We’re approaching what is traditionally strong period for mining stocks, according to analysis from Citi Research. With Chinese policymakers becoming increasingly proactive when it comes to stabilising economic activity, and with prevailing sentiment towards the world’s largest consumer of commodities still fragile, it suggests there may be decent upside for mining stocks in the months ahead.

“Mining equities tend to perform well starting the month of October towards year-end, based on 25-plus years of seasonality analysis,” Citi wrote on Monday. “While the mining equities have corrected in the recent weeks, they have remained resilient relative to the prevailing bearish sentiment around macro backdrop relating to China.”

Citi says without ruling out incremental jitteriness, “we think we are possibly around the end of this rough patch with favourable seasonality effect could alleviate some of the concerns. We therefore believe that the ongoing jitteriness over China demand would likely present positioning opportunities to the investors into the year-end and full year earnings”.

Seasonal strength, stimulus measures may support commodity prices

Even without potential risk of Chinese policymakers rolling out far larger economic stimulus measures this year, Citi’s analysis shows that over the past quarter-century, the MSCI World Mining Index has gained six percentage points on average in the final three months of the year.

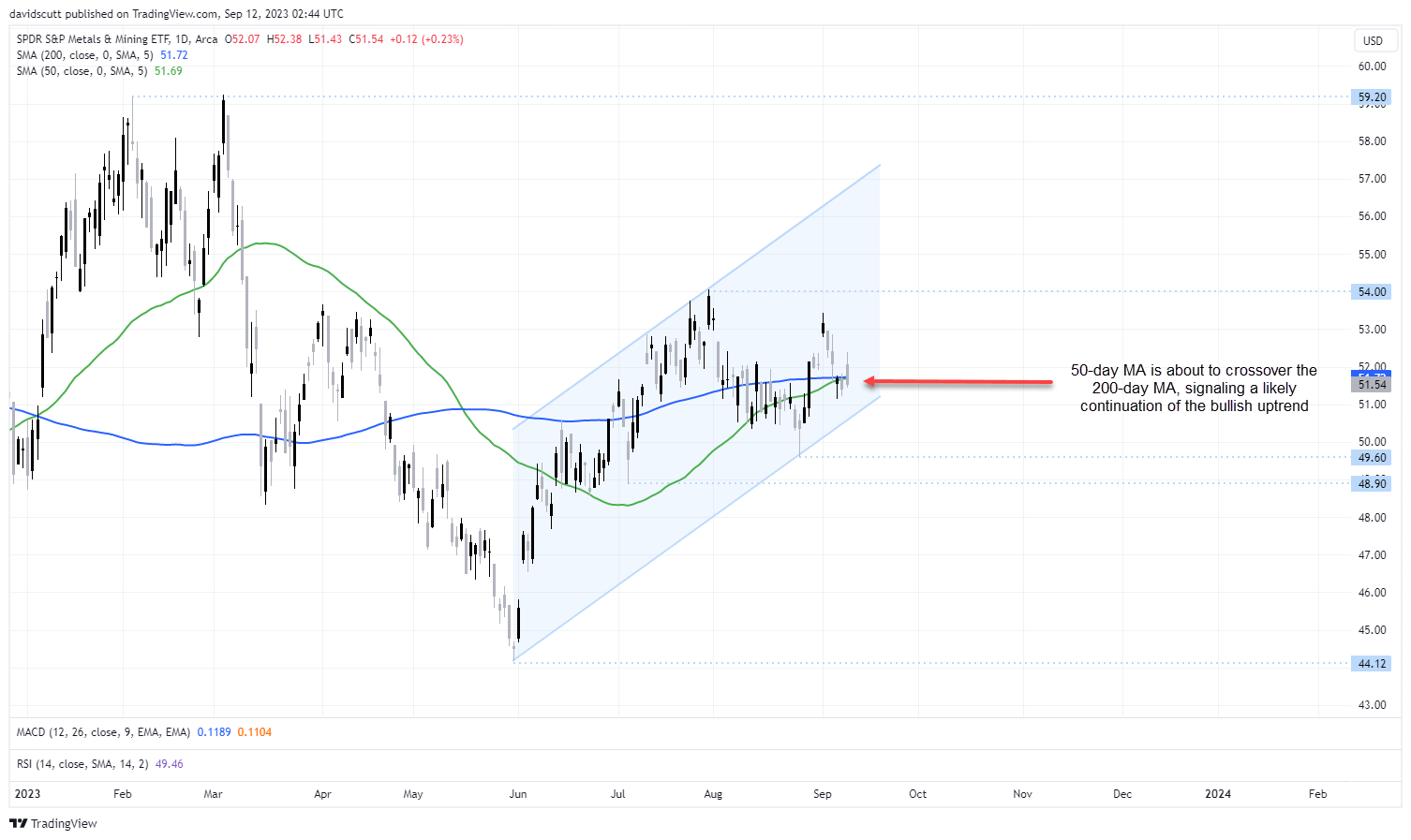

If the double whammy of seasonality and stimulus whets your appetite for a long trade, you could look at the SPDR S&P Metals & Mining ETF, a product that aims to provide returns, before fees and expenses, that correspond with the total return performance of the S&P Metals and Mining Select Industry Index.

Bullish signal triggered for SPDR S&P Metals & Mining ETF

The daily shows its already siting in an uptrend that began in late May. Of note, the 50-day moving average is about to cross over its 200-day equivalent, generating a golden cross that points to a potential continuation of the bullish trend. Should we see further gains, the high struck earlier this month around $53.40 would be the first upside target and then again at $54. A break of the latter would put the double-top of $59.20 into play.

Should the trade go awry, a stop below the prevailing trend channel support, or the August low of $49.60, would help to limit capital losses.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade