- Crude oil analysis: Crude set to end March and the first quarter higher

- Oil prices buoyed by easing demand concerns and sustained supply cuts by the OPEC+

- Investors eye official US crude inventories report today, with US dollar also in focus

- WTI technical analysis points higher, for as long as $79-$80 support area holds

Crude oil analysis video and insights into precious metals

Crude oil prices were initially lower by nearly 1% in early European trade, before bouncing back to turn flattish on the day ahead of the publication of the official US crude inventories report later in the day. Oil prices look set to end the month of March and first quarter of the year higher, as concerns over demand eases while the OEPC+ continues to withhold supplies.

Crude oil analysis: What factors are helping to keep oil prices supported?

Oil has rallied in these first three months of the year, albeit not in a clean trend. Geopolitical uncertainty concerning Ukraine and the Middle East and extended supply cutbacks by OPEC+ have helped to support oil prices. These factors have outweighed prior concerns about a challenging economic situation in China and non-OPEC supply growth.

However, concerns over China have eased somewhat following the government’s ambitious 5% growth target announcement and improvement in economic data.

The latest data from China has shown that profits in the Chinese industrial sector surged by 10.2%, reaching a peak not seen in 25 months, suggesting that the slowdown might be reaching its lowest point. While the rebound in Chinese industrial profits is promising, it's important to note that this growth is partly inflated by a relatively low comparison base from the previous year. Still, several other data releases have also pointed higher. Last week, for example, China reported surprisingly robust investment and industrial data, hinting at a potential shift in growth drivers for 2024 with the looming prospect of a stimulus rollout. The 7% y/y rise in industrial production data bolstered hopes for a robust demand recovery in commodities, nudging crude prices slightly higher and keeping Chinese equities supported.

Accelerating output in Chinese factories should mean more demand for oil, which so far has been met with record imports from Russia. But to bring itself in compliance with the OPEC+ cuts and in order to offset non-OPEC supply growth to keep prices supported, Russia has recently announced a cut in its oil production.

As a result, oil prices have remained supported on the dips and some major banks are now calling for even higher prices. Among them, analysts at JPMorgan have warned that crude oil could hit $100 a barrel. Their rationale is that Russia’s recent decision to cut output is going to keep oil market tight, if not balanced by other measures.

Crude oil analysis: inventories data and US dollar in focus

The earlier decline in oil priced followed weakness from Tuesday and came after the American Petroleum Institute (API), an industry group, reported a large 9.3-million-barrel build in US oil inventories. Traders will now want to see if the data will be confirmed by the Energy Information Administration’s (EIA) figures later. As well as the headline number, it is important to watch for stocks at the Cushing hub, and those of crude products such as gasoline, as they will hold key information about demand. Gasoline inventories have fallen for 7 weeks already, and another drop would make it the longest run of declines in almost a year.

Oil traders will also want to keep a close eye on the direction of US dollar, which has been gaining bullish momentum of late, increasing import costs for foreign buyers. Following last week’s central bank meetings, they will want to see a resumption lower in the US dollar. However, if the dollar rises significantly further, it will potentially weigh on buck-denominated commodities, including crude oil.

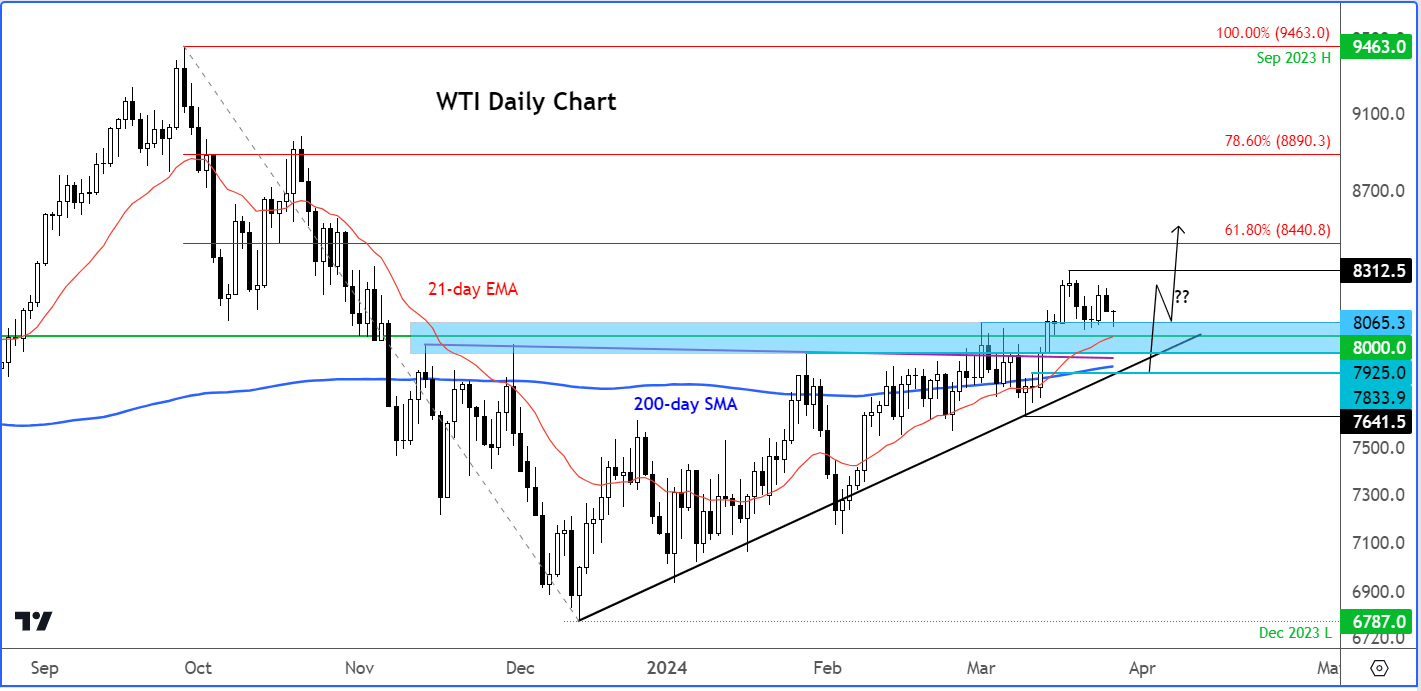

WTI technical analysis

Source: TradingView.com

From a technical perspective, the charts of crude oil continue to appease the bulls even if prices have been somewhat stagnant for the past week and a half. For those taking a pessimistic view on oil, it might be wise to wait until a distinct reversal pattern emerges or a lower low forms first.

For now, WTI continues to hold its breakout above the key $79-$80 area and holding comfortably above its 200-daymoving average. What’s more, recent sell-offs have gradually become less severe, pointing to a healthy bullish trend. With a decisive breakthrough above the $79.00 threshold earlier this month, followed by surpassing the psychologically significant $80.00 level, the technical outlook indicates a clearer path of least resistance towards higher price levels.

If WTI continues to hold its ground above these levels, this could potentially propel prices towards the mid-$80s in the coming days and weeks. The next measured move target is at $84.40, which converges with the 61.8% Fibonacci retracement of the last major downward swing that began from the peak of $94.63 in September.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade