When will Wells Fargo release Q3 results?

Wells Fargo will release third quarter earnings before the US markets open on Thursday October 14.

Wells Fargo Q3 earnings preview: what to expect from the results

Investors will be primarily focused on how the loan market is shaping-up considering Wells Fargo is more exposed to lending and its consumer and corporate businesses compared to other US banks, with CEO Charlie Scharf warning low interest rates and tepid loan demand continued to weigh on the business during the last quarter.

Individuals and businesses have tried to reduce their debt and refrain from taking out new loans during the pandemic but, with the economic recovery gaining pace, markets are looking for signs that demand is starting to return as businesses look to build back better and capitalise on new opportunities. Analysts are expecting net interest income to improve in the third quarter from the second after the bank flagged some pockets of resilience in its last update, but investors are not expecting a transformational turnaround in demand.

The threat to that demand returning is the anticipated rise in interest rates next year. Although this would benefit net interest income and be welcomed news considering Wells Fargo is the most exposed to interest rates, it does threaten to dampen appetite for new loans as the costs increase.

Wells Fargo has the additional problem of the asset cap imposed by the Federal Reserve back in 2018 following a string of scandals and failures across the business, from overcharging consumers to having millions of fake accounts on its books. This has prevented the bank from growing its balance sheet over the $1.95 trillion it had back in 2017, which in turn has limited its ability to lend, invest and ultimately grow.

‘We continue to hold the firm accountable for its deficiencies with an unprecedent asset cap that will stay in place until the firm has comprehensively fixed its problems. We are not going to remove that asset cap until that’s done,’ said Fed chair Jerome Powell in September.

Investors are desperate for the cap to be removed but that looks highly unlikely to happen anytime soon considering Wells Fargo has been hit by further fines this year after failing to improve its business in a timely manner. The longer it goes on, the longer Wells Fargo’s growth will be restricted and the more damaging it will prove to the bank’s reputation.

That comes at a time when the wider banking industry is battling against higher costs as they spend on attracting staff and investing in digital operations in order to stave-off competition from digitally-savvy fintech rivals.

Wall Street is expecting Wells Fargo’s third quarter revenue to nudge down to $18.37 billion from $18.86 billion the year before. Net income attributable to shareholders is forecast to jump to $4.14 billion from just $1.72 billion the year before, with diluted EPS to rise to $0.98 from $0.42.

Earnings are expected to be boosted by around $1.2 billion of reserves that had been set aside for potentially bad loans during the pandemic, down from the $1.6 billion released in the second. The release of reserves that has flattered numbers over the past year are expected to unwind across the industry this quarter considering the majority of reserves have already been released.

Where next for the Wells Fargo share price?

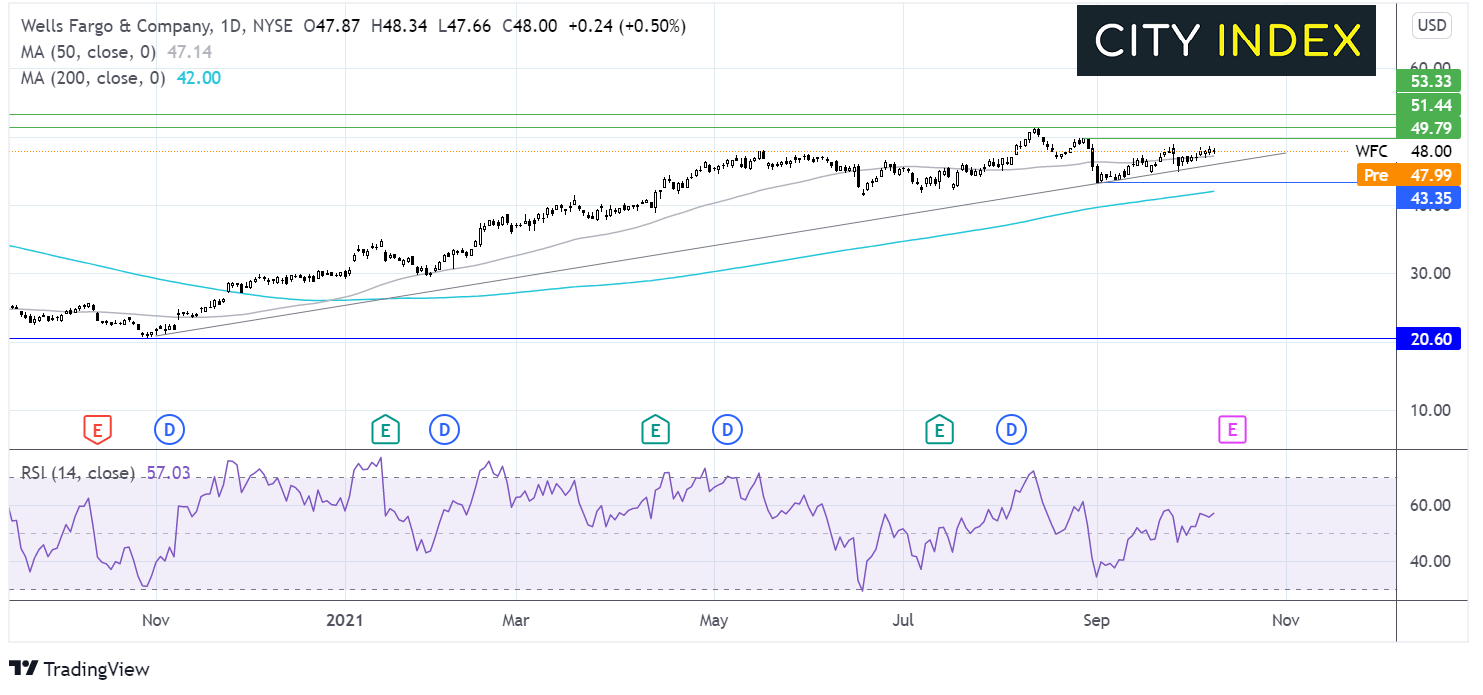

Wells Fargo has been trending higher since November last year. The price has more than doubled from $20.60 to current levels of $48.00.

The price trades above its 50 & 200 sma on the daily chart. Whilst the RSI is also supportive of further upside.

Immediate resistance can be seen at $49.80 the late August high. A breakthrough here could open the door to 51.25 the post pandemic high. Beyond here $53.35 the 2020 high comes into play.

On the flipside the 50 sma offers immediate support at $47.14 which would expose the rising trendline support at $46. Below here horizontal support at $43.25 could be important with a move below this level negating the near term up trend. The 200 sma sits at $41.91.

How to trade Wells Fargo shares

You can trade Wells Fargo shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Wells Fargo’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade