Market Brief: Rest and Recovery Friday for Indices, Led by DE, NVDA, and GE

- After a crazy week for global markets, volatility was limited in Friday’s trade, especially once European markets closed for the day.

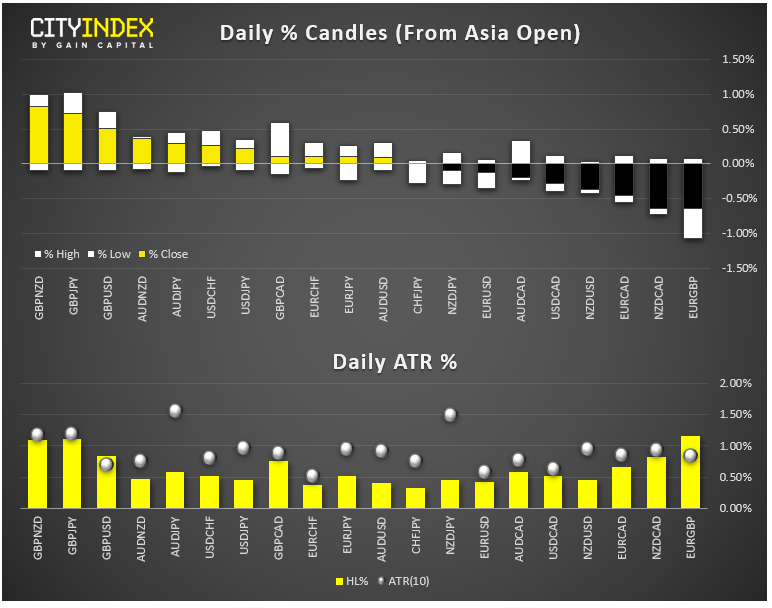

- FX: The pound’s recovery rally extended again today, taking GBP/USD to a 1-week high in the mid-1.2100s. The kiwi was the weakest major currency in otherwise quiet trade (see our take on the Australian dollar vs. the New Zealand dollar for more).

- US data: U of M consumer sentiment fell sharply to 92.1, well below expectations of 97.0. Housing starts missed expectations, though building permits were strong.

- Commodities: Gold ticked lower in quiet trade, oil gained nearly 1%.

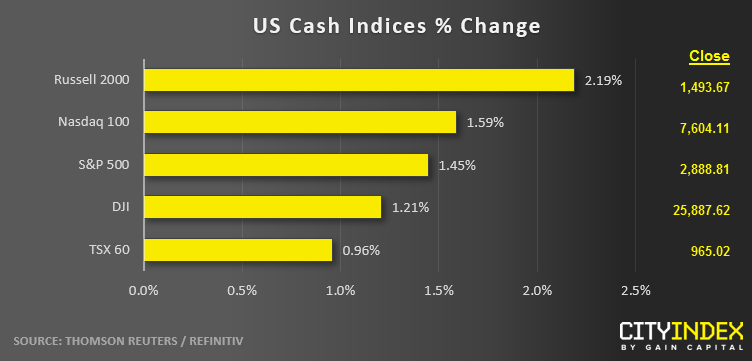

- US indices tacked on 1%-2%, with all the gains captured in the first two hours, followed by sideways price action for the rest of the day.

- Industrials (XLI) were the strongest sector, while defensive-oriented Utilities (XLU) were the weakest.

- Stocks on the Move:

- Deere & Co. (DE) rallied 4% after a beat on revenues. Though earnings missed estimates, the strong sales data suggested that farmers haven’t been hit as hard by US-China trade tensions as expected.

- Nvidia Corp. (NVDA) gained 7% after beating analyst estimates on both earnings and revenues.

- General Electric (GE) recovered nearly 10%% after its CEO called allegations of accounting fraud “market manipulation” and bought nearly $2M of stock.

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM