index, which is made up of 12 publicly-listed US companies that derive revenue from AI applications such as semiconductors, data centres and machine learning.

This allows you to trade a group of companies in order to gain exposure to the wider AI theme that has ripped through markets in 2023.

If you want to find out more, head over to Trade the AI Index.

AI index : What AI stocks are included?

The index is rebalanced semi-annually and is weighted by free-float market cap. Below is a list of the top 10 constituents of the AI index, along with their weightings, as of August 2023:

|

Constituent |

Weighting |

|

Upstart Holdings |

17.4% |

|

IonQ |

15.6% |

|

Palantir |

10.2% |

|

C3.ai |

9.7% |

|

NVIDIA |

8.9% |

|

Ambarella |

8.2% |

|

Dynatrace |

7.8% |

|

Altair Engineering |

7.5% |

|

Cerence |

7.2% |

|

Sprinklr |

4.8% |

Why trade the AI index?

Trading the AI Index offers several benefits for traders looking to gain exposure to the AI trend. Trading a basket of stocks requires less research and is less risky than trading individual stocks by offering you a way to trade the trend of AI through a diversified basket of companies.

Trading individual AI stocks requires more work, but can offer better returns. For example, traders that owned NVIDIA shares have outperformed those holding the AI index this year. However, putting all your eggs in one basket is more risky.

We also offer AI-focused exchange-traded funds, including the LG Artificial Intelligence ETF and the second Global X Robotics Artificial Intelligence ETF.

How to trade AI stocks and the AI Index

If you’re ready to get started, then you can trade the AI Index or individual AI stocks in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the instrument you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.