Q2 2024 Central Banks Outlook

Major central banks have begun to change gears in 2024 as the Bank of Japan (BoJ) lifts interest rates for the first time in 17 years, while the Federal Reserve continues to forecast a less restrictive policy for later this year.

North America

Federal Reserve

The Federal Reserve looks posed to alter the course for monetary policy as the central bank acknowledges that ‘it will likely be appropriate to begin dialing back policy restraint at some point this year.’

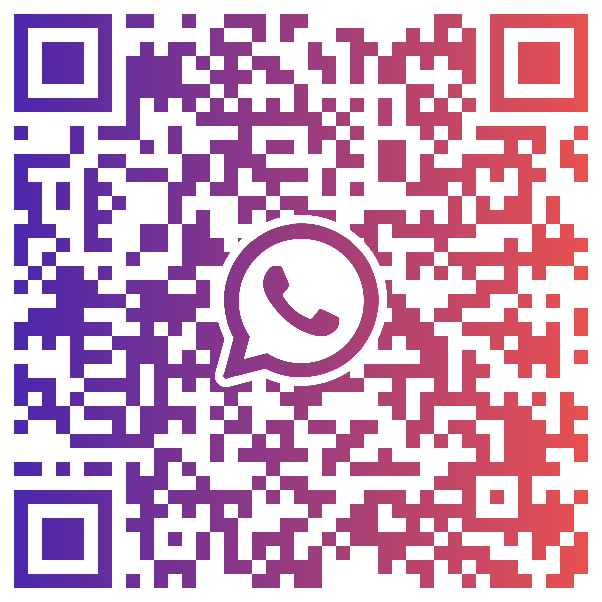

Source: FOMC

As a result, the Federal Open Market Committee (FOMC) may offer more details over the coming months as the ‘median participant projects that the appropriate level of the federal funds rate will be 4.6 percent at the end of this year.’

The developments coming out of the Fed’s March meeting suggest the central bank is preparing to unwind its restrictive policy as the committee also discussed ‘issues related to slowing the pace of decline in our securities holdings,’ and Chairman Jerome Powell and Co. may continue to adjust the forward guidance over the coming months as ‘an unexpected weakening in the labor market could also warrant a policy response.’

In turn, expectations for a looming change in regime may sway foreign exchange markets as Fed officials still forecast three rate cuts in 2024, and it seems as though other major central banks will follow a similar path as the high-interest rate environment continues to curb inflation.

Europe

European Central Bank

The European Central Bank (ECB) also appears to be on track to switch gears in 2024 as inflation ‘is expected to decline to our target as labour costs moderate and the effects of past energy shocks, supply bottlenecks and the reopening of the economy after the pandemic fade.’

According to the ECB, ‘inflation is expected to continue this downward trend in the coming months,’ and the Governing Council may gradually prepare European households and businesses for lower interest rates even though the central bank endorses a data-dependent approach in managing monetary policy.

As a result, President Christine Lagarde and Co. may start to discuss a less restrictive policy for the Euro Area as the ‘staff now project inflation to average 2.3 per cent in 2024,’and it remains to be seen if the ECB and FOMC will shift gears at a similar time and pace with both central banks on track to achieve their mandate for price stability.

EUR/USD Weekly Chart

Source: TradingView

The threat of a head-and-shoulders formations persist for EUR/USD as it continues to hold below the December high (1.1140), with a breach below the February low (1.0806) raising the scope for a move towards 1.0610 (38.2% Fibonacci retracement).

Next area of interest comes in around the 2023 low (1.0448) with a break/close below the 1.0370 (38.2% Fibonacci extension) to 1.0410 (50% Fibonacci retracement) region to provide conviction of a key reversal in EUR/USD.

At the same time, EUR/USD may track the flattening slope in the 50-Week SMA (1.0846) if it defends the February low (1.0806) but need a move above the 1.0870 (23.6% Fibonacci retracement) to 1.0940 (50% Fibonacci retracement) area to bring the 1.1070 (23.6% Fibonacci retracement to 1.1090 (38.2% Fibonacci extension) back on the radar.

Asia/Pacific

Bank of Japan

Meanwhile, the Bank of Japan (BoJ) offered zero hints of a hiking-cycle after concluding its negative interest rate policy (NIRP) as the ‘Bank anticipates that accommodative financial conditions will be maintained for the time being.’

It seems as though the BoJ will slowly shift gears even though Governor Kazuo Ueda and Co. acknowledge that ‘a wide range of firms have maintained their stance of raising wages’ as the central bank plans to continue its purchases of Japanese government bonds (JGB) as ‘broadly the same amount as before.’

Looking ahead, the BoJ looks poised to further adjust its guidelines over the coming months as the policy board plans to discontinue purchases of non-JGBs ‘in about one year,’ but the central bank seems to be in no rush to switch gears as ‘underlying CPI inflation is likely to increase gradually toward achieving the price stability target.’

With that said, speculation for a currency intervention by Japanese authorities may also take shape as the BoJ continues to move to the beat of its own drum, and the deviating paths may sway carry trade interest even as the Fed and ECB prepare to alter the course for monetary policy.

USD/JPY Weekly Chart

Source: TradingView

USD/JPY clears the February high (150.89) following the failed attempt to push below the 146.10 (23.6% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region, with the exchange rate approaching a key resistance zone which incorporates the 2022 high (151.95) along with the July 1990 high (152.25).

USD/JPY may continue to trade to fresh yearly highs as it seems to be tracking the positive slope in the 50-Week SMA (144.84), with the next area of interest coming in around 155.50 (61.8% Fibonacci extension) to 155.80 (June 1990 high).

However, failure to clear the historic resistance zone may curb the recent advance in USD/JPY, with a move below 149.70 (38.2% Fibonacci extension) raising the scope for a move towards the 146.10 (23.6% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region