- Crude oil outlook: Middle East tensions still remain high

- IMF raises global GDP forecasts as US economy again displays resilience

- Key Chinese data eyed for week ahead

At the time of writing on Friday afternoon, crude oil had extended its weekly losses to 7%, more than wiping out previous week's sharp gains. Oil took a tumble this week amid news of a potential ceasefire between Israel and Hamas while concerns over Chinese demand weighed on prices, too. The drop means crude oil has more than wiped out the previous week’s entire sharp gains.

Crude oil outlook: Middle East tensions remain high despite potential ceasefire

Crude oil prices remain quite sensitive to the developments in the Middle East, and it appears as though nothing else matters too much. On Thursday, WTI prices gave up gains as much as 1.45% to drop 2.5% on the session, before falling as much as 2.5% on Friday. The big reversal was in response to news of a ceasefire between Israel and Hamas. Whether or not this will turn into a long-lasting peace remains to be seen. With the US an UK military being involved in the conflict with Houthi rebels in Yemen, with the group being apparently backed by Iran, there is a lot going on in the region. The situation remains tense and this could keep oil prices volatile.

However, questions remain as to how much the risk premium should be attached to the Middle East situation, because so far oil supplies have not yet been directly impacted much by crisis, apart from re-routing of the ships around the African continent, which, if anything should be adding to the cost.

So, news of a potential ceasefire may have caused oil to drop, but there is so much impact this will have on oil prices moving forward, given that actual supply is not disrupted.

Instead, it will be the demand situation which should move oil prices more meaningfully. Right now, there are conflicting signals from around the world.

China worries weigh on all commodities, local stocks

China's ailing property sector sparked demand worries earlier this week, and with stock markets continuing to struggle since, there is no wonder why we haven’t seen much demand for key commodities like crude, copper and iron ore. China’s real estate crisis has deepened in recent weeks. A Hong Kong court has ordered the liquidation of property giant China Evergrande Group. The upcoming data from China should be followed closely by oil traders.

China data in the week ahead will include Caixin services PMI on Monday and CPI inflation on Thursday. Even the promise of further stimulus from China failed to revive sentiment towards Chinese equities or iron ore last week. Will the CPI data change that? Last month saw the annual rate of CPI improve to -0.3% from -0.5%. It nevertheless marked the third month of deflation. This week we will also have the Caixin Services PMI from China to provide additional clues about the health of the world’s second largest economy. Oil could bounce back if we see some surprise strength in Chinese data.

Crude oil outlook: Improved demand outlook in the US

Friday’s rather strong nonfarm jobs data was another sign that the U.S. is holding its own well, which is helping to support the view that demand for oil is going to be stronger from the world’s largest economy.

Those expectations were underscored after the IMF lifted its forecasts on world growth outlook, thanks to a resilient US economy. The IMF reckons the global economy will be expanding 3.1% this year, up from 2.9% seen in October, and 3.2% in 2025. What’s more, concerns over the Eurozone’s economy have also diminished somewhat after it avoided a technical recession. So, the demand outlook for oil from the West has improved, and this is something that might help to keep prices supported. However, there is so much heavy lifting the US could do. China’s economy needs to start improving and soon, to keep oil’s downside risks limited.

Looking ahead, we will have the latest inventories report from the US with the American Petroleum Institute (API) set to release its numbers on Tuesday ahead of the official Energy Information Administration (EIA) on Wednesday. The big 9.2 million drawdown that was reported by the EIA a couple of weeks ago was at least partially responsible behind the big gains we saw in WTI that week, although the latest inventories report showed a bigger than expected 1.2-million-barrel build. Let’s see what this week will bring from the US.

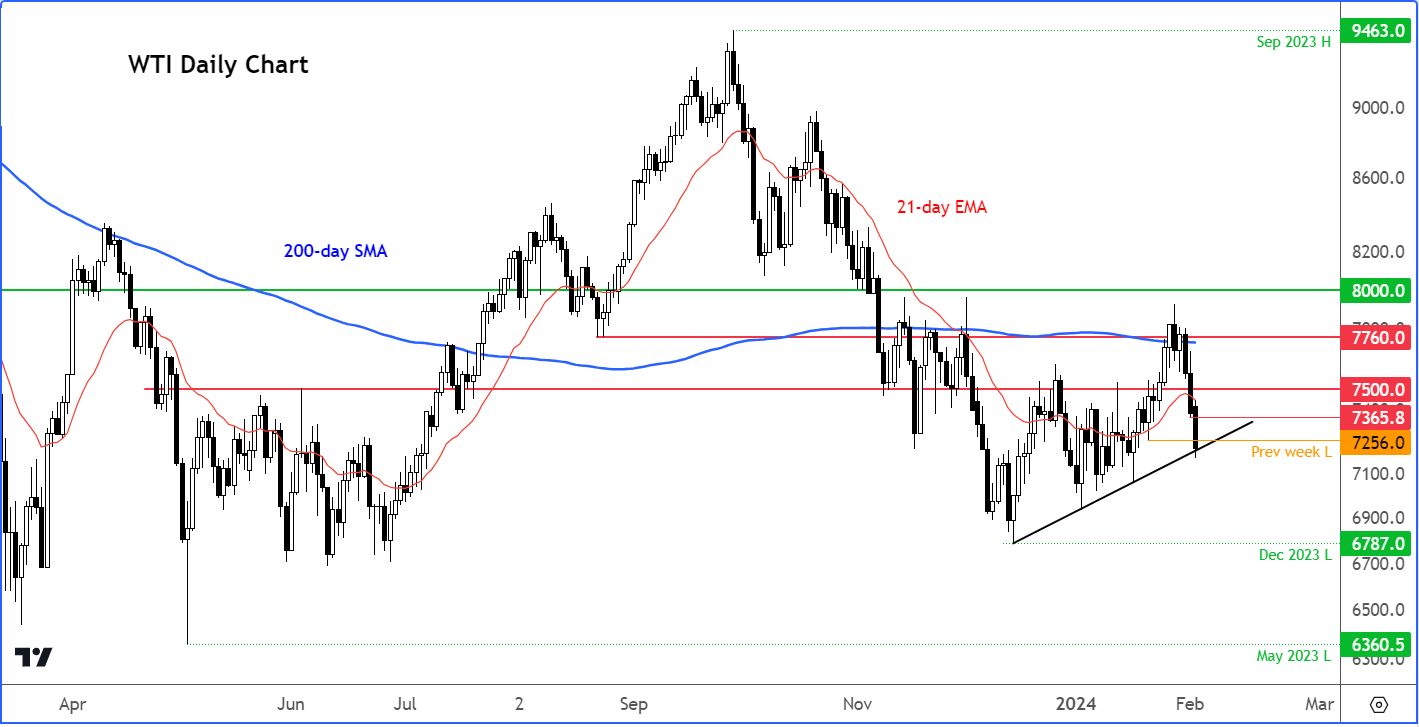

WTI Crude oil technical analysis

Source: TradingView.com

The previous week's breakout had everyone in the bullish camp excited about long opportunities in oil that never materialised. Instead, prices broke support after support to move back below that week’s range. This failure means the technical path of least resistance now again to the downside, with the December low at $67.87 a major target for the bears. Will it get there? It could if Chinese concerns intensify and there is no fresh escalation in the Middle East situation. The bulls will now need to show a clear sign of forceful buying before we can talk about a potential bottom again.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade