When will AstraZeneca release Q3 earnings?

AstraZeneca is scheduled to publish its third quarter earnings on the morning of Friday November 12.

AstraZeneca Q3 earnings preview: what to expect from the results

This will be the first set of results to incorporate the contribution from Alexion Pharmaceuticals since AstraZeneca completed its acquisition of the firm back in July. The company raised its full year guidance when it released its interim results to take the acquisition into account, stating revenue would rise by a ‘low twenties percentage’ while core EPS is expected to rise at a faster rate to a range of $5.05 to $5.40 from the $4.02 delivered in 2020.

There could be room for guidance to be upgraded again this week considering markets have pencilled in a 42% rise in revenue in the third quarter to $9.40 billion from $6.58 billion the year before, well ahead of the annual growth target. For context, revenue jumped 24% in the first half.

The acceleration will be down to Alexion’s contribution and continued strong growth from its oncology and respiratory drugs. Oncology product revenue is forecast to grow 22.7% in the third quarter from last year (accelerating from 19% in H1), respiratory revenue is forecast to rise 15.5% (accelerating from 11% in H1) and cardiovascular drug sales are seen rising 11.8% (slowing from 21% in H1).

Plus, its full year guidance excludes any contribution from sales of its coronavirus vaccine, which generated $1.17 billion worth of sales in the first half. This also partly explains why topline growth is expected to be faster in the third quarter compared to its full year growth target.

Notably, reports from the Financial Times this week said AstraZeneca is creating a new division for vaccines and antibody therapies. This would allow it to separate its Covid-19 jab that has fallen behind compared to rivals like Pfizer (which sold $11.4 billion worth of Covid vaccines in H1 and $13 billion in Q3), while allowing management to focus on more profitable areas of the business such as oncology. Notably, AstraZeneca is not making any profit from its Covid-19 vaccine at present under the agreement it has with Oxford University, although it hopes to reap a profit in the future. We may hear more news on this new unit this week.

The main threat that could prevent AstraZeneca from raising its guidance this week could be a rise in costs, partly thanks to significantly higher investment in certain drugs, with core R&D spending up 28% in the first half.

Sticking with third quarter expectations, core EPS is forecast to jump to $1.28 from $0.94 last year, with reported EPS at the bottom-line seen climbing to $0.84 from $0.49.

If it meets expectations in the quarter, that should see AstraZeneca deliver revenue of $24.94 billion, core EPS of $3.81 and reported EPS of $2.44 over the first nine months of 2021. That would compare to revenue of $19.21 billion, core EPS of $2.95 and reported EPS of $1.66 delivered during the first three quarters of 2020.

Notably, we have seen a number of AstraZeneca’s drugs secure new approvals since it reported first half results. This includes Saphnelo being approved in the US and Japan to treat an autoimmune disease, Forxiga being approved in Japan and the EU to treat chronic kidney disease, Breakthrough Therapy Designation being given to Enhertu in the US, and approval for Ultomiris being expanded to cover use on children with a severe blood disorder in the EU. Meanwhile, it has released a flurry of positive trial results for the likes of Imfinzi, Lynparza, Enhertu and its potential Covid-19 fighting antibody cocktail AZD7442, which is currently being reviewed for approval by EU regulators.

AstraZeneca shares have risen over 26% since the start of 2021 and currently trade at all-time highs of 9,387.0p. Brokers remain bullish and have an average Buy rating on the stock with an average target price of 9,864.69p, implying there is over 5% potential upside.

Where next for the AstraZeneca share price?

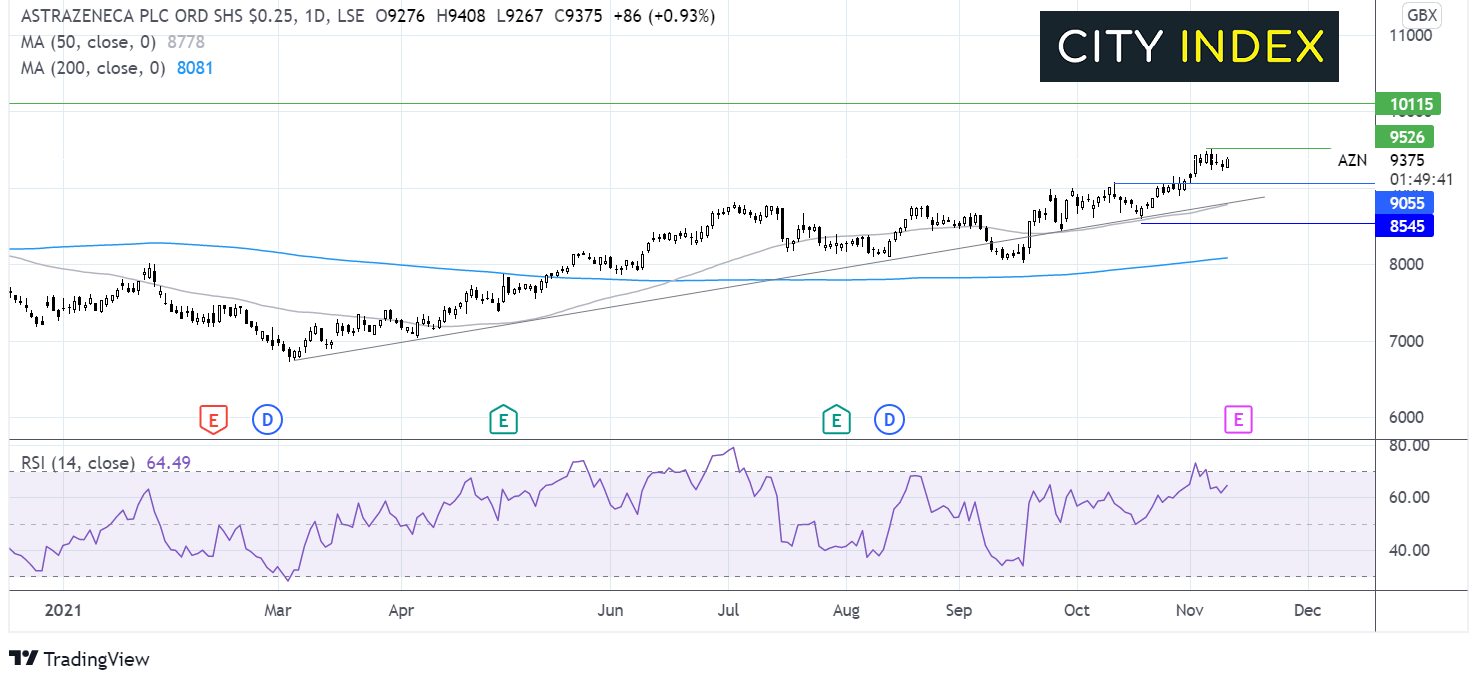

The AstraZeneca share price has been trending higher, forming a series of higher lows and higher highs since March. It trades above its ascending trend line from this date, as well as above its 50 & 100 sma.

The RSI is supportive of further upside whilst it remains out of overbought territory.

Buyers will look to take out the recent high of 9,523p in order to target the all-time high from July last year of 10,120p.

On the downside, a move below 9,114p could negate the near term uptrend. Support can also be seen at the rising trend line and 50 sma at 8,840p. However, it would take a move below 8,545p for the sellers to gain traction.

How to trade AstraZeneca shares

You can trade AstraZeneca shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘AstraZeneca’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade