Top UK Stocks | PZ Cussons Shares | Entain Shares | Flutter Shares | Saga Shares | Halma Shares

PZ Cussons sees profits grow but warns of tougher comparatives

PZ Cussons delivered higher revenue and profits in its recently-ended financial year thanks to broad-based growth across its portfolio of hygiene, health and baby brands, but warned it is starting to come up against tougher comparatives.

PZ Cussons shares were down 7.9% in early trade this morning as concerns over the outlook overshadowed its annual results, pushing the stock down to its lowest level in over one year.

Revenue rose 2.7% in the year to the end of May to £603.3 million from £587.2 million the year before, with organic growth of 7.1%. The company said it experienced growth across all regions and its core brands in hygiene, baby and beauty and said its ‘Must Win’ brands grew 11%, with seven out of eight of them reporting growth.

PZ Cussons also booked better margins thanks to more favourable price and mix improvements made in its core categories, helping counter increased marketing spend on its ‘Must Win’ brands.

Adjusted pretax profit jumped 11% to £68.6 million from £61.8 million, coming in above the £63 to £64 million expected by markets. Reported pretax profit from continuing operations rocketed to £63.2 million from just £18.3 million last year.

Notably, PZ Cussons sank to a loss after tax at the bottom-line of £16.6 million when discontinued operations were taken into account, such as the sale of Nutricima and Luksja.

‘The revenue momentum was broad-based, with all but one of our Must Win Brands and all of our regions in growth. We were able to demonstrate improved levels of profitability and significantly step up investments in marketing activity and commercial capabilities as we set out to be a business that builds stronger brands and serves more consumers. This was set against a backdrop of the Covid-19 pandemic, which saw unprecedented levels of demand for hygiene products,’ said chief executive Jonathan Myers.

PZ Cussons said it is paying a dividend of 6.09 pence per share for the year, up 5% from the 5.8p payout made last year.

The company also released an update for the first quarter, revealing it is starting to feel the impact as it comes up against tougher comparatives from last year when demand exploded for its health and hygiene products. Revenue in the quarter was down 9% year-on-year as a result at £131.4 million – although this was still 13% above pre-pandemic levels.

Still, the company said it returned to overall growth in August and expects this to remain the case in the second quarter. PZ Cussons said its profit targets for this year remain unchanged despite the pressure coming from rising input costs and supply chain pressures.

‘We continue to navigate the well-publicised inflationary pressures on commodities and freight. We have a co-ordinated effort underway to reduce product, manufacturing and logistics costs that the consumer does not value while also accelerating our revenue growth management plans to drive price/mix. Combined with sustained and more effective marketing investment, stronger brand plans and new product innovation, these interventions mean that, assuming no further disruptions, we expect to return to growth for Q2 and to deliver low to mid single-digit revenue growth for the year, in line with our strategic financial framework we outlined at the Capital Markets Day in March,’ said PZ Cussons.

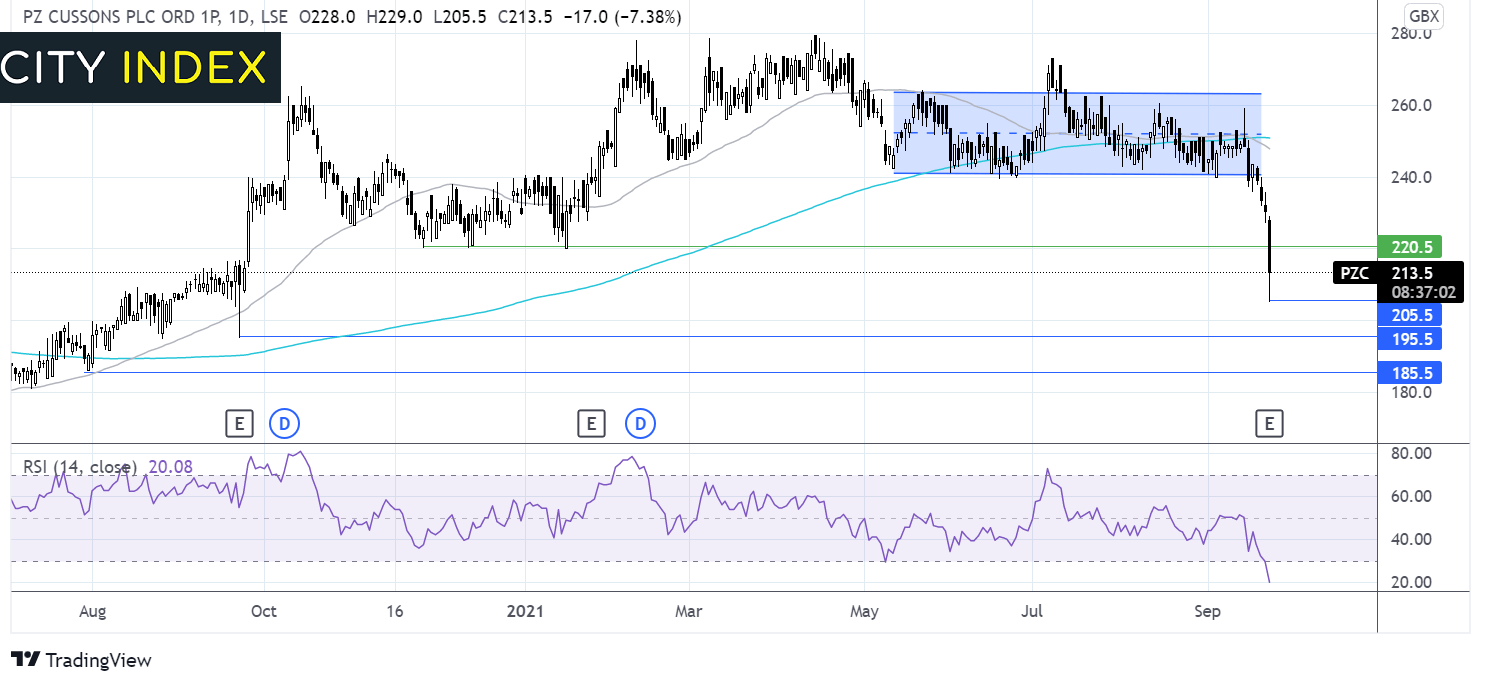

Where next for the PZ Cussons share price?

PZ Cussons share price traded within a holding pattern across the past 5 months, capped on the upside by 260p and on the lower side by 240p.

The price is extending its break out of the pattern which started earlier this week, hitting a yearly low of 205p.

The RSI has moved well into oversold territory suggesting that we could see a period of consolidation or a move higher.

Immediate support beyond today’s low of 205p is at 196p the September low a break below here could open the door to 185p the August low.

On the upside, 220p horizontal support could provide some resistance as the price targets 240p the lower band of the holding pattern.

Entain considers takeover offer from DraftKings

Entain said it will ‘carefully consider’ the latest takeover offer from US outfit DraftKings but urged investors to take no action in the meantime.

A statement was released yesterday afternoon by Entain confirming it had been approached with an offer from DraftKings that would involve both cash and shares – but did not reveal any further details.

This morning, Entain confirmed DraftKings made an earlier approach that was worth 2,500p per share in cash and shares, valuing Entain at £14.6 billion, and said this was rejected.

The latest offer on the table is worth 2,800p per share comprised of 630p in cash and the balance to be paid in DraftKings shares. That values Entain at £16.4 billion. Importantly, it said the exchange ratio to be used for the stock-element of the deal was to be ‘fixed immediately prior to the first agreed public announcement’ – which should prevent any share price movements scuppering the deal.

Entain said it is considering the latest offer as it represents a 46.2% premium to its closing share price on Monday of 1922.3p.

Entain shares, which rocketed 18% yesterday when the initial news broke, were trading 7.2% higher this morning at 2432p – still some way below the offer price.

‘The board of Entain strongly believes in the future prospects of the company underpinned by its leading market positions, world class management team and industry-leading technology. The company has a strong track record of growth and runway for further significant growth as set out in the capital markets day on 12 August, with the potential for its total addressable market to grow by more than three times to $160 billion,’ said Entain.

‘The board of Entain will carefully consider the proposal and a further announcement will be made as and when appropriate. Shareholders are urged to take no action at this time,’ the company added.

Entain owns a sprawling empire of gambling brands. It is best known for owning bookmakers Ladbrokes and Coral and its online brands including bwin. It also owns a number of gaming brands like Gala Bingo, Foxy Bingo and Cheeky Bingo. It also followed other UK gambling outfits into the high-growth US market, where it has a 50:50 joint venture with BetMGM.

Flutter Entertainment settles long-running dispute in Kentucky

Meanwhile, fellow gambling stock Flutter Entertainment said it has reached a settlement with the Commonwealth of Kentucky.

The company said it has agreed to pay $200 million to the Commonwealth of Kentucky in addition to the $100 million already forfeited during the case in order to get it to cease all further legal action against the business.

‘The group strongly believes that this agreement is in the best interests of Flutter shareholders. The group now considers the matter closed,’ said Flutter this morning.

Flutter has been locked in legal battles with the Commonwealth of Kentucky after it initiated proceedings against subsidiaries of The Stars Group way back in 2010. Flutter inherited the problems after buying The Stars Group back in 2020.

The case centres around Kentucky trying to reclaim alleged losses incurred by PokerStars players in the state over the five years to 2011.

The sum to be paid to settle the case should be welcomed by investors considering the potential sum sought by the Commonwealth of Kentucky were much higher at one point. For example, one Supreme Court ruling last year supported an original $870 million judgement against The Stars Group alongside high interest rates.

Flutter shares were up 6.2% this morning at 16170p, marking its highest level since March.

Saga aims to return to full service after restarting cruises and tours

Saga said it is working hard to return to full service after restarting its cruises and tours and is encouraged by the level of demand it is seeing as it published interim results.

Revenue in the six months to the end of July declined to £156.4 million from £192.4 million the year before. That came as the pandemic continued to weigh on the business, particularly its travel segment, which only restarted its cruises and tours in late June.

Saga turned to an underlying pretax loss of £2.8 million from a £15.9 million profit the year before. However, it swung to a small reported pretax profit at the bottom-line of £700,000 from the £55.5 million loss booked last year.

Its insurance business reported a 0.5% rise in the number of home and motor policies sold and retention rates also increased after it introduced a new three-year fixed product. Margins per policy also improved to £76 from £74. Underwriting has seen a temporary benefit from the reduction in motor claims during lower levels of travel and the unit reported an 11% rise in underlying profits, partly boosted by the release of reserves.

‘In Insurance, customer retention remains strong, and the attraction of our offer is borne out by the increased uptake of our new three-year fixed-price product. From a financial perspective, we further strengthened our position through a series of financing transactions, including the recent completion of our bond issue,’ said chief executive Euan Sutherland.

Cruises restarted in late June but international sailing only got underway in August. It said the current bookings means its cruises have a load factor of 70% for this year due to government restrictions. It said bookings for next year were ahead of pre-pandemic levels and that prices were higher than expected. Meanwhile, bookings for its tours for this year amount to just £18 million but bookings for 2022/23 have risen above pre-pandemic levels to £109 million.

‘We have successfully recommenced our travel operations, including the launch of our newest ship, Spirit of Adventure. I am delighted with the positive feedback received so far and encouraged by the strong pipeline of future bookings,’ Sutherland said.

‘Following the successful restart of operations in our travel business, we continue to work towards a full return to service, while remaining mindful of future potential volatility relating to Covid-19. As we have demonstrated through the last 18 months, we will continue to take an agile, proactive approach to navigate any challenges,’ he added.

The restart of its cruises allowed Saga to deliver operating cashflow of £41.9 million in the first half and said the cash burn rate of its travel business has now fallen to just £5.9 million, below the initial guidance of £7 to £9 million.

Saga shares were down 4.6% this morning at 337p.

Halma raises guidance as sales and orders grow better than expected

Halma said profits will be slightly better than expected this year after sales and orders flooded-in during the first half, but said it expects things to normalise again in the second.

Halma shares were up 1.2% this morning at 3094p, hovering near its all-time highs.

The company, which runs a number of health, safety and medical businesses, said revenue in the first half of its financial year came in higher than expected and above historic levels, while the growth in order intake has outpaced the rise in sales. That puts Halma on course to report a strong set of interim results considering its performance will be flattered by weak comparatives from the year before, when the pandemic was having the largest impact on the business.

‘This performance reflects the benefits of the long-term growth drivers in our markets, the breadth of our portfolio, and the agility of our business model which has enabled our companies to respond rapidly to changing market conditions,’ said Halma.

This will lead to ‘strong organic constant currency revenue and profit growth’ in the first half. It highlighted that profits will have the additional benefit of a slower-than-forecast rise in variable costs as restrictions ease.

‘We expect more typical rates of revenue growth and return on sales in the second half of the year, with the latter more in line with historic levels as variable overhead costs gradually return. Although we expect to see continued impact on revenue, costs and working capital from increased supply chain, logistics and labour market disruption, we currently expect adjusted profit before tax for the full year to be slightly ahead of our previous guidance,’ said Halma.

Halma is currently aiming to deliver ‘low double-digit percentage’ organic constant currency profit growth over the full year.

Halma said work from the safety, environmental and analysis sector had seen the biggest improvement in the first half as customer activity rebounds as restrictions ease. Medical has also improved as elective surgeries resume after being hit whilst hospitals dealt with the pandemic.

The company also said it has spent £108 million on acquisitions in the period and sold of Texecom for £65 million.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade