- Crude oil outlook: What factors will oil investors be focusing on this week?

- Oil prices have been choppy in recent weeks, but risks skewed to upside

- Crude oil outlook: WTI technical analysis point higher

After rising for two consecutive days at the back end of last week, crude oil made a negative start to the new week. In early European trade, oil prices were down as much as 0.9%. But by afternoon trading, prices had turned positive on the session, and judging by what I consider as constructive price action in the last few weeks, a bullish breakout looks more probable than a sell-off from here.

Crude oil outlook: What factors will oil investors be focusing on this week?

The US markets are shut on Monday for Presidents' Day, and the upcoming week lacks significant macroeconomic events to closely monitor. However, attention will turn to China's return from a week-long holiday, which should inject some liquidity into the global markets, and Nvidia's earnings in mid-week could impact risk sentiment.

Another key focus area for oil traders will be Thursday's release of global manufacturing and services PMIs, particularly those from Germany and the Eurozone, where economic growth has lagged behind the US. The PMI data will provide us indications about the health of the major developed economies, many of which are net importers of oil. If the PMI data shows surprising strength, then oil prices may find support on signs of potential strength in demand. Conversely, weaker PMI data may set off recession alarm bells, and thus weigh on oil prices.

Meanwhile, the weekly crude oil inventories report from the US will come in a day later than usual, on Thursday instead of Wednesday, due to the bank holiday on Monday. More on this later.

Oil prices have been choppy in recent weeks, but risks skewed to upside

Oil has been quite choppy in recent weeks, partly because of the dollar strength. The impact of the dollar has been offsetting supportive measures such as the Middle East situation, OPEC’s ongoing intervention and hopes economic conditions in China will improve in the coming quarters.

Another reason behind oil’s struggles has been the not-so-bullish US oil inventories reports lately. Last week, the Energy Information Administration (EIA) reported a much bigger rise in inventories than expected at 12.0 million barrels, adding to the above-forecast addition of 5.5m barrels in the preceding week. The build was largely driven by lower refinery utilisation rates, which meant that gasoline stocks declined by 3.66m barrels over the week, down for second consecutive week, pushing gasoline inventories below their 5-year average. If commercial crude inventories continue to build then that may be an indication of lower demand or higher supply, both negative indications for oil prices. But the lower refinery run rate could also be because of the seasonal maintenance. Let’s see what this week’s report will bring.

All told, however, I still think the risks are skewed to the upside for oil, as there are not many other negative influences, apart from those mentioned, to negatively impact crude prices. Still, a technical “buy” signal is now needed as the recovery has lost momentum.

Crude oil outlook: WTI technical analysis

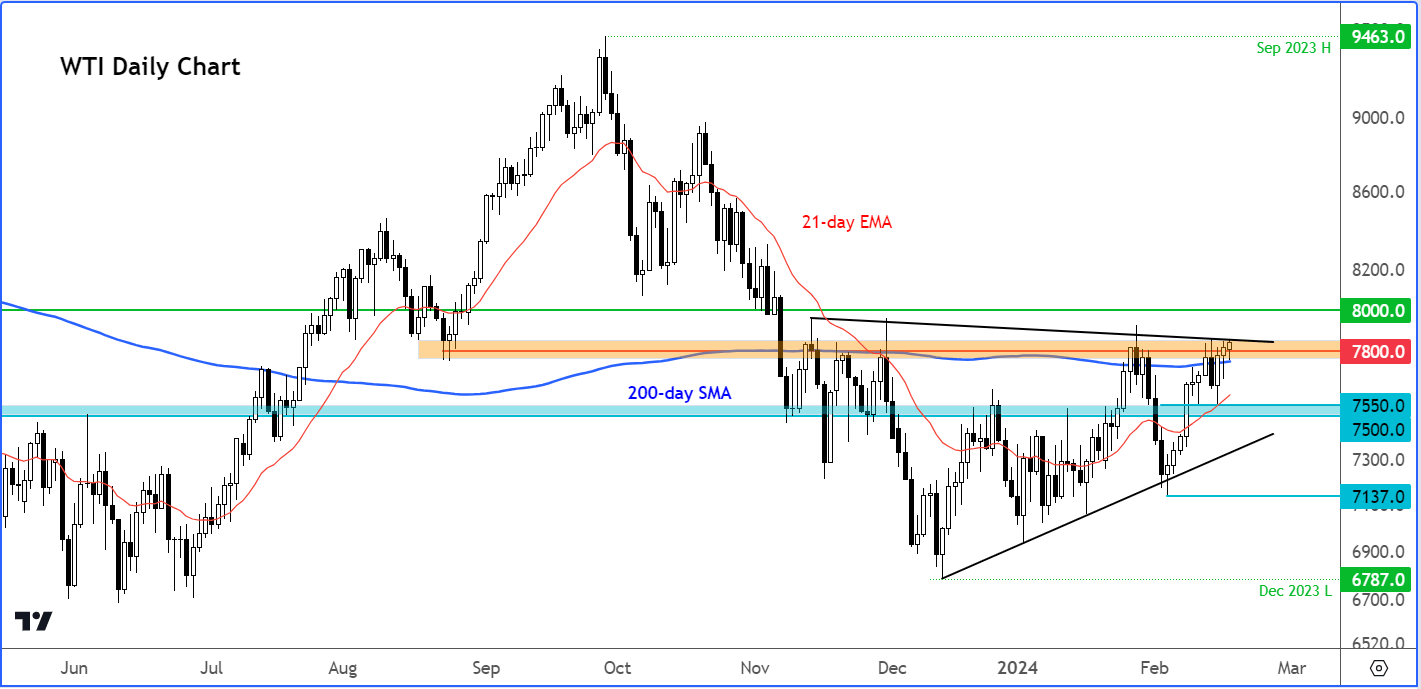

WTI has been consolidating in recent weeks, with a slight bullish tilt thanks to a higher close in January. Since breaking below the 200-day average in November, WTI has now had several attempts to reclaim the average but has struggled to stay more than a couple of days above it. On Friday, however, it closed above it to end the week on a positive note and provide a bullish signal for the week ahead. So, a bullish breakout looks the more likely scenario here.

If prices dip again, WTI will need to hold above the 200-day average round $77.50-60 area to maintain its short-term bullish bias. If so, then this could lead to a continuation towards $80.00 and potentially higher levels thereafter. Even if WTI goes on to dip a little below the 200-day, this won’t necessarily be a game-changer, for as long as the next support levels around $75.50 area followed by $75.00, hold.

But any move lower than $75ish, would be bearish, in my opinion. If this scenario plays out, then a revisit of $70 or even lower would not be ruled out.

All told, my base case is for the bullish scenario to play out in light of the recent bullish price action and mostly supportive macro factors.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade