Key takeaways

- US banks will kick off the Q2 earnings season on Friday July 14

- Mixed performance expected, with those most exposed to rising interest rates set to outperform

- Conditions for trading and investment banking remains challenging

- Major banks recently passed annual stress test, allaying concerns over financial strength following the banking crisis and allowing them to raise dividends

- Confidence in regional banks is still shaky, so this will be another test for small-to-mid sized players

- M&A activity likely to increase as regional banks streamline and slimdown

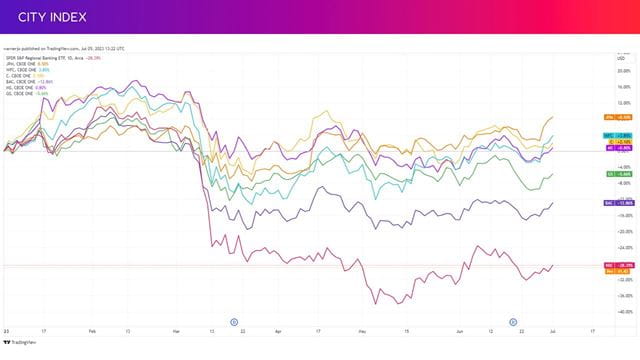

- Big bank stocks have booked gains in 2023 and avoided the selloff that has hit smaller rivals, but have still significantly underperformed the wider market

- View our technical analysis on the S&P 500, JPMorgan and Bank of America

US bank stocks: Q2 financial calendar

The second quarter earnings season for US banks will begin on Friday July 14 and follow on to the following week. Below is a table outlining the earnings dates for the biggest players:

|

Bank |

Q2 Earnings Date |

|

JPMorgan |

Friday July 14 |

|

Citigroup |

Friday July 14 |

|

Wells Fargo |

Friday July 14 (TBC) |

|

Bank of America |

Tuesday July 18 |

|

Morgan Stanley |

Tuesday July 18 |

|

Goldman Sachs |

Wednesday July 19 |

US bank stocks: Q2 earnings consensus

It is expected to be a mixed bag of earnings in the second quarter, with Wells Fargo and JPMorgan forecast to deliver the fastest growth while Citigroup, Morgan Stanley and Goldman Sachs are set to see their bottom-lines contract. Below are consensus estimates for adjusted EPS compared to what was reported the year before:

|

Adjusted EPS |

Q2 2022 |

Q2 2023E |

YoY Growth |

|

JPMorgan |

$2.76 |

$3.77 |

37% |

|

Citigroup |

$2.19 |

$1.44 |

-34% |

|

Wells Fargo |

$0.74 |

$1.20 |

62% |

|

Bank of America |

$0.73 |

$0.85 |

17% |

|

Morgan Stanley |

$1.44 |

$1.42 |

-1.2% |

|

Goldman Sachs |

$7.73 |

$5.72 |

-26% |

(Source: Consensus numbers from Bloomberg)

The difference in performance at the bottom-line will ultimately come down to two areas of exposure, one to rising interest rates and the other to separate activities such as investment banking, trading and wealth management – where conditions remain tough.

For example, Wells Fargo boasts the highest net interest margin of the group and is therefore expected to experience the biggest boost from rising rates while also avoiding any drag from other activities due to its focus on traditional banking activities. JPMorgan and Bank of America will grow slower because they have lower margins and will see their earnings dragged down from their other activities.

Morgan Stanley and Goldman Sachs differ from the other banks as they do not reap as many rewards from higher interest rates and are more focused on trading, investment banking and wealth management – all of which are struggling in the current environment thanks to subdued demand for listings, M&A and fundraisings. Morgan Stanley is set to suffer a milder decline in earnings than Goldman Sachs because its investment banking division is forecast to be more resilient and because its wealth management arm should also help soften the blow.

Citigroup remains the laggard of the group considering adjusted EPS is set to suffer a year-on-year decline for the seventh consecutive quarter! Its net interest margin is also relatively low versus the wider group, and it is also exposed to the weak trading and investment banking environment.

US bank stocks: Q2 earnings previews

Let’s have a look at what to expect from major US banks this earnings season.

US bank stocks pass 2023 stress test

US banks have just undergone their annual stress test designed to see how each of them would perform in the event of an extreme downturn. This helps the Fed set capital requirements that determine how much cash and assets each bank must hold to ensure they can weather whatever is around the corner.

This year’s test carried extra significance considering it was the first one to be conducted since the banking crisis that erupted back in March, which led to a several banks collapsing, from Silicon Valley Bank, Signature Bank and First Republic in the US to the demise of Credit Suisse in Europe.

The hypothetical downturn created by the Fed assumed that there would be a ‘severe global recession’ that would see commercial real estate prices drop by 40% and that house prices plunged 38%, with unemployment rising to a peak of 10% and economic output dropping by the same amount.

The Fed said that this scenario could lead to projected losses of $541 billion, but that all 23 banks tested remained above their minimum capital requirements. The Federal Reserve said the ‘banking system remains strong and resilient’.

As expected, some performed better than others. All six of the major banks have found some much-need support since passing, albeit by differing amounts with JPMorgan and Wells Fargo having gained the most momentum since the results were released on Friday June 30.

So, why is this important? Well, firstly, it provides insight as to how financially strong each individual bank is. That is particularly important right now considering the current environment. Rising interest rates continue to boost profitability for banks, but it is also heightening risks of a recession and stirring discussion about what sort of landing – hard, soft or somewhere in-between – that the Fed can deliver.

US bank stocks raise Q3 dividends

Secondly, the stress test is also crucial in deciding how much excess capital they have to return to shareholders, influencing dividends and share buybacks.

Most of the major banks swiftly confirmed that they will be raising their dividends from the third quarter following the stress test, providing some certainty ahead of the results. Below is a table outlining how much will be paid out compared to what is due for the second quarter:

|

Dividend |

Q2 2023 |

Q3 2023 |

|

JPMorgan |

$1.00 |

$1.05 |

|

Citigroup |

$0.51 |

$0.53 |

|

Wells Fargo |

$0.30 |

$0.35 |

|

Morgan Stanley |

$0.775 |

$0.85 |

|

Goldman Sachs |

$2.50 |

$2.75 |

The outlier of the group is Bank of America. It has not yet clarified what is happening with its dividend and the Financial Times reported it delayed a planned announcement because it performed better than it expected in the stress test. The report said it was planning to raise its payout before postponing the announcement.

Will US bank stocks accelerate buybacks?

With dividends sorted, attention will be on share buybacks. The clean bill of health from the Federal Reserve means they are free to repurchase stock. However, the industry is still bracing for tighter capital requirements to be introduced in the wake of the banking crisis and this may make banks more hesitant to part ways with large sums of cash before they know what the new rules are.

Deposits and loan growth

We have seen overall deposits in the regulated banking system consistently decline since peaking in the first quarter of 2022, hitting a two-year low in the first three months of 2023. The largest banks, generally speaking, benefited from an influx of cash in the last quarter as people shifted their money out of smaller banks that are deemed more risky and into vaults at the more secure institutions. Will this trend have stabilised or accelerated in the second quarter?

On the loan side of things, tighter capital requirements will not only force banks to hold more capital but will supress their appetite to lend by encouraging them to adopt stricter criteria. Loan growth is already slowing and this could apply the brakes further. That comes at a time when mortgage demand is being tested by the impact rising interest rates is having on the housing market, while demand for commercial properties remains weak.

US bank stocks are building provisions

US banks continue to put more money aside for potentially bad loans given the nerves over the economic outlook.

For example, the largest bank, JPMorgan, is expected to book some $2.5 billion of provisions in the second quarter. That would be more than double what it put aside the year before and represent the fourth sequential rise. That shows banks are becoming more pessimistic. Bank of America and Wells Fargo are also forecast to book more than twice the amount of provisions compared to last year, while Citigroup’s is expected to jump over 50%. These are expected to remain elevated during the second half.

Provisions will also rise at Morgan Stanley, although these are at much lower levels thanks to its focus outside of the traditional banking system. Goldman Sachs is the only one expected to reduce the size of provisions being booked this quarter.

What about US regional bank stocks?

Regional banks have been under the spotlight since the banking crisis. The ship has been steady in recent weeks but the waters are still rocky. The problems that caused the collapse of SVB and others still exist today – interest rates continue to climb and erode the value of assets, with any hopes of a pivot now pushed firmly into 2024. Plus, uninsured deposits are still, well, uninsured. Regulators have been reluctant to promise they will insure all deposits, but they have swiftly done so when a bank has failed. Other headwinds could surface if we enter a recession or the fears circling the commercial real estate sector become a reality.

The SPDR S&P Regional Banking ETF that is made up solely of small-to-mid sized banks is still down over 27% since the chaos started in early March, showing that confidence is yet to return. That is reinforced by the fact that JPMorgan, Wells Fargo and Citigroup are all trading higher today than at the start of the year.

Investors will therefore remain focused on how stable each bank is, which will keep loan growth and deposits (including the level of uninsured deposits) centre stage. Exposure to commercial real estate, which is struggling with higher interest rates, and the quality of their loan portfolios will also remain important this season.

US banks M&A activity set to rise

Many regional banks have been taking proactive action to try and shore-up their balance sheets and assure investors they are financially strong. For example, PacWest Bancorp, which has been one of the hardest hit this year, recently sold $3.5 billion worth of loans to private equity firm Ares in order to bolster liquidity and that has proven supportive for the stock, following on from its divestment of a portfolio of construction loans to real estate investor Kennedy Wilson.

Expect more deals of all shapes and sizes as regional banks look to streamline and refocus their businesses and the consolidation theme builds. The largest banks are getting bigger while smaller ones are slimming down. US Treasury secretary Janet Yellen has suggested she is willing to allow the largest to grow inorganically if it helps the wider sector. ‘We certainly don’t want overconcentration and we’re pro-competition, but that doesn’t mean no,’ she said regarding mergers.

Still, the opportunity is not limited to the biggest banks. First Citizens Bank, a much smaller player with a $20 billion valuation, was the one to take on assets from SVB after it collapsed. That shows that some small-to-mid size players see a chance to capitalise from the shaky environment. Huntingdon Bancshares CEO said earlier this year that it this will be an ‘opportunistic period of time for us’ to buy deposits, loans and other assets from rivals.

Plus, Ares and other non-bank firms like KKR are being offered more loan portfolios – from car and consumer loans to commercial real estate and specialty finance, according to a Financial Times report late last month. With more banks looking to divest, that is prompting them to offer bigger discounts to improve the appeal versus what is on offer by their competitors.

JPM stock: Where next for JPMorgan shares?

JPMorgan has been the best performer among the major banks in 2023, with its size and scale coming into its element during the crisis as it led rescue efforts and drew attention as markets looked for stability during uncertain times.

The bank managed to break above the 61.8% retracement at $145.80 from the lows we saw last October for the first time on Monday before slipping back below it today. A sustained move above here would allow it to hit new 16-month highs and bring the 78.6% retracement at over $157 into view, which is aligned with the next set of peaks set back in February 2022.

We can see that the bank has been following a supportive trendline since bottoming-out late last year, suggesting it will step in again if JPMorgan stock suffers and reversal. Right now, that could take it down to the 50-day moving average at $139.

BAC stock: Where next for Bank of America shares?

At the other end of the spectrum is Bank of America, which has been the worst performer of the group of big six banks in 2023. That poses the question of whether this earnings season will lead to it regaining lost ground or fuelling more losses.

The bank has struggled to find higher ground since bottoming-out last March. The stock struggled to hit $30 in June, which is the immediate upside target. A sustained move above here could allow it to climb toward the 23.6% retracement level, which is aligned with the 200-day moving average, to signal it is finally in recovery mode.

The 50-day moving average has shown little signs of providing support, so if it comes under renewed pressure we could see it slide to the last low of around $27.50, with $28.50 there to provide a safety net before the 50% retracement at $137.50 is back in play.

S&P 500 forecast: Where next for the index?

The S&P 500 is weighted around 11% to financial stocks and their importance to the broader economy means their updates can impact the wider market.

The index booked its strongest monthly gain in June in 32 months and hit a 15-month high at the end of the month, providing some positive momentum now that we are in the second half. The start of July has provided little clues due to the disruption caused by the July 4 holiday, which has resulted in subdued trading volumes thus far. Keep an eye on how activity fares for the rest of this week and next to confirm its back to business as usual or whether there has been a change in appetite. If anything, we should start to see volumes increase as earnings season approaches.

The series of highs set over the past eight months have been limited by a rising trendline. If earnings season can drive the S&P 500 higher then we could see it move closer toward the 78.6% retracement from the lows we saw last October and return above the 4,500 threshold.

However, the RSI remains on the cusp of overbought territory to suggest the index has rallied too high, too quickly following last month’s rally.

The index should find support around the 4,300 level if it comes under renewed pressure considering this is aligned with the bottom we saw last month, the peak saw last August and the 61.8% retracement. Any slip below here risks a fall below 4,200 or possibly even 4,100 considering the monthly chart shows this was a tough ceiling to break during the four months to February.

How to trade US bank ETFs

You can trade individual bank stocks this earnings season, or you could opt to trade the sector as a whole given the uncertain environment.

For example, you could opt for the SPDR S&P Bank Index (KBE) if you want to trade the industry as a whole. This is comprised of around 66% regional banks with the rest made up of the larger banks and other financial firms.

If you want direct exposure to the more volatile regional banking sector, then go for the SPDR S&P Regional Banking ETF (KRE) that tracks the performance of a basket made up solely of small and mid-sized banks.

How to trade bank stocks

You can trade bank stocks, banking ETFs and indices with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock, ETF or index you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.

Take advantage of extended hours trading

The major US banks will release earnings before US markets open and most traders must wait until they open before being able to trade. But you can get ahead of the game by taking a position in premarket hours by taking advantage of our service that allows you to trade JPMorgan, Bank of America and Wells Fargo using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.